“Hawk On A Wire” Stock Market (and Sentiment Results)…

On Wednesday we got a de-clawed hawk in Chairman Powell and he treaded carefully. It was as if he was a hawk on barbed wire knowing if he swayed too far to either side he would get cut. For the first time he acknowledged we are in a dis-inflationary environment and goods inflation is coming down fast.

Powell attempted to temper the dovish sentiment by saying there was “more work to be done” and the dot plot could go higher OR LOWER at the next meeting. Or lower? WOW, just wow. In my view, the most important quote of the press conference was, “you saw what the Bank of Canada did.” I’m now convinced he is a reader of our blog (kidding, not kidding!) considering our article and podcast from last week was exclusively focused on how the Bank of Canada paused last week and Powell should follow suit.

My 'Closing Bell' notes

Thursday morning I joined Maria Katarina on CNBC “Closing Bell” Indonesia to discuss the latest Fed Move and implications. A few key points from my Show Notes ahead of the segment:

Is inflation headed back to 2%?

-Latest year-over-year change in core PCE at just 4.4%. This last hike of 25bps hike took the Fed Funds rate above this level – which is historically what has been needed to crush inflation.

–Fed now has justification to PAUSE if they want to. Interest expense has been raised from $400B to $1T due to rate hikes. Cannot afford with 120% debt/gdp. Must inflate away by running inflation at 3%+.

-5 yr. inflation breakevens have dropped to 2.29% from 3.59% last March. Inflation expectations (which drive behavior) are contained.

-For the first time he acknowledged we are in a dis-inflationary environment and goods inflation is coming down fast.

“We can now say I think for the first time that the disinflationary process has started. We can see that and we see it really in goods prices so far,”

What are the odds of the Fed raising interest rates at the next meeting this year?

Right now futures markets have an 82.7% probability of 25bps and 17.3% chance of no hike.

Will be data dependent upon 2 jobs reports and inflation numbers.

Powell attempted to temper the dovish sentiment with saying there was “more work to be done” and the dot plot could go higher OR LOWER at the next meeting.

Jerome Powell said it is “certainly possible” that the Fed will keep its benchmark interest rate below 5%. The Fed’s latest hike brings that Federal funds rate to a range of 4.50% to 4.75%.

Powell also said that he still thinks the Fed can get inflation back down to 2% “without a really significant downturn, or a really significant increase in unemployment.”

What is the impact of the Fed’s decision on stock movements on Wall Street?

-We saw Stocks UP, 10year yield dropped to 3.4% and Dollar Dropped.

-Market thinks pause or one more 25bps at next meeting. Tightening process at/near end.

What are today’s investors looking for: safer stocks or bonds?

Buy high quality companies that have been marked down:

Alibaba – Best Idea. Buy at 2014 prices. Government focused on consumption.

Is gold still a safe haven or do investors tend to hold their funds in cash?

Buy productive companies to guard against inflation. Gold is a non- productive asset.

How attractive is the financial market in Indonesia? The largest financial market in Southeast Asia, with inflation tending to be under control after the price of crude oil slumped below USD100/dollar.

Good demographics/strong balance sheet. Third largest democracy. Debt/GDP 41%.

How do you see the strength of the rupiah and other countries in the Asian region amidst the still strong dollar index?

Dollar has come down 11%. EEM currencies will appreciate.

Now onto the shorter term view for the General Market:

