Okta Could Collapse With Lockup Expiration

October 4, 2017 concludes the 180-day lockup period on Okta (NASDAQ:OKTA).

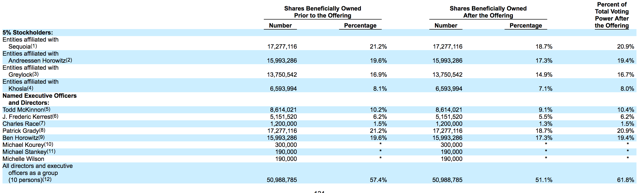

When the lockup period ends for OKTA, its pre-IPO shareholders, directors and executives will have the chance to sell their restricted shares. Currently, more than 79 million shares - approximately 88% of all shares outstanding - are subject to lockup restrictions. The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of Okta shares.

![]()

Currently, OKTA trades in the $29 to $30 range, above its IPO price of $17, and higher than its first day closing price of $23.51 on April 7, 2017.

More than 10 directors and numerous corporate entities currently own restricted shares of OKTA. We believe that they will be eager to take profits as soon as possible after the IPO lockup restriction is lifted.

(Source: S-1/A)

Business Overview: Provider Of Identity as a Service (IDaas) Platform

Okta, Inc. operates an integrated system that connects individuals through devices. Its identity cloud connects a wide array of companies across multiple sectors with pre-integrated apps and devices every day. Okta offers universal directory products, lifecycle management, adaptive multi-factor authentication, mobility management, and single sign-on for IT clients; and user management, complete authentication, API access management, flexible administration, and developer tools for developers.

Its clients include Twilio, Pitney Bowes, MGM Resorts, MassMutual, LinkedIn, Github, Flex, Engie, Adobe, and 20th Century Fox. Okta also maintains partnerships with leading cloud vendors including Workday, ServiceNow, SAP, NetSuite, Microsoft, Google Cloud, Box, and Amazon Web Services.

The company was incorporated in 2009 as Saasure Inc. and later reincorporated in 2010 as Okta. Okta is headquartered in San Francisco.

Financial Highlights

For the first quarter of fiscal 2018 ended April 30, Okta reported the following financial highlights:

-

Total revenue was $53.0 million, an increase of 66.8% year over year.

-

Subscription revenue reached $48.4 million, an increase of 75.4% year over year.

-

GAAP operating loss was $28.6 million, or 54.0% of total revenue, compared to $22.7 million in the first quarter of fiscal 2017, or 71.4% of total revenue.

-

Non-GAAP operating loss was $19.7 million, or 37.2% of total revenue, compared to $19.3 million for the first quarter of fiscal 2017, or 60.7% of total revenue.

-

GAAP net loss was $28.9 million, compared to $22.8 million in the first quarter of fiscal 2017. GAAP net loss per share was $0.73, compared to $1.22 for the first quarter of fiscal 2017.

-

Non-GAAP net loss was $20.0 million, compared to $19.3 million in the first quarter of fiscal 2017. Non-GAAP net loss per share was $0.50, compared to $1.04 for the first quarter of fiscal 2017.

Okta announced expectations for the full fiscal year of 2018:

-

Total revenue of $233.0 to $236.0 million.

-

Non-GAAP operating loss of $91.2 to $88.2 million.

-

Non-GAAP net loss per share of $1.15 to $1.11 using shares outstanding of approximately 80.2 million.

Management Team

CEO and Co-founder Todd McKinnon launched Okta as SaaSure in 2009. His previous experience comes from senior positions at Salesforce (NYSE: CRM) and PeopleSoft. Mr. McKinnon holds a Master of Science in computer science from California Polytechnic State University, San Luis Obispo and a Bachelor of Science in management and information systems from Brigham Young University.

Chief Operating Officer and Co-founder Frederic Kerrest also serves on the board of directors. His previous experience comes from Hummer Winblad Venture Partners and Salesforce. Mr. Kerrest holds a Masters in Business Administration from the MIT Sloan School of Management and a Bachelor of Science in computer science from Stanford University.

Competition: IBM, Microsoft and Oracle

Okta faces competition from authentication providers, life-cycle management providers, multi-factor authentication providers, and mobility management providers. These include Computer Associates (CA), IBM (IBM), Microsoft (MSFT), Oracle (ORCL), RSA, Symantec (SYMC), VMware (VMW), and Citrix (CTXS).

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

Okta |

$2,815.0 |

($96.0) |

18.4 |

n/a |

|

Microsoft |

$581,051.0 |

$21,204.0 |

8.0 |

27.8 |

|

Oracle |

$200,473.0 |

$9,713.0 |

3.6 |

20.9 |

|

VMware |

$44,853.0 |

$1,186.0 |

5.2 |

39.5 |

|

Industry Average |

$9,018.0 |

$237.0 |

5.9 |

27.7 |

Early Market Performance

OKTA made its market debut on April 6, 2017, raising $187 million through its offer of 11 million shares. Okta's IPO priced at $17 per share, at the high end of its expected price range of $15 to $17. The stock gained more than 38% during the first day of trading. Since then, the stock has climbed steadily and now trades in the $28 to $30 price range.

Conclusion

When the 180-day lock-up period - which restricted insiders' ability to trade shares - expires on October 4, 2017, the company's 79,758,777 previously restricted shares will be eligible for trading. This represents approximately 88% of the total shares outstanding.

With the IPO lock-up for currently restricted shares quickly approaching, we recommend investors consider shorting shares ahead of October 4.

We believe the company insiders will be eager to sell shares once restrictions are lifted, leading to a price dip surrounding the event.

Investors should cover positions in the remainder of the trading week following the lock-up expiration event on October 5th.

Disclosure: I am/we are short OKTA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more