Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Nick Peters-Golden and Elle Caruso debate the investment case for low-volatility equity exposure via active ETFs.

Nick Peters-Golden, staff writer, VettaFi: Hi Elle! Thanks for joining me for this discussion – I can’t think of many topics more appropriate to the news over the last two weeks than that of low-volatility equity ETFs. There’s an anomaly to be found – and celebrated – in low-volatility equities, in which they display a higher Sharpe ratio than their high-volatility counterparts. The question before us today is, should we go active or passive to play this factor? Personally, I think active low-volatility equity ETFs deserve a look.

Elle Caruso, staff writer, VettaFi: Hey, Nick! I couldn’t agree more – now is a great time to discuss low-volatility equity ETFs. While low volatility has sputtered a bit year to date, it has historically outperformed during bear markets — and right now, there are many headwinds for the global economy (higher rates, sticky inflation), and volatility is exceptionally high.

However, I’m going to have to take the bear case for this one and instead advocate for passive exposure. To outperform, active funds take greater risks (not what you want in a low vol strategy) and charge high fees – and typically end up underperforming.

In 2022, the Invesco S&P 500® Low Volatility ETF (SPLV) outpaced the actively managed Franklin U.S. Low Volatility ETF (FLLV) by nearly 400 basis points during the year. While both funds outperformed broader U.S. indexes, SPLV’s outperformance highlights why paying more for an active strategy is unnecessary. Even just a few basis points will add up over time, chipping away at total returns.

Peters-Golden: We can certainly agree on the virtue of low volatility strategies – the time when market analysts could just assume that higher risk equities necessarily come with higher returns has long since passed.

At VettaFi, we’ve seen recent data from advisors indicating their concern that owning only passive ETFs will leave their clients exposed to market conditions without the ability to pivot. To me, amid all the uncertainty right now, that presents a clear use case for active, low-volatility strategies thanks to their maneuverability.

ETFs with passive, indexed exposure to your low-volatility sectors and holdings may sound appealing initially for a topsy-turvy environment like this one, but their inability to pivot could belay their purported lack of risk relative to active ETFs. In a post-pandemic economic environment with interest rates that have risen faster than they have in half a century and the end of a decade-plus regime of easy money and low rates, the possibility of trusted sources of calm in markets coming undone calls for active.

One ETF that combines exposure to well-vetted, low-volatility equities with a frequent, weekly rebalance would be the sole ETF from Zacks Investment Research. Zacks leverages founder Len Zacks’ original earnings surprise alpha factor model to help identify firms with strong track records during a recession – an approach that falls into the active, low-volatility equity ETF category in the form of Zacks’ first ETF, the Zacks Earnings Consistent Portfolio ETF (ZECP).

ZECP actively invests in firms that have exhibited high stability through recessions, taking a universe of 750 equity securities and screening for financial statement filing consistency, earnings through recessions, profits, and valuation.

The firm touts that every firm in its portfolio as of last month lived through the 2008 recession, and by leveraging Zacks’ proprietary earnings approach, ZECP has returned 2.1% over the last six months charging 55 basis points and adding $3 million over the last month. For what it’s worth, that’s also outperforming SPLV in that time frame per YCharts, while keeping tight to SPLV’s 30-day rolling volatility, a YCharts measure of fluctuations experienced by the strategy.

Compare that to a passive strategy with a monthly rebalancing that may be just somewhat cheaper rather than drastically cheaper, and I’m not entirely convinced why I wouldn’t go active here.

Caruso: Liquidity is a primary concern with active ETFs – an important element when investing in ETFs that add factor tilts to a portfolio, as investors may need to move in or out of a position quickly and efficiently. For that reason, passive is clearly the way to go.

ZECP, for example, has just $31 million in assets. The largest active low volatility equity ETFs include the LHA Market State Tactical Beta ETF (MSTB), the Franklin U.S. Low Volatility ETF (FLLV), and the Vanguard U.S. Minimum Volatility ETF (VFMV), which have just $151 million, $142 million, and $85 million in assets under management, respectively.

Trading volume is also low. MSTB has the highest average volume at nearly 44 thousand shares traded daily, but FLLV exchanged hands an average of 10 thousand times and VFMV less than five thousand during the same period.

