What’s inside:

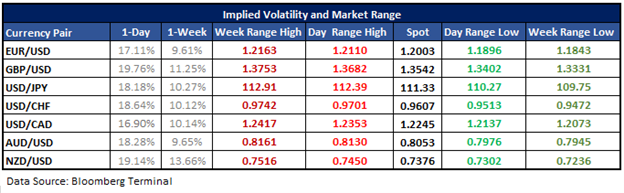

- One-day implied volatility for EURUSD rises to 17.11%, 1-stdev range of 11896-12110

- One-day IV for USDJPY bumps up to 18.18%, 1-stdev range of 11027-11239

- FOMC announcement set for 14:00 GMT time

The importance of trading psychology can’t be understated. Check out this beginner’s guide – Building Confidence in Trading.

In the following table, you’ll find levels of implied volatility (IV) for major USD-pairs looking out over the next one-day and one-week time-frames. Using these levels, we’ve derived the range-low/high prices from the current spot price within one-standard deviation for specified periods. Statistically speaking, there is a 68% probability that price will remain within the lower and upper-bounds.

EURUSD options implied volatility rises to 17.11%, implies a 1-stdev range of 11896-12110

At 14:00 GMT time, the FOMC will announce its decision on rates, which are expected to remain unchanged. The market’s focus will be on the Fed’s plans with its balance sheet and QE, along with the central bank’s outlook towards future rate hikes. For live coverage of the announcement, join Chief Currency Strategist John Kicklighter at 13:45 GMT.

Based on implied volatility there is a 68% probability that the euro will close somewhere between 11896 and 12110. A pretty sizable range. The latter level if seen could kick off the start of a ‘head-and-shoulders’ pattern we discussed in this morning’s webinar. But we will still need to see a break of the 11825 area (which the one-week projected low aligns with) and the April trend-line before becoming overly bearish. On the top-side, should we see the upper threshold met or exceeded, it would mean a breakout for EURUSD is underway and clearance of the 2012 low. The one-week projected high is at 12163. The one-day levels are in close proximity to the one-week expected range high/low, highlighting the fact that the market pricing in much of the next week’s volatility into the outcome of today’s meeting.

Join Paul live each week; for details please see the Webinar Calendar.

EURUSD: Daily

USDJPY options implied volatility rises to 18.18%, points to a 1-stdev range of 11027-11239

The projected daily range-low at 11027 is of interest given it roughly aligns with support going back to March. Should we see a move down to that point buying interest may show up. Looking higher, the 11239-projected daily high is not far above the 200-day moving average, possibly undercutting further intra-day momentum. The one-week high is of interest as it aligns well with the trend-line running down off the December high. A move to that level may stall as intermediate-term resistance comes into play.

For other currency volatility-related articles please visit the Binaries page.

USDJPY: Daily

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.