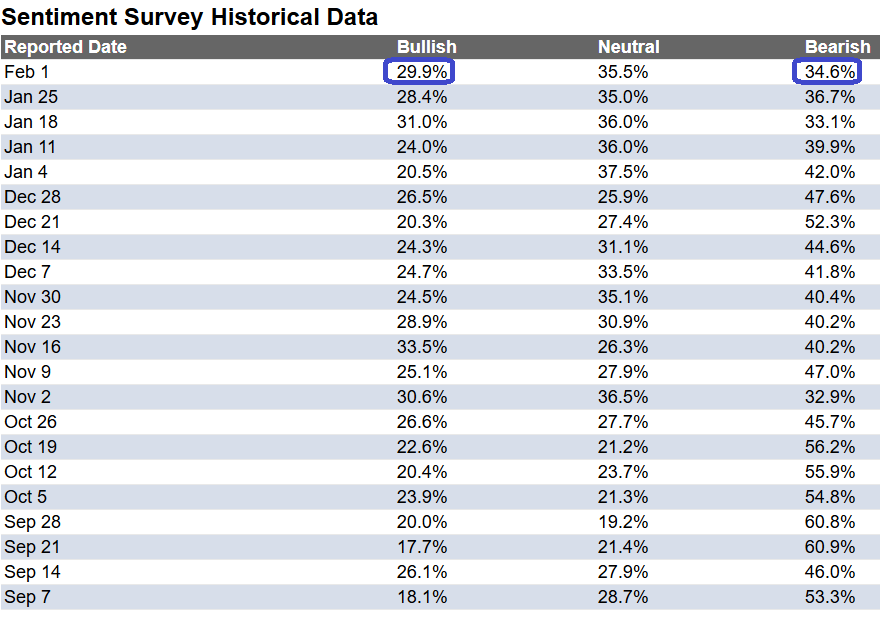

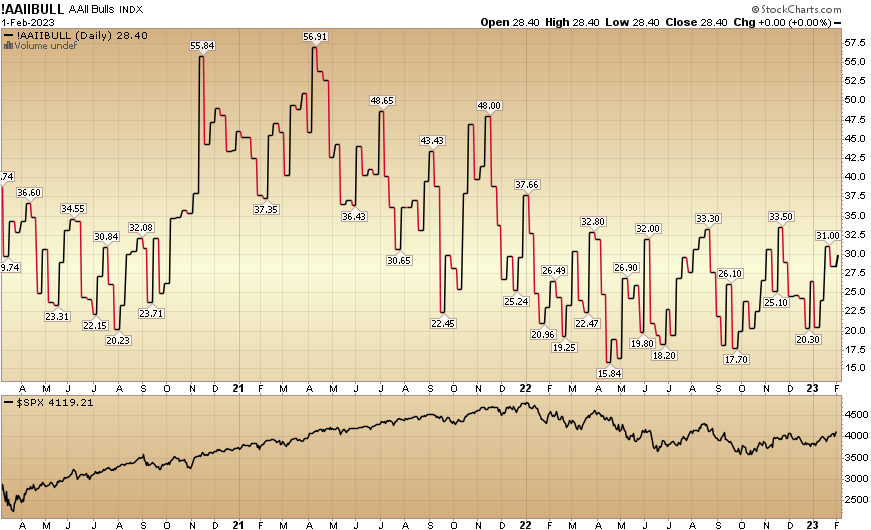

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 29.9% from 28.4% the previous week. Bearish Percent ticked down 34.6% from 36.7%. Sentiment is still weak for retail traders/investors.

