Over the last 5 years, shares of chipmaker Advanced Micro Devices (AMD) have appreciated by over an amazing 2000%. The giant strides have seen it slowly eat away at CPU rival Intel’s market share, and move it closer to GPU titan Nvidia. There has been no significant pullback in the period, and COVID-19 has been swatted away as the stock has added another 14% of muscle in 2020, so far.

But Deutsche Bank analyst Ross Seymore argues that even though there’s no doubt AMD has deliveredon “expanding its product roadmap and taking share across most of its product categories,” there might be some headwinds down the road.

“While we expect the strong execution to continue, we see a greater than typical range of uncertainties across both revenues and gross margins (GM) due to the volatility of macro conditions and the significant deltas between new product margins,” the 5-star analyst noted

AMD’s target for revenue growth in 2020 is in the 25% range. Seymore maintains the chance of meeting the figure is high enough, based on the “upcoming ramp of semicustom processors for game consoles.”

While AMD is aware that COVID-19’s impact will result in lower consumer demand for the C&G (computer and graphics) side of the business, further tailwinds are expected from EPYC processor sales in 2Q onwards, and the high performance Milan microprocessors’ launch in 4Q20.

Seymore has no beef with any of these assessments. Where the analyst sees issues, is in AMD’s other significant target for the year.

“While we believe these somewhat offsetting dynamics are still likely to yield total revenue growth in the +25% range, we believe the mix of these moving parts may yield a greater challenge for AMD to attain its 45% GM target in 2020 based on our segment-driven gross margin modeling.”

Consequently, Seymore maintains a Hold rating and $50 price target. The figure indicates downside of 8% from current levels. (To watch Seymore’s track record, click here)

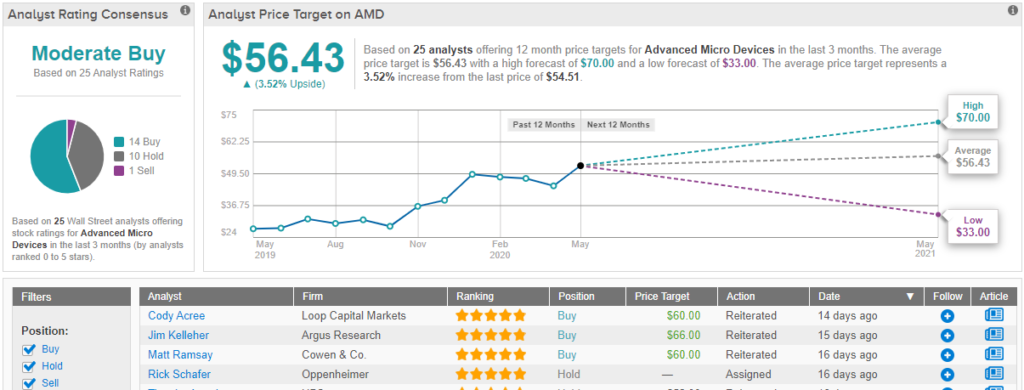

Looking at the consensus breakdown, the bulls have the edge. 14 Buys vs 10 Holds and 1 Sell add up to a Moderate Buy consensus rating. With an average price target of $56.43, the analysts foresee shares increasing by 3.5% in the coming months. (See AMD stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.