Royce Is Major Shareholder of Company With Better-Than-Expected Losses

- By Omar Venerio

Apparel brands continue to increase their focus on new product lines, e-commerce and investments in company-owned retail as well as international expansion.

Guess? Inc. (GES) is one of the most popular brands in the U.S. apparel subindustry but faces severe competition from Gap (GPS), Calvin Klein and Diesel. As a result, there is a lost because younger generations are attracted by those other brands. Moreover, looking inside the company there were some problems in internal controls among the Marciano brothers, but the recent promotion of Victor Herrero as the CEO should contribute to positive decisions.

Warning! GuruFocus has detected 7 Warning Signs with GES. Click here to check it out.

The intrinsic value of GES

Further, initiatives in the core of the business, in areas such as manufacturing, merchandising, retailing and branding should contribute to sales increases by the end of fiscal 2017. For example, markets in Europe and Asia are growing (revenues were up 23% and 17% in the first trimester).

An important aspect to mention is that the company lost cost advantages, and this affects pricing power flexibility among a young target market. Thanks to GuruFocus, we can see that operating margin has been in a five-year decline with an average rate of 36.2%, which means a severe warning sign. It is crucial for Guess to change with the pattern of revenue decline and start the recovery to obtain better profitability.

After reporting first-quarter results, shares traded higher and many investors are wondering if it is the appropriate time to buy it now. For the first quarter of fiscal 2018, the company recorded GAAP net loss of $21.3 million, a 15.4% improvement when compared to the first quarter of the past year. The company recorded adjusted net loss of $19.4 million, and adjusted diluted loss per share deterioration of 4.3% to 24 cents from 23 cents for the prior-year quarter. Total net revenue increased 2.2% year over year to $458.6 million compared to $448.8 million in the same quarter a year ago and beat estimates by $9.36 million. In constant currency, net revenue increased by 4.0%.

The gross profit margin inched up 1.3% to $144.6 million in the quarter.

Long positions

Hedge fund guru Chuck Royce (Trades, Portfolio) added this stock to his portfolio in the first quarter, raising his holding by 9% to 809,400 shares, valued at $9.03 million.

Relative valuation

In terms of valuation, the stock sells at a trailing price-earnings (P/E) of 36.2x, trading at a premium compared to an average of 20.37x for the industry. To use another metric, its price-book (P/B) ratio of 1.0x indicates a discount versus the industry average of 1.65x while the price-sales (P/S) ratio of 0.43x is below the industry average of 0.70x. These last two metrics indicate that the stock is relatively undervalued and seems to be an appealing investment relative to its peers.

Final comment

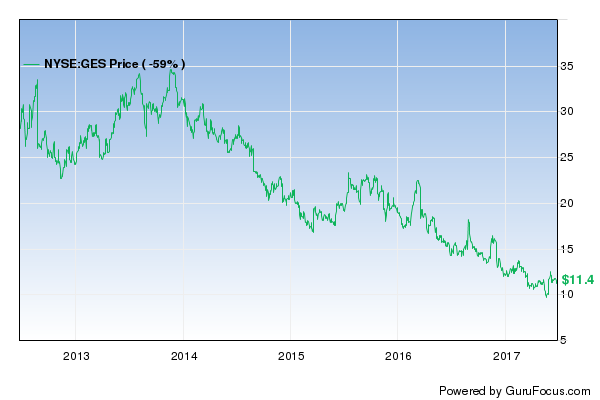

Although the stock lost nearly half of its value in the past five years, it seems to be the right time to add the stock to a long-term portfolio due to opportunities in new categories, new geographies and better results.

Disclosure: Author holds no position in any stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 7 Warning Signs with GES. Click here to check it out.

The intrinsic value of GES