3 Chip Stocks Suited Nicely For Income Investors

Image: Bigstock

Investors love chip stocks, with many quickly realizing the vital role semiconductors play in everyday life. Of course, many investors also target dividend-paying stocks, aiming to achieve a passive income stream and limit the impact of drawdowns in other positions.

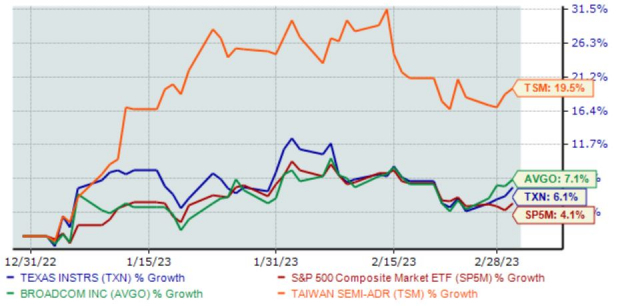

And several stocks, including Texas Instruments (TXN - Free Report), Broadcom (AVGO - Free Report), and Taiwan Semiconductor Manufacturing (TSM - Free Report), provide investors with exposure to chips and the ability to reap an income stream.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those interested in chips and reaping an income stream, here is take a closer look at each one.

Texas Instruments

Texas Instruments is an original equipment manufacturer of analog, mixed-signal, and digital signal processing (DSP) integrated circuits. TXN’s annual dividend yield stands tall at 2.9%, paired with a sustainable payout ratio sitting at 53% of its earnings. Impressively, 2022 marked the company’s 19th consecutive year of increased payouts.

Image Source: Zacks Investment Research

Texas Instruments posted better-than-expected results in its last quarter, exceeding bottom line expectations by nearly 9%. Quarterly revenue totaled $4.7 billion, 2% above expectations and pulling back marginally year-over-year.

Image Source: Zacks Investment Research

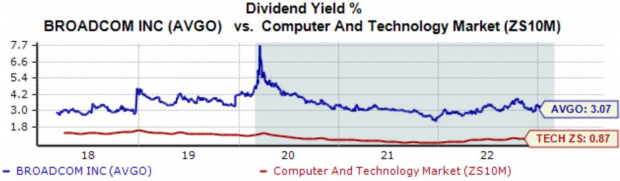

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. Broadcom’s dividend metrics are hard to ignore; its annual dividend presently yields 3.1%, more than triple that of the Zacks Computer and Technology sector.

And to top it off, the company’s 21% five-year annualized dividend growth rate reflects a strong commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

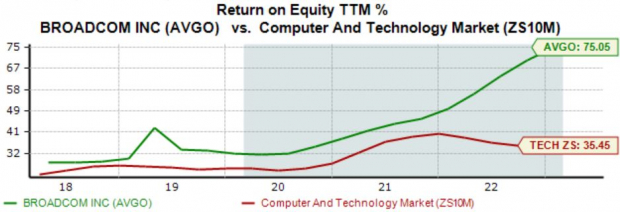

In addition, AVGO’s 75.1% TTM return on equity is undoubtedly impressive, reflecting a higher level of efficiency in generating profit from existing assets compared to peers.

Image Source: Zacks Investment Research

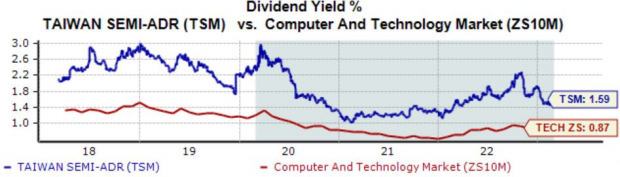

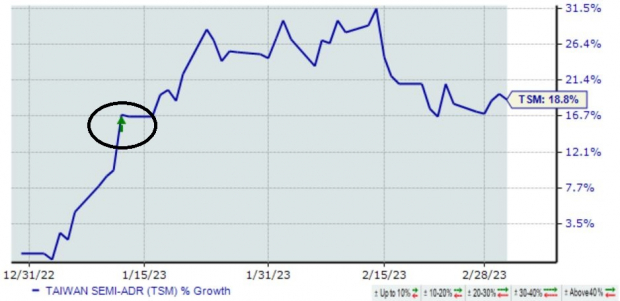

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing is the world’s largest circuit foundry. The stock gained widespread attention following a purchase from the legendary Warren Buffett a few months back.

TSM’s annual dividend yield stands at 1.6%, again well above the Zacks sector average. Similar to AVGO, Taiwan Semiconductor has shown a commitment to its shareholders, upping its payout 11 times over the last five years.

Image Source: Zacks Investment Research

Shares got a nice boost following the company’s latest quarterly release, as illustrated by the green arrow in the chart below.

Image Source: Zacks Investment Research

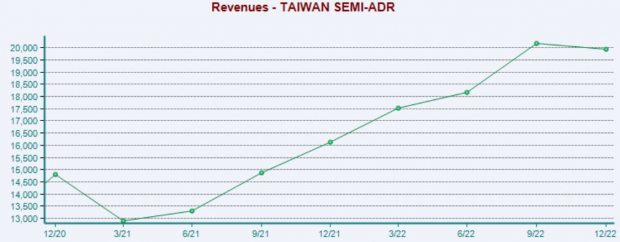

TSM exceeded the Zacks Consensus EPS Estimate by roughly 1% in its latest quarter, reporting earnings of $1.82 per share. Quarterly revenue totaled $19.9 billion, reflecting a sizable 26% year-over-year increase.

Image Source: Zacks Investment Research

Bottom Line

Chip stocks are undoubtedly exciting investments, rewarding shareholders handsomely with gains over the last several years.

And for those interested in reaping a steady income stream paired with exposure to the semiconductor industry, all three stocks above – Texas Instruments (TXN - Free Report), Broadcom (AVGO - Free Report), and Taiwan Semiconductor Manufacturing (TSM - Free Report) – would provide that.

More By This Author:

5 Major Tech Players Competing With ChatGPT TechnologyMacy's Surpasses Q4 Earnings And Revenue Estimates

Best Buy Beats Q4 Earnings Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more