Meanwhile, the largest passive offerings in the area are fund giants, mitigating liquidity concerns. The iShares MSCI USA Min Vol Factor ETF (USMV) and the Invesco S&P 500® Low Volatility ETF (SPLV) have $28 billion and $10 billion in assets under management, respectively. USMV and SPLV each have an average trading volume above 2.4 million shares every day.

Peters-Golden: Liquidity is important – especially now amid all this bank drama; it’s really underscored how important it is to get in and out of a strategy safely. If you’re an advisor looking at the active side of low-vol equity ETFs, then you might be initially turned off by some of the AUM numbers you see.

But active, low-volatility equity ETFs can still offer liquidity. That’s because an ETF has two sources of liquidity: at the fund level and the security level, and the securities in which low-vol strats invest are often very liquid. An ETF may have a low daily trading volume, but if it invests in very liquid names – think firms like Visa (V) or Merck & Co. (MRK) – it actually ends up being pretty liquid despite that trade volume.

What’s more, while passive strategies can often leverage their low fees to pick up flows and perform for their investors, the fees on active, low-vol equity ETFs aren’t that bad when you think about it.

Advisors know they’re paying that premium for a reason, with active managers’ bringing expertise and large cohorts of researchers to their investing approach, but when the aforementioned FLLV charges just 29 basis points, and Vanguard offers the Vanguard U.S. Minimum Volatility ETF (VFMV) at just 13, that’s a nice bonus.

VFMV invests actively in U.S. stocks that are less susceptible to big price moves based on a quantitative methodology applied to firms of all cap sizes and holds a notably narrower set of stocks than Vanguard’s passive ETF, which also focuses on the Russell 3000 benchmark.

