Economy Recovering From Hurricanes

Graham-Cassidy Vote Coming Mid To Late Next Week

The deadline to pass the Graham-Cassidy healthcare bill in the Senate is September 30th which is in 8 days. If it does pass the Senate, the House will have enough time to vote on it. The issue is never going to be time. Deadlines are the catalyst for Congress to get things done. If there were no deadlines, nothing slightly controversial would be passed. There was a huge boost in the betting market which forecasts whether the Senate will vote on the healthcare bill this year. It moved up 14% to 50%. The majority of those expecting a vote this year are those who think a vote will occur next week. In the past, it was generally thought that a vote only occurs if the leadership thinks it will pass. With the July votes failing, there’s new precedent for a vote to occur and fail. At the same time, John McCain’s vote was a shock, so that precedent may not have changed. At the current moment, I’d say it’s a tossup whether the vote occurs. There’s a slightly lower chance the Senate approves it and a slightly lower chance the House approves it. That means the bill has somewhere between a 25% and a 33% chance of becoming law.

On the battlefield, it appears some last minute changes are being made to the bill to get the votes needed. Part of the reason why the second July vote didn’t pass is because McCain didn’t voice his displeasure until the vote. If Murkowski is honest about her intentions and no other votes change, then the plan can be altered to get her on board. There have been reports that the latest tweaks were made so that Alaska and Hawaii are the only two states that will get premium tax credits under Obamacare. There’s other reports that Alaska and other sparsely populated states will be shielded from Medicaid cuts until 2026. Murkowski is essentially getting a personalized law for Alaska. We will probably know more information about what she is thinking in the next couple days as the media constantly asks her about it.

Economic News

The jobless claims report showed a decline of 23,000 jobs to 259,000 jobs. That was a big positive surprise compared to the 300,000 expected. This is a signal that the economy has recovered quickly from the two hurricanes that ravaged Houston and Tampa Bay. Further good news is that neither hurricane Jose nor hurricane Maria have made/are going to make landfall on the American mainland. Maria had a big effect on Puerto Rico and the U.S. Virgin Islands which is tragic, but not pertinent to our economic concerns.

The unadjusted jobless claims in Texas fell 23,549 last week which is the second straight drop, signaling the economy is getting its footing back. The initial spike in Texas after the storm was 51,683. With the 11,800 decline two weeks ago, most of the claims have gone away. Florida is headed in the opposite direction, but the totals are much smaller. Unadjusted jobless claims increased 5,133 last week. The Labor Department estimated the data from the U.S. Virgin Islands and South Carolina.

Interestingly, the leading indicators report for August increased 0.4% month over month which doubled expectations even though hurricane Harvey hit Houston at the end of August. The official statement claimed the report didn’t include the total hurricane effect. It’s also worth noting that one of the indicators in the report is the stock market; stocks didn’t fall as a result of the storms.

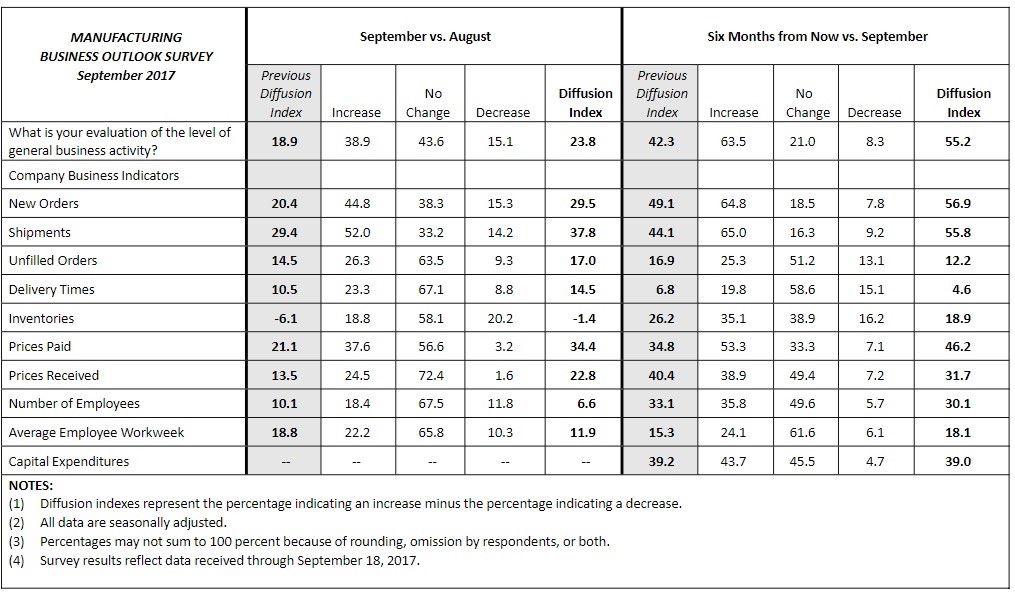

The other major economic report that came out on Thursday was the manufacturing business outlook survey. The headline report showed the diffusion index at 23.8 which beat expectations for 17.1. The table below summarizes the report. As you can see, new orders increased by 9.1 points. The biggest takeaway from this report is the results from the forward looking index. As you can see, the diffusion index was up 12.9 to 55.2. Most of the underlying metrics were up as well. The other takeaway is the increases in prices. Both prices paid and prices received increased decently. This September report supports the pickup we saw in the CPI report for August.

With the jobless claims figures in Florida popping much less than those in Texas, I think it’s fair to say I overemphasized the effect the hurricanes will have on the economic data which will be reported in the next few weeks, specifically GDP, inflation, and the non-farm payrolls report. Therefore, I think we’ll see GDP growth between 1.5% and 2.0%, a slight pickup in inflation, and a jobs report between 50,000 and 100,000. Analysts are expecting a 60-95 basis point drag on personal income growth. That would imply a slight decline in consumer spending.

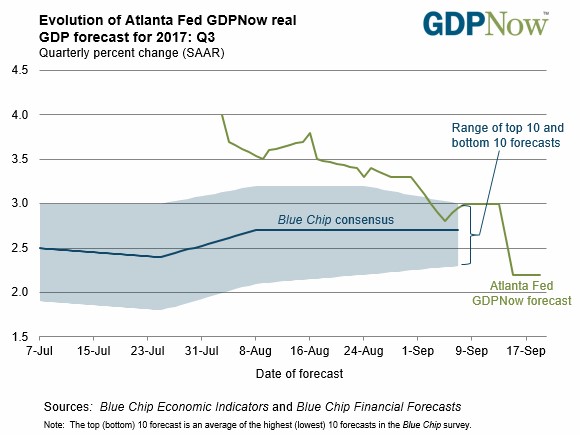

The chart below gives you can idea of where GDP growth will be when it’s reported next month. As you can see, the latest GDP Now estimate shows 2.2% GDP growth which is the same as the last update. It seems like much of the decline is now over although there’s still some August economic reports which will soon be released. The GDP Now report was affected by the new residential construction report and the import/export price indexes. At this point in the cycle, the forecasts are usually accurate, but there still might be another shoe to drop because of weakness from the storms.

Conclusion

Humana stock was down 0.43% today. Whenever it is down, that means the bill is gaining momentum. When the stock goes up, that means the bill is losing momentum. You can just watch Humana stock instead of reading the news if you want a quick take on the bill’s chances. I don’t think it will be passed as of Thursday, but I could change my mind after new reports are released.

While the natural disasters were terrible, unless you own stock in an insurance company, an airline, or Dupont, you probably won’t notice an effect to your portfolio. It looks like the recovery is underway. There might me a blip higher in the September economic reports because of this.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more