USD/CAD Weekly Forecast: Slowing US Economy Dents Dollar

A subtle bearish trend emerges in the USD/CAD weekly forecast as the dollar relinquishes its strong position amid the slowdown in the US economy.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week characterized by dollar weakness. Several economic reports from the US pointed to a slowdown in the economy that weighed on the dollar. Notably, business activity fell in April, showing the impact of higher interest rates.

Similarly, the economy grew at a smaller-than-expected 1.6% rate in the first quarter. Although this was a welcome relief for the Fed, inflation remained high, leading to a drop in rate cut expectations.

Next week’s key events for USD/CAD

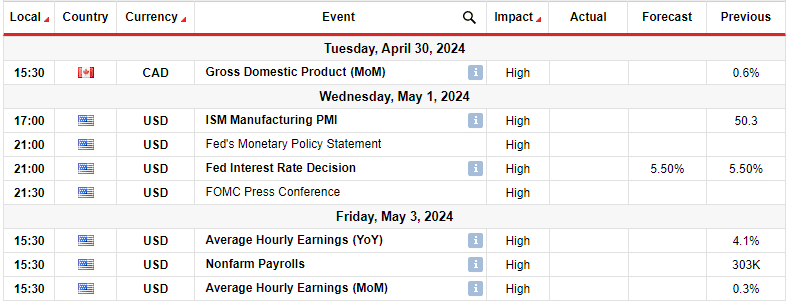

(Click on image to enlarge)

Next week, Canada will release its gross domestic product report. Canada’s economy has slowed down significantly as higher interest rates lower demand. A weak GDP report would likely increase the chances of the first BoC cut in June.

Meanwhile, investors will focus on the FOMC meeting and the jobs report from the US for clues on when the Fed might start cutting interest rates. Due to the stubborn inflation, the central bank will likely hold rates and call for patience on rate cuts.

Additionally, the NFP report could surprise on the upside again. In such a case, investors would scale back Fed rate cut expectations.

USD/CAD weekly technical forecast: Uptrend pauses, pullback reaches SMA support

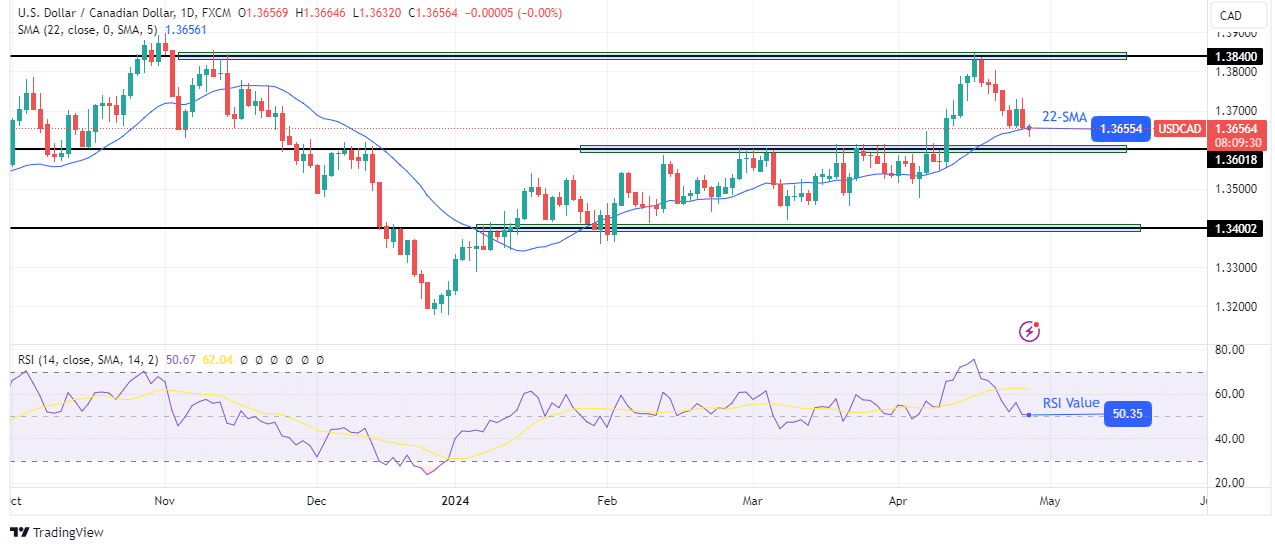

(Click on image to enlarge)

USD/CAD daily chart

On the technical side, the USD/CAD price has pulled back to retest the 22-SMA after finding resistance at the 1.3840 key level. At the same time, the RSI has fallen to the 50-mark, which it respects as support. This is a sign that the bullish trend has paused for a pullback.

Moreover, the price now trades with the nearest support at 1.3601 and the nearest resistance at 1.3840. Since it is in a bullish trend, making higher highs and lows, it might respect the SMA as support and climb to retest the nearest resistance.

Still, a sentiment shift will occur if the price breaks below the SMA and the nearest support level. This would signal a bearish takeover, allowing the price to target the 1.3400 support level.

More By This Author:

AUD/USD Forecast: Rallies as Rate Cut Bets Ease After Hot CPIUSD/JPY Outlook: Intervention Warnings Mildly Lift Yen

GBP/USD Forecast: 1.23 Broken Following BoE’s Remarks

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more