by Clement Thibault

On Monday January 11th, Arch Coal filed for bankruptcy under Chapter 11. Arch Coal (OTC:ACIIQ) was the second largest U.S coal producer; It’s now the fourth U.S coal company to have declared bankruptcy in the past year, along with Alpha Natural Resources (OTC: ANZRQ), Patriot Energy, and Walter Energy (OTC:WLTGQ).

The outlook for coal companies is bleak. Environmental concerns about the usage of coal has spurred new, restrictive regulations, curbing the use of the commodity and driving consumers and industrial companies to favor natural gas.

Coal companies aren't the only victims of the current carnage in the energy sector. Many oil exploration and production companies are also feeling the pain; On January 6th of this year the NYSE announced that trading on SandRidge Energy was suspended and the stock delisted because of ‘abnormally low’ price levels; Miller Energy, a Texas-based oil and gas driller filed for bankruptcy on October 1, 2015.

And that’s just the tip of the iceberg. More than three dozen energy companies have filed for bankruptcy in 2015, among them Swift Energy, New Gulf Resources, LLC, Magnum Hunter Resources Corporation, Cubic Energy, Inc., and Energy & Exploration Partners, Inc. which all filed in December 2015 alone. Overall, more than $17 billion worth of oil company funds are tied up in secured and unsecured debt, according to a report by Haynes and Boone, LLP.

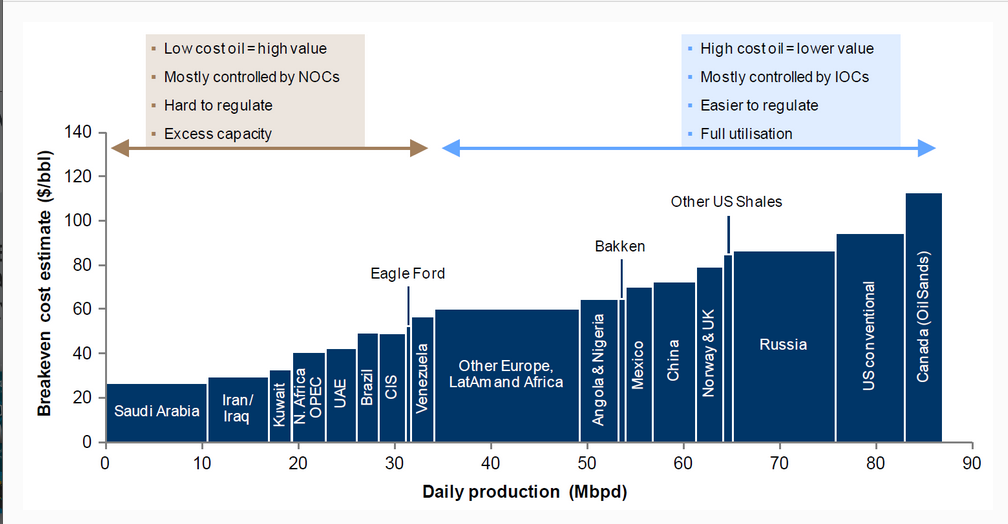

Because of the business model of most energy sector companies—which relies heavily on borrowing prohibitive sums of money in order to finance exploration, extraction and production activities before the first drop of oil or gas can be sold and any revenues booked—with the latest market downturn and precariously low oil and gas prices, energy companies find themselves in an uncertain situation. U.S. conventional oil extraction is estimated to have technical costs of around $85 USD per barrel, not including taxes or dividends to shareholders. The only countries still profitable at current oil prices are Saudi Arabia, Iran and Iraq. This chart, from the linked article illustrates the situation:

Source: Alliance Bernstein, October 2014

Which explains why energy companies are so tethered to commodities prices; For U.S. companies, profitability depends on approximately $100 per barrel price for oil. That's a far cry from what we're seeing now. Commodity prices at lower levels than a company may have bargained for leaves companies powerless, unable to eke out enough revenue to repay outstanding debt.

With Halliburton (N:HAL) reporting earnings on Monday, January 25th, Baker Hughes (N:BHI) on the 28th, and Phillips 66 (N:PSX) on the 29th, the energy sector enters the Q4 playing field. Here are 3 high-risk (potentially high reward) energy companies that could be facing ‘make-it-or-break-it’ circumstances going forward.

