Alphabet (GOOGL) has announced that it has opened a waiting list to get access to Bard, Google’s AI chatbot tool designed to take on ChatGPT, and within its role in Search, provide a riposte to the tech integrated inside Bing, Microsoft’s search engine.

The launch reflects Google’s attempt to regain ground lost to its Big Tech rival in what appears to be a new paradigm in the Search universe.

That said, Stifel analyst Mark Kelley thinks concerns over Google losing share are overblown. “We believe the recent press surrounding Microsoft’s OpenAI demonstrations have conflated use-cases within Search and do not present an existential threat to the core Google Search business,” the 5-star analyst said.

While the search giant’s initial presentation of its AI-based products left a lot to be desired, Kelley expects the company to offer “similarly convincing products within its greater search business (and others) that will keep Google users satisfied.”

Nevertheless, taking a conservative stance, Kelley’s model now calls for ~150bps of Search revenue market share losses across 2023 and 2024.

While Kelley takes a sanguine view on the risk of Google losing share in the Search market, there is the concern around the incremental costs related to running a Large Language Model (LLM) and the impact on margins. However, here Kelley also strikes an optimistic tone, believing that as most search queries are unlikely to require a Large Language Model (LLM), he does not believe there will be a “material impact” on Search margins.

Elsewhere in the Alphabet universe, considering its position in the combined Linear and CTV+ landscape, Kelley sees a “substantial opportunity for YouTube and YouTube TV.”

Put together, the Linear TV and CTV+ markets’ global ad spend amounted to $155 billion in 2022. Here, YouTube’s share has grown from 10% of in 2019 to 19% in 2022. As linear TV budgets continue the shift over to CTV+, Kelley anticipates “continued share gains.” By 2027, a 25% market share for YouTube would represent a $42 billion business.

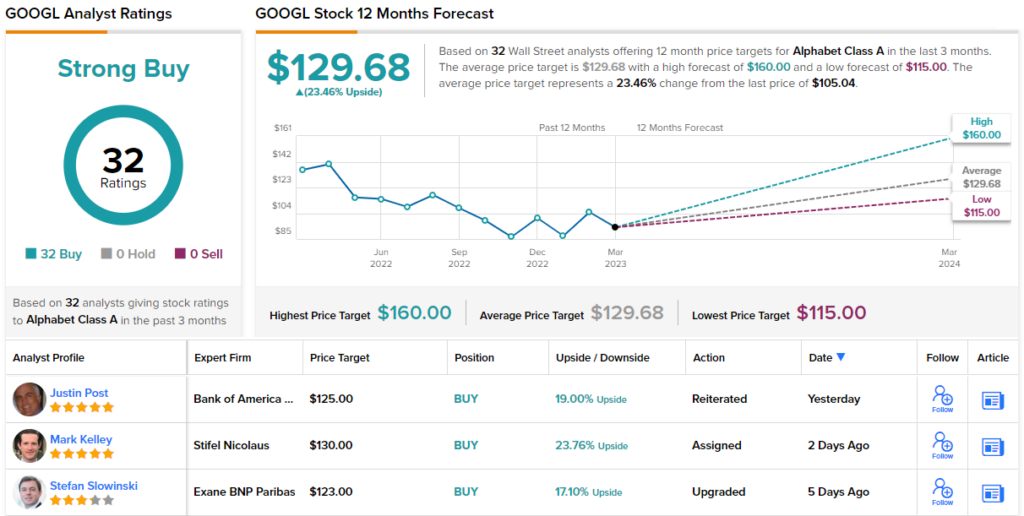

So, down to the nitty-gritty, what does it all mean for investors? Kelley resumed coverage of GOOGL stock with a Buy rating, backed by a $130 price target. Should the figure be met, investors will be sitting on returns of 24% a year from now. (To watch Kelley’s track record, click here)

GOOGL stock is that rare beast – a name with large, unanimously positive coverage; the stock receives Buy ratings only – 32, in total – naturally culminating in a Strong Buy consensus rating. At $129.68, the average target represents one-year upside of 23%. (See GOOGL stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.