The Russian war with Ukraine created a lot of instability in the global energy markets in 2022. In Europe, the natural gas markets suffered from a sharp decline in supplies, pushing the prices much higher. Natural gas prices in Europe reached a record high of €350 per megawatt-hour (MWh) in 2022.

This also led to buyers switching to alternate sources, which in turn reduced the natural gas demand. As a result, by the end of 2022, prices began to fall. In January 2023, the natural gas prices have fallen to €76/MWh, similar to the levels of €75/MWh in 2021.

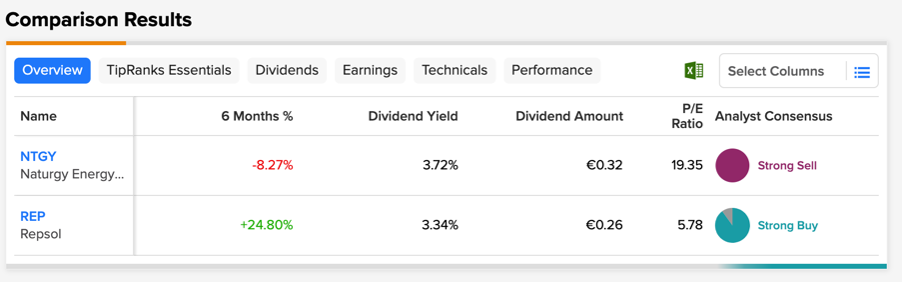

Spanish utility companies Naturgy Energy Group (ES:NTGY) and Repsol (ES:REP) have been on the receiving end of the Russia-Ukraine war and have posted higher profits in 2022. However, with falling energy demand and gas prices back to pre-war levels, these companies are expected to take a hit in the margins. Analysts are bullish on Repsol with a Strong Buy rating, while Naturgy’s valuation looks expensive at this moment and has a Sell rating.

Let’s have a look at more details on these Spanish stocks.

Repsol S.A.

Based in Spain, Repsol is a multinational company dealing in a wide range of energy products in around 100 countries.

Thanks to high energy prices, Repsol has delivered higher growth numbers in 2022. The company’s net income of €1.4 billion jumped by 137% in the third quarter of 2022 as compared to the prior year’s quarter numbers. The operating cash flow increased by 121% to €3.1 billion. Moreover, the company was significantly able to reduce its net debt by 64% to €2.1 billion as compared to €6.1 billion in Q3 of 2021.

Moreover, analysts are also positive about the company’s commitment to reward its shareholders and increase their returns over a period of time. The company’s strong cash flow smoothly covered its investments, dividends, interests, and others. In 2022, the company paid a dividend of €0.63 per share, which it is targeting to increase to €0.75 per share by 2025.

Is Repsol a Good Investment?

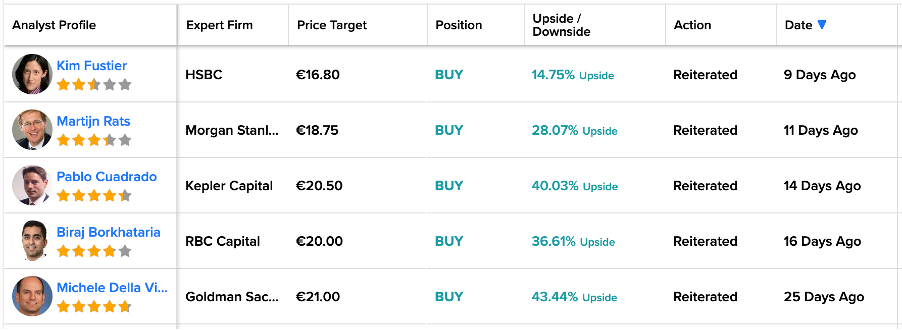

The analysts are bullish on the stock and have a consensus Strong Buy rating on TipRanks. The solid profit numbers, stable financial position, and increasing dividends for shareholders make the stock an attractive investment opportunity.

Recently, HSBC, Morgan Stanley, Kepler Capital, and others have reiterated their Buy ratings on the stock. Analyst Michele Della Vigna from Goldman Sachs has the highest target price of €21.00 for the stock, which has an upside of 43%.

The average target price is €18.26, which shows a change of 25% from the current price.

Naturgy Energy Group, S.A.

Naturgy is a Spanish energy company engaged in the generation and distribution of gas and electricity, with a presence in more than 20 countries.

The company’s stock has generated a return of almost 30% in the last three years. In the last year, the performance has been shaky, and the stock has traded down by 4%.

Talking about the business operations, the company’s renewable energy expansion is not on track as compared to other players in the industry. Naturgy has a target installed capacity of 13.1 GW by 2025, which will lead to a reduction in the wholesale gas business. Given the current market scenario, there is an expected delay because of the high capex involved.

The company’s debt position also remains a concern for analysts. As of September 2022, the company’s net debt was €10.2 billion. Considering a shaky outlook for the energy market, the company expects its net debt position in 2022 to be similar to that of the previous year.

In terms of share price growth, the analysts are not bullish on the company. The analyst feels that, compared to its peers, the company’s sales are expected to fall at a faster rate. The company’s exposure to gas supply is much riskier and is highly affected by volatile margins.

Recently, Gonzalo Sanchez Bordona from UBS raised the target price of the stock from €21.05 to €22 but maintained the Sell rating.

Naturgy Stock Price Forecast

According to TipRanks, Naturgy stock has a Strong Sell rating, based on four Sell recommendations.

The average target price for NTGY is €22.75, which is 12.2% lower than the current price.

Conclusion

The majority of energy companies in Europe have witnessed a solid year of growth and earnings, supported by a huge rise in oil and gas prices. According to experts, price volatility will remain in the market for quite some time.

Analysts believe Naturgy’s share price growth will be hampered by high debt levels, shrinking margins, and a delay in renewable investment.

On the other hand, Repsol remains a top pick among analysts in the Spanish energy market with its growing numbers and dividends.