Will they default or will investors and traders double down after they report?

1. Chesapeake Energy

Chesapeake (N:CHK) has been free-falling for almost a year and a half now, on the slump in commodity prices. Priced at $29.39 a share at the end of June 2014, the company closed on Friday at a meager $3.51, a fraction of its former price.

The bankruptcy threat for Chesapeake comes from multiple directions. To begin with, the amount of long-term debt the company has taken on is hefty, about $10.6 billion according to the Q3 2015 report. It's safe to say, $25 oil prices were likely not expected by anyone when the debt was assumed. Chesapeake also has a 0.78 current ratio, a measure of a company's liquidity vis a vis its assets, suggesting it could run into problems settling its upcoming liabilities. Indeed, for comparison purposes, an ideal current ratio would approach 2.0. On top of all this, $2.8 billion in capital expenditures were sunk into the business during the first 9 months of 2015, in an attempt to drill new wells.

Was there really a need to drill new wells amid a bruising slump in commodity prices, crippling the company's cash flow? Hard to say. However, it’s clear that if oil doesn't recover soon, we could see Chesapeake heading for bankruptcy protection. On the other hand, the stock is already priced for a disastrous year which includes every potential worst-case-scenario except for bankruptcy. If bankruptcy isn't in the cards, we believe a strong recovery will surely occur—eventually. Chesapeake's Q4 earnings report is due on Wednesday, February 24th.

2. Comstock Resources

Like Chesapeake, Comstock (N:CRK) crashed in the second half of 2014. The company fell from a high of $29.49 on July 1, 2015 to its close on Friday of $1.70, and for good reason: revenues plunged from $145 million in Q3 2014 to $61 million in Q3 2015, with earnings declining from -$0.19 to -$1.06 per share. Without a doubt, the revenue decline is unsustainable and that alone could spell the company’s downfall. Moreover, this decline leaves Comstock highly leveraged, with a total debt to EBITDA (Revenue – Expenses, excluding tax, interest, depreciation and amortization) ratio of 6.5 which raises questions about its ability to overcome the debt it has accumulated. In comparison, Chevron (N:CVX) has a much healthier EBITDA of $21.6B to $35.8B of debt, a ratio of 1.65.

Back in November, Moody's downgraded Comstock debt to Caa2 status with a negative outlook, showing a lack of faith in the ability of the company to straighten the ship amid low gas and oil prices, which have plummeted further in the past couple of months. On the bright side, Comstock's first wave of bonds won’t mature until the end of 2017. The stock also bounced 61% in the second half of last week, after falling to under one dollar per share on January 14, the line at which NYSE officials reconsider a company's listing on the exchange. Being delisted from a major exchange can cause capital problems for publicly traded companies which often rely on the prestige of the exchange for their financing activities.

The recent bounce clearly shows that investors have not given up on the company and will try to ride it back up should oil and gas prices increase before the company runs out of wiggle room. Comstock's Q4 earnings announcement will take place on Monday February 8th.

3. Peabody Energy

Coal miner Peabody Energy Corp (N:BTU), with $6.2 billion in long-term debt and an EBITDA of $545 million is, like Comstock, highly leveraged. The stock and its bonds have been regularly downgraded over the past few months by rating companies, with Moody's lowering Peabody's credit rating to a dangerous Caa3 in late December. But the coal industry’s troubles are now deeper than just low commodity prices, having been exacerbated by President Obama's plan to tackle greenhouse gases from coal powered power plants. As mentioned earlier, Arch Coal has already gone under, and the entire industry should be watched carefully in the coming months. A bit over a week ago, the Obama administration ordered a pause on issuing coal mining leases on federal lands, a decree roundly criticized by Republican politicians who say it is "ravaging the coal country."

If that’s the case, the situation for Peabody is not just a matter of global economic supply and demand, but rather a case of direct interference by the Federal government in order to promote a Presidential climate-change agenda. Peabody has $1.5 billion worth of bonds maturing in 2018, but before that even occurs, it appears its fate could be determined by policy makers rather than in the state of the market. Peabody reports Q4 earnings on Monday January 25th, and has a staggering earnings-per-share forecast of -$8.58.