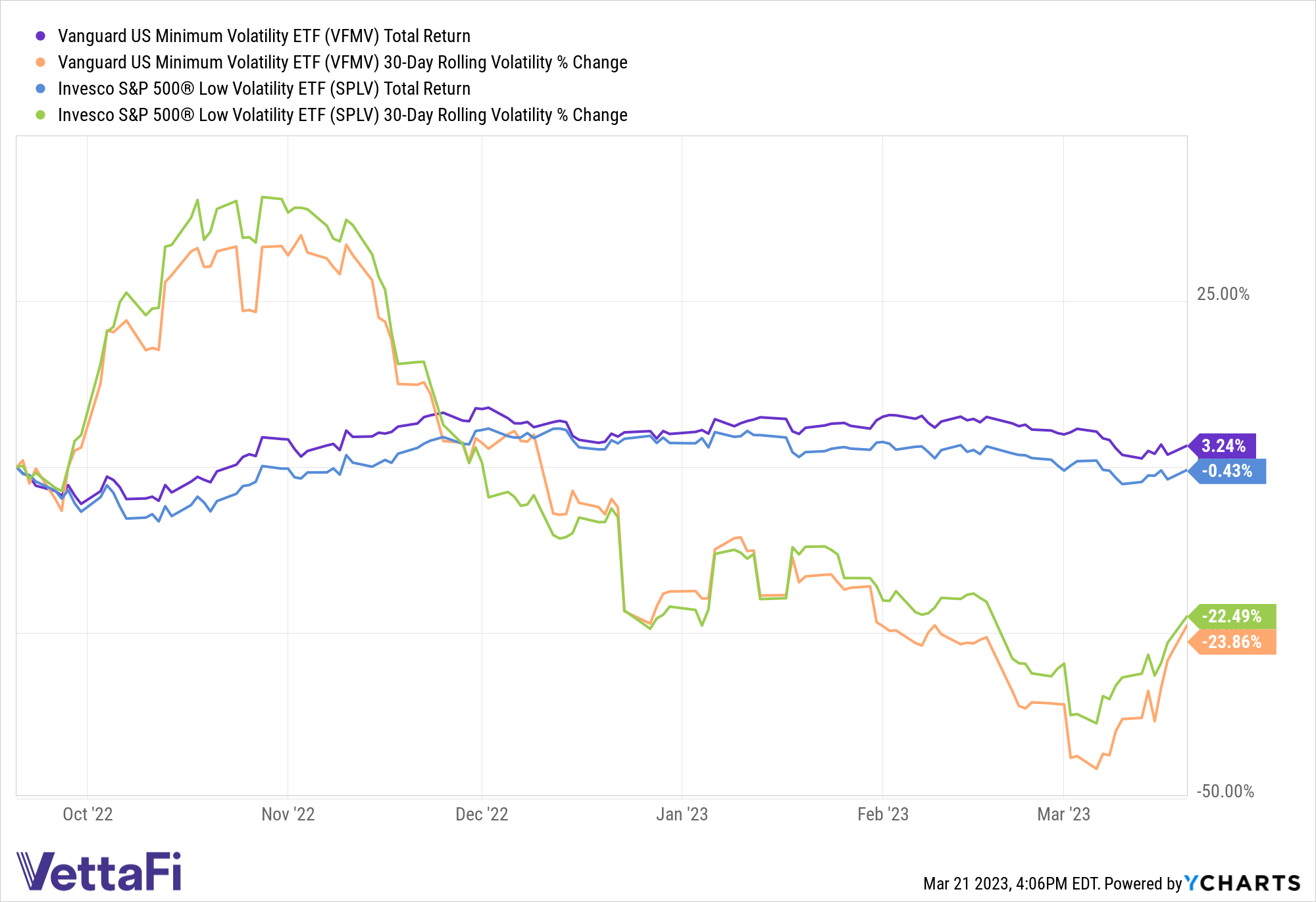

For just 13 basis points, it has outperformed SPLV by even more than ZECP over the last six months, returning 3.2% compared to –0.4%. The pair have also kept close to each other regarding the rolling volatility measure, boosting the argument that active strats can provide that cover from volatility that investors expected because of the name on the tin.

Caruso: As I showed earlier, passive funds work as they were intended to work – all while rebalancing just four times a year. Active management had a good 2022 but has trouble keeping up with the S&P 500 Index over any longer period per SPIVA.

Transparency is another key reason it’s prudent to go passive for low volatility exposure. Investors need to know what they own and why they own it. Particularly in times of market uncertainty, it makes sense to avoid the bias that comes with discretionary investing. Passive takes the emotion out of investing.

SPLV is my favorite pick for this reason. SPLV is based on the S&P 500 Low Volatility Index, which comprises the 100 securities from the S&P 500 with the lowest realized volatility over the past 12 months. Its methodology is simple, and it worked last year when investors needed it to, outpacing the S&P 500 by 1,322 basis points.

Peters-Golden: Here’s the thing with low-volatility equity ETFs: they’re not meant to be your core allocation. That’s why it’s a great opportunity for an active allocation here, letting a manager’s expertise shine. Advisors are looking for strategies that can provide cover for their yield hunting elsewhere – an active low-vol equity ETF that could outperform on top of it adds some notable appeal.

There’s clear research that shows that when factors like volatility spike, the opportunity for active stock picking grows. Dispersions, in return, set the stage for smart, active management that can take advantage of opportunities – and they may be worth a look for advisors’ active allocations.

First, let’s look at FLLV. Launched back in 2016, it actively invests in U.S. firms with the lowest volatility in each sector, according to the ETF’s management team, looking for capital appreciation at the cost of less market turbulence than the Russell 1000 index at the cost of just 29 basis points.

