Despite the difficult backdrop offered by 2H22 and reflected in PC inventory digestion, Advanced Micro Devices (NASDAQ:AMD) has navigated the rough terrain rather well.

Ahead of the chip giant’s fiscal fourth quarter earnings (Jan 31), Mizuho analyst Vijay Rakesh reckons the full-year 2022 results should show 43% year-over-year growth, boosted by a strong showing from data center (DC), which Rakesh sees climbing 60% higher y/y. This will amount to a “significantly better” performance than competitor Intel with its DC “potentially flattish” y/y.

In fact, on the back of the September quarter PC challenges, which saw share losses to Intel, AMD appears to have clawed back share in Q4, with the ramp of the Ryzen 7000 desktop processors driving the gains. And while in PC, the company expects another soft year ahead (potentially a 5-10% year-over-year decline), Rakesh thinks AMD is “well-positioned with new Ryzen products and long-term secular trends within PC gaming.”

Moving forward elsewhere, the 5-star analyst thinks AMD has “benefited from improving server market share and should continue to see good ramps into 2023E with its highly anticipated 5nm Genoa product line.” The 5nm Genoa – the new line of server CPUs – should provide a “significant tailwind” vs. Intel, given the fact its “competitive” 10nm++ Sapphire Rapids offering won’t ramp until 2H23E. There’s also the anticipated ramp of the company’s 5nm Bergamo cloud optimized CPU in the latter half of the year to look forward to.

And while the Xilinx deal, which closed in early 2022, should prove to be only “neutral” to earnings, its planned FPGA compute roadmap offers a “compliment” to AMD’s CPU roadmap.

Lastly, addressing the recent announcement of CFO Devinder Kumar’s retirement – who played an important part in AMDs strong growth – Rakesh assuages investor fears by noting successor Jean Hu comes with not only a background in engineering but having served as Marvell’s CFO since 2016, he has “solid CFO experience.”

Based on the above, Rakesh designates AMD his Top Pick for 2023 and rates it a Buy. On top of this, the 5-star analyst sets a $95 price target on AMD, which implies 26% upside potential. (To watch Rakesh’s track record, click here)

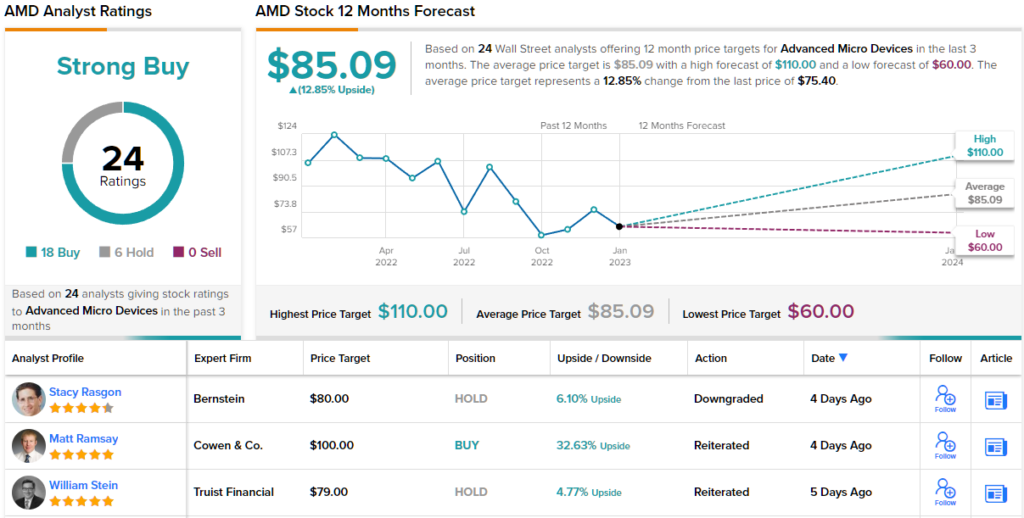

Most analysts share the same sentiment; the stock’s Strong Buy consensus rating is based on 18 Buys vs. 6 Holds. The forecast calls for 12-month gains of ~13%, considering the average target clocks in at $85.09. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.