Ken Fisher Buys Vodafone

- By Kyle Ferguson

Guru Ken Fisher (Trades, Portfolio) is a San Francisco native who learned his investment strategies under his father Philip A. Fisher's guidance. Ken Fisher's father wrote the book "Common Stocks and Uncommon Profits."

Warning! GuruFocus has detected 2 Warning Signs with VOD. Click here to check it out.

The intrinsic value of VOD

Legendary investor Warren Buffett (Trades, Portfolio) said he attributes 15% of his investment style to Philip A. Fisher and the other 85% to the father of value investing, Benjamin Graham.

Ken Fisher purchased 12,420,913 shares of Vodaphone Group PLC (VOD) during the first quarter. The shares were purchased in an estimated price range of $24.42 to $26.91 per share.

Headquartered in Newbury, the United Kingdom, Vodafone is a telecommunications company. Its business is organized into two geographic regions: Europe and Africa, Middle East and Asia Pacific (AMAP). Its segments include Europe and AMAP. Its Europe segment includes geographic regions, such as Germany, Italy, the United Kingdom, Spain and Other Europe.

Vodafone is one of the world's largest telecommunications companies providing a wide range of services including voice, messaging, data, fixed broadband and TV.

The company has 470 million mobile customers, 14 million fixed broadband customers and 9.8 million TV customers and about 108,000 employees. The company has mobile operations in 26 countries, partners with mobile network providers in over 50 more and has fixed operations in 17 countries.

Vodaphone has a market cap of $70.27 billion, an enterprise value of $116.92 billion, a price-book (P/B) ratio of 0.89 and a dividend yield of 5.80%.

Ken Fisher may have made the purchase because the company is one of the largest telecommunications companies in the world with 30 years of operating experience and more than 480 million customers worldwide.

The company's price is close to its three-year low. Its dividend yield is close to its two year high. And its price-sales (P/S) ratio is 1.31, which is close to its three-year low of 1.25.

According to GuruFocus, the company has a 4 of 10 financial strength rating with a cash-debt ratio of 0.25 and an equity-asset ratio of 0.47. It has an interest coverage ratio of 0.86. The company's Beneish M-Score of -2.90 indicates it is not a manipulator of its financial statements.

The company has a 4 of 10 profitability and growth rating. It has an operating margin of -8.57%, a net margin of -15.53%, a return on assets (ROA) of -5.13% and a three-year EBITDA growth rate of -6.20%.

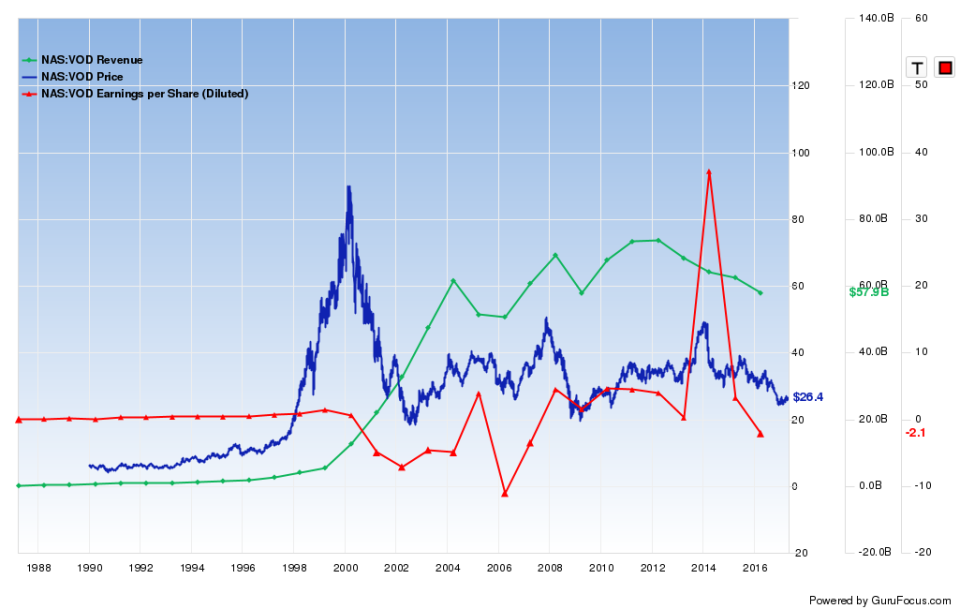

Below is a Peter Lynch chart that shows Vodafone is trading below its intrinsic value

Disclosure: Author does not own any shares of this company.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with VOD. Click here to check it out.

The intrinsic value of VOD