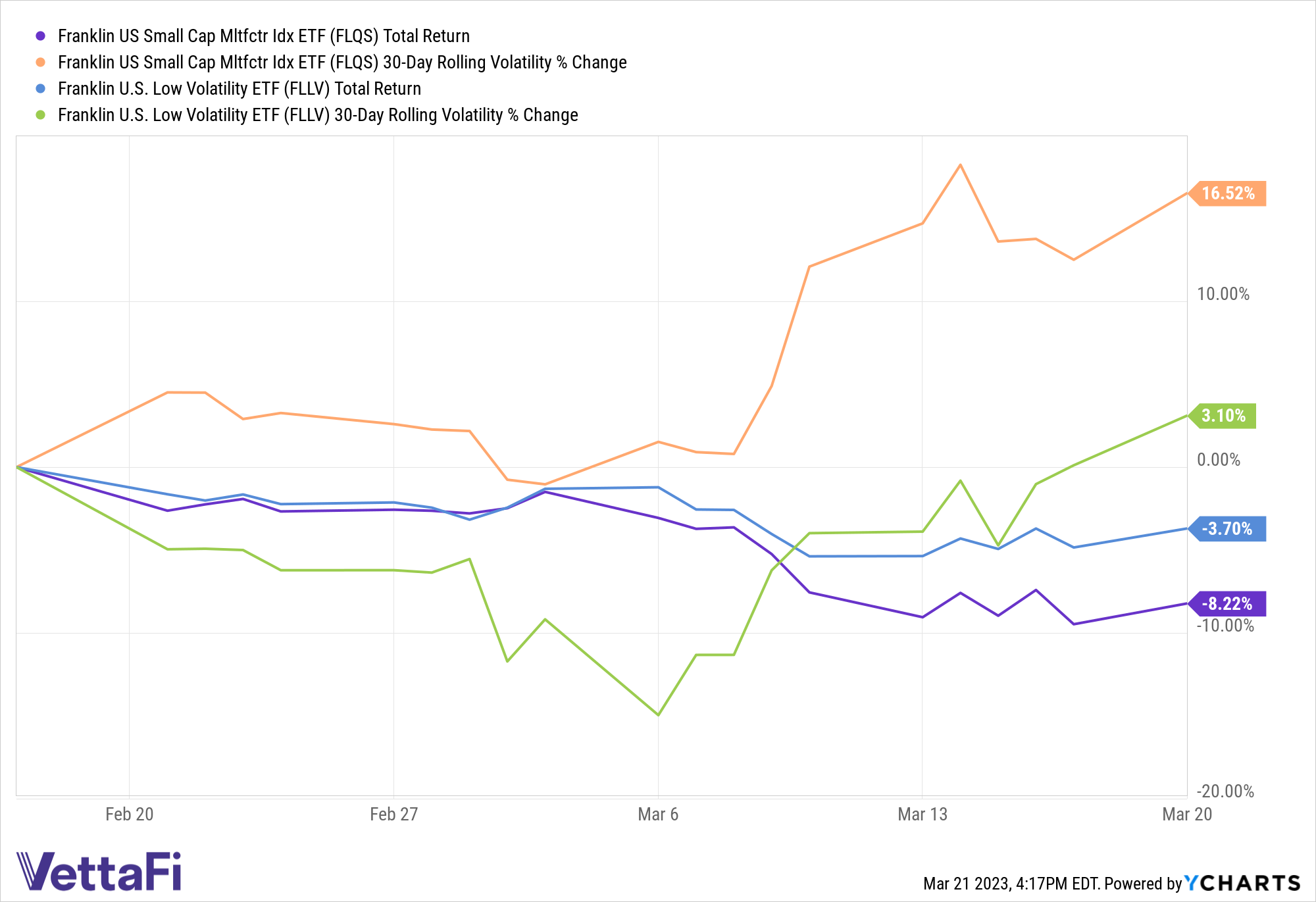

FLLV has added $7 million in net inflows over the last three months and returned 3.6% over the last six months, a solid performance for its fee with –27% 30-day rolling vol in that time. That’s less than the passive, low-vol Franklin U.S. Small Cap Multifactor Index ETF (FLQS), which returned 5.1% in that time, but it’s how the two have responded to the recent market chaos that shows active’s value.

Neither strategy has done that well over the last month, but FLLV has adapted better, outperforming FLQS by almost 5% with much less volatility, to boot, as seen here:

Active managers have a place in portfolios, and in a market environment like this, an active, low-vol equity ETF can be a potent overlay on top of core allocations.

Caruso: You made some excellent points, Nick, but I’m still not sold. Perhaps I could be swayed if active management outperforms passive again this year. Time will tell!

Peters-Golden: I’m going to keep riding the active train wherever it takes me – let’s come back to this when the much-discussed recession we’ve all been fearing hits later this year and see which style did better!

For more news, information, and analysis, visit the Innovative ETFs Channel.