Friday, April 26, 2024 11:50 PM EDT

Image Source: Unsplash

Kering’s (PPRUY) profitability is firmly tied to the performance of it’s Gucci brand with Bloomberg reporting that Kering derives nearly 70% of its profitability from Gucci.

Gucci is reported to be facing a problem of desirability and mass production even as it reports on slowing sales from China. Gucci is currently striving to reclaim its coveted status of “desirability,” a pinnacle pursued by all luxury brands. Its placement on the Lyst index, which monitors brands and products based on searches and mentions on social media, plummeted to as low as No. 12 in the third quarter of 2023, falling behind even smaller competitors like Prada and Miu Miu.

So, will the CEO, Francois-Henri Pinault. With nearly two decades in the job there is a wealth of experience to draw on, but will his approach for reform and renewal be enough?

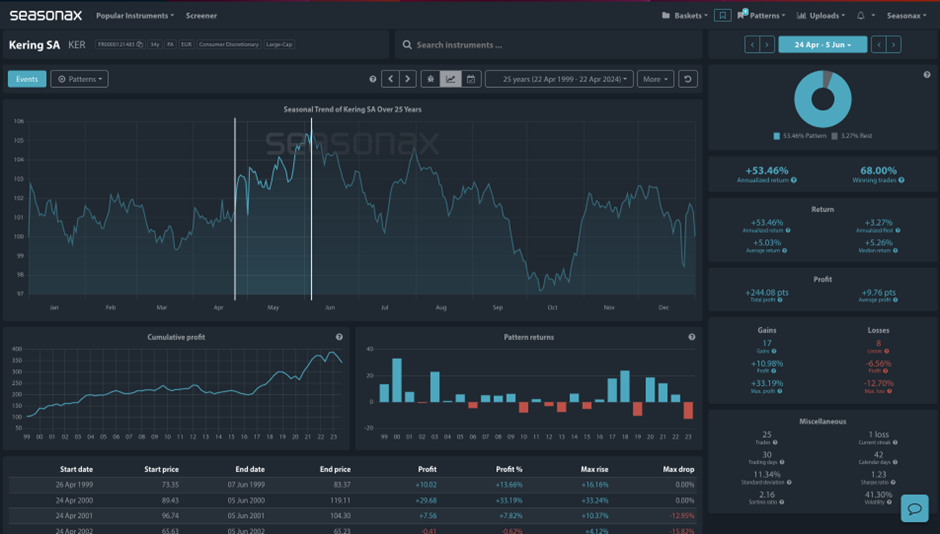

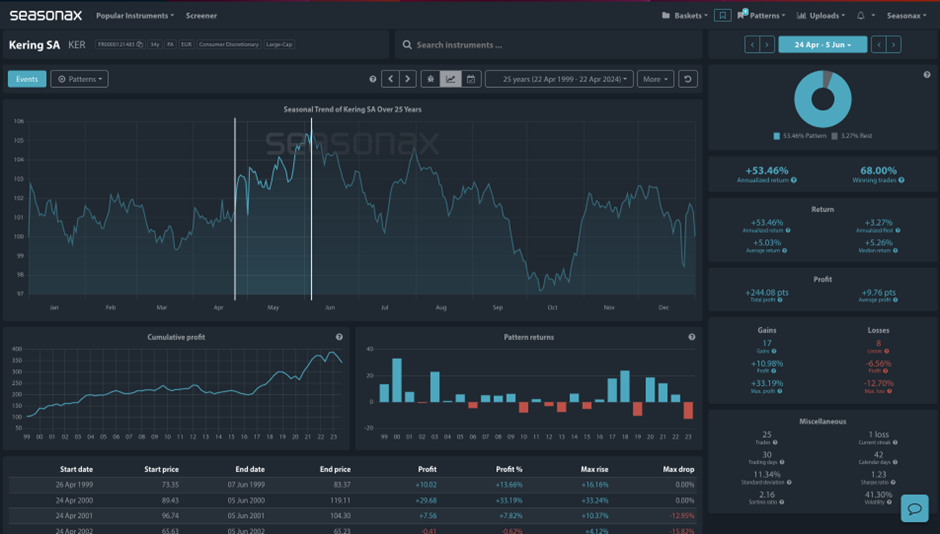

Kering SA seasonals are certainly strong. Over the last 25 years, between April 24 and June 05, Kering SA’s share price has risen over 5% with a number of years of double-digit gains. Will this string seasonal pattern repeat itself again this year?

Technically, Kering SA has been in a strong, downtrend and has just broken key support around the 360 region.

The major trade risk here is that previous seasonal patterns don’t necessarily repeat themselves each year.

More By This Author:

Crude Oil: Is The Next Price Surge Coming?Is Volatility About To Breakout? S&P 500: Which Is The Best Day Of The Week?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.