Owens-Illinois (OI) Tops Q1 Earnings & Sales, Reaffirms View

Owens-Illinois, Inc. OI reported first-quarter 2017 adjusted earnings per share of 58 cents, surpassing the Zacks Consensus Estimate of 53 cents. In addition, earnings jumped 21% year over year and exceeded the management guidance range of 50–55 cents per share.

Including one-time items, the company’s earnings decreased to 30 cents per share in the quarter from 42 cents recorded in the year-ago quarter.

Operational Update

Owens-Illinois’ net sales went up 2% year over year to $1.62 billion. Revenues also beat the Zacks Consensus Estimate of $1.58 billion. Sales volumes advanced 2% year over year. Currency translation adversely affected net sales by less than 1%. On a global basis, pricing was up less than 1%.

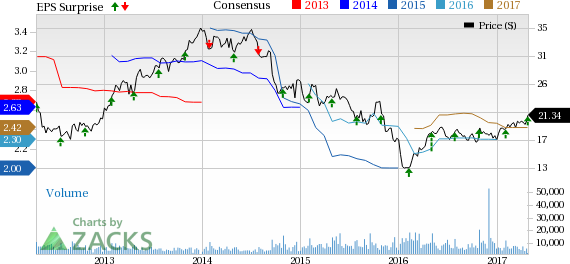

Owens-Illinois, Inc. Price, Consensus and EPS Surprise

Owens-Illinois, Inc. Price, Consensus and EPS Surprise | Owens-Illinois, Inc. Quote

Shipments in Europe increased 4%, mainly attributed to higher beer shipments. In Latin America, volume increased 3%, backed by stronger shipments – primarily beer – in Mexico and the Andean region. On the other hand, sales volume in North America declined 2%. Sales volume in Asia Pacific increased 4% year over year, primarily driven by increased shipments of wine in Australia and beer in Southeast Asia, as well as the favorable geographic mix of business.

Cost of sales was up 2.4% to $1.3 billion in the quarter. Gross profit edged down 1.3% to $315 million from $319 million recorded in the year-earlier quarter. Selling and administrative expenses declined 7.8% to $119 million. Segment operating profit improved 3.3% year over year to $218 million. Segment operating profit margin expanded 20 basis points to 13.5% in the quarter.

Financial Update

Owens-Illinois had cash and cash equivalents of $312 million at the end of first-quarter 2017 compared with $492 million at the end of 2016. The company recorded cash used for operating activities of $337 million in the reported quarter compared with cash usage of $301 million recorded in the prior-year quarter.

Owens-Illinois’ long-term debt increased to $5,431 million at the end of first-quarter 2017, compared with $5,133 million at the end of 2016.

Guidance

Owens-Illinois reaffirmed its adjusted earnings per share outlook for 2017 in the band of $2.40–$2.50 per share. The guidance reflects uncertainty in macroeconomic conditions and currency rates, as well as several other factors.

Share Price Performance

Over the last one year, Owens-Illinois outperformed the Zacks classified Glass Products sub-industry with respect to price performance. The stock gained around 16.6%, while the industry recorded growth of 14.4% over the same time frame.

Zacks Rank & Key Picks

Owens-Illinois currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Donaldson Company, Inc. DCI, Casella Waste Systems, Inc. CWST and Parker-Hannifin Corp. PH. All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Donaldson Company has an average positive earnings surprise of 5.93% for the trailing four quarters. Casella Waste generated an outstanding average positive earnings surprise of 165.21% over the past four quarters, while Parker-Hannifin has an average positive earnings surprise of 12.44% for the last four quarters.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owens-Illinois, Inc. (OI): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research