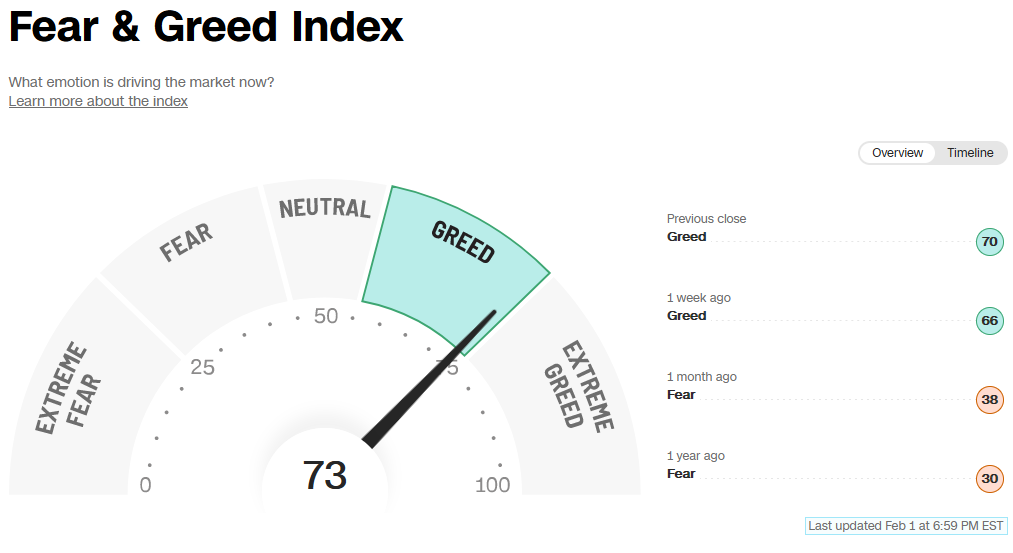

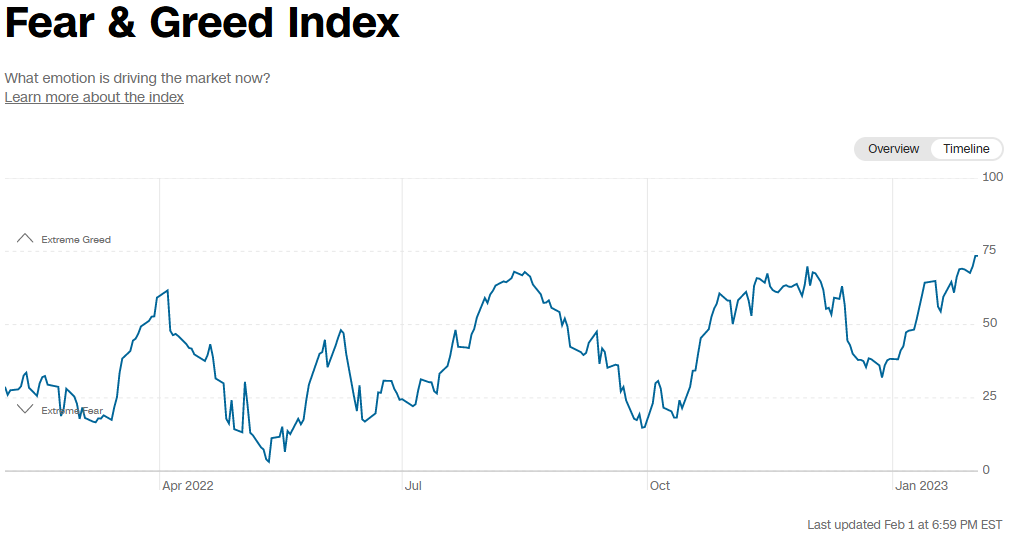

The CNN “Fear and Greed” rose from 64 last week to 73 this week. Sentiment is getting hotter. You can learn how this indicator is calculated and how it works here: (Video Explanation)

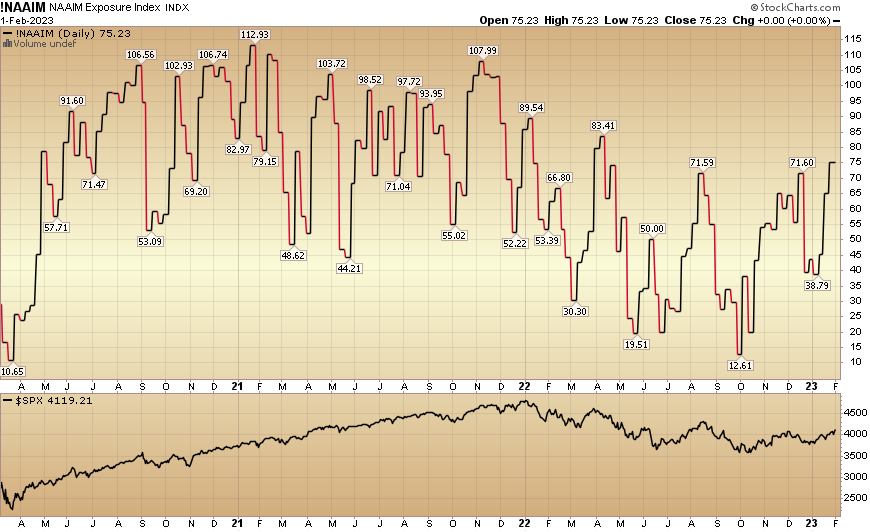

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 75.23% this week from 65.07% equity exposure last week. Managers are starting to chase as they came into the year with record cash levels.

More By This Author:

“Famous Friends” Stock Market (and Sentiment Results)…

Stock Market Breather (and Sentiment Results)…

“Friends In Low Places” Stock Market (And Sentiment Results)