Warsh Has A 28% Chance Of Being The Next Fed Chair

Fed Pick Pivotal

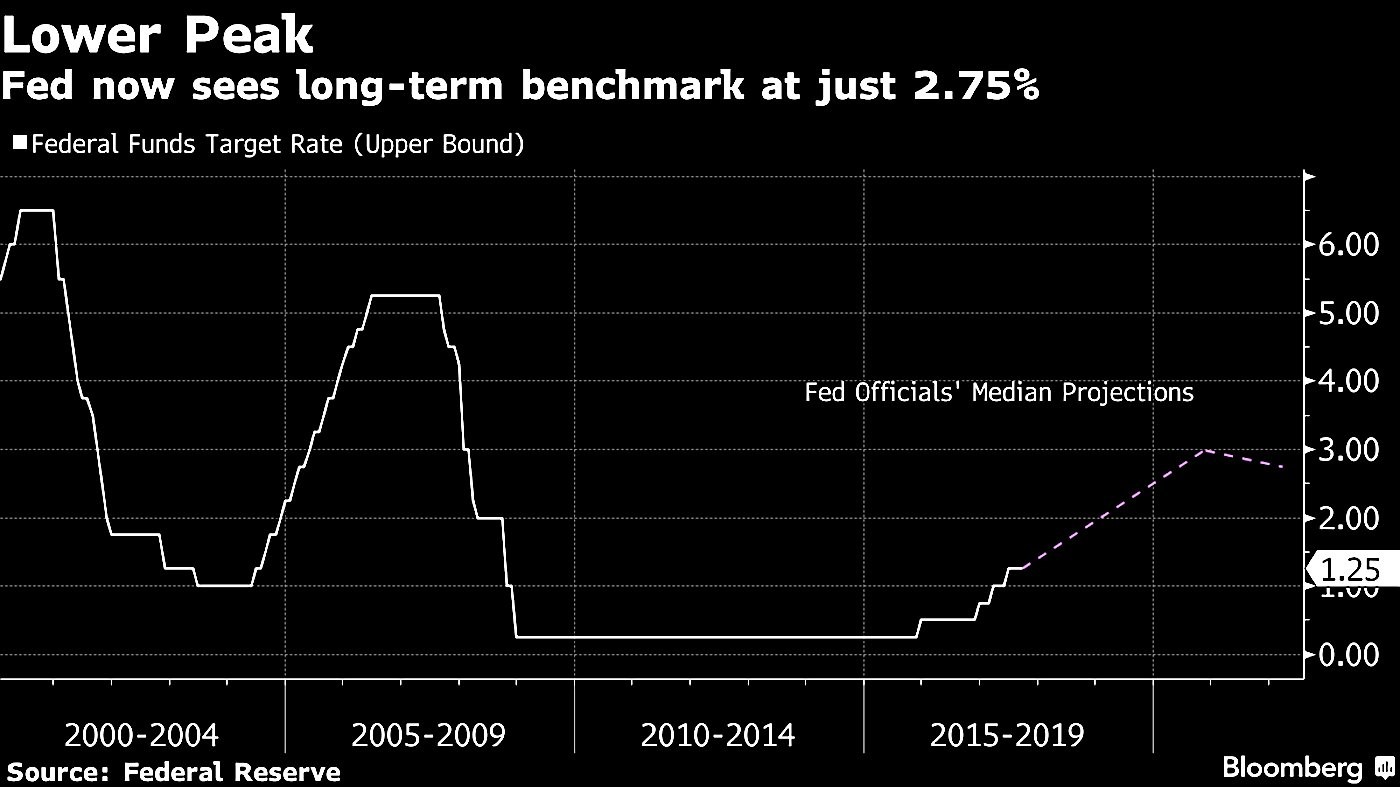

A previous article reviewed the Fed’s guidance for interest rates over the next few years, but I think the chart below does a unique job at contextualizing the situation we are in. As you can see, the trend of interest rates having lower peaks is continuing. The difference between this cycle peak and the last cycle peak is greater than the previous difference between peaks. This is because inflation has been in decline along with GDP per capita. In the next few years, some are expecting inflation to increase because of demographic trends. The influx of Chinese and other emerging market laborers caused wage inflation to decline. That labor force growth is moderating which could cause wage inflation to increase.

The current scenario is bullish for stocks unless that wage inflation comes soon. The lower peak reinforces the notion that the Fed is still dovish even while it is raising rates. The Taylor Rule says interest rates should be near 2.75% which means the Fed might not exceed the Taylor Rule and become hawkish this cycle. It’s an interesting experiment because we know interest rates being too low led to the last bubbles being created, but they burst because the Fed got too hawkish. Will the current economy avoid a recession if the Fed funds rate never exceeds the Taylor Rule? That’s what we shall find out in the next 2-3 years.

These statements work off the basis that the Fed will keep the same policy stance. However, if Kevin Warsh is picked, then I could see the Fed’s guidance on rates move higher. Lately Kevin Warsh’s chances of being picked have increased in the betting market. He’s now at 28% which is 2 points below Yellen who is at 30%. Personally, I would put Warsh’s odds at 50%, Yellen’s odds at 20% and the field’s odds at 30%. The PredictIt market doesn't seem to acknowledge how President Trump criticized Yellen in his 2016 interview on CNBC.

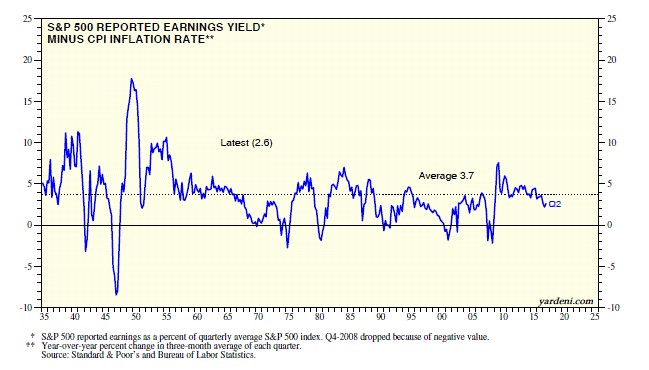

Just to reinforce the importance of inflation when valuing stocks, the chart below shows the S&P 500 earnings yield minus the CPI inflation rate. As you can see, when the difference goes negative, the stock market is expensive. Looking at historical valuation metrics has painted a bearish picture in the past few years. Only when looking at historically low inflation and interest rates can you come to a bullish viewpoint. I am siding with that TINA perspective because it has been working. That may sound simplistic, but why would you side with an indicator that has been wrong for a few years? It’s not that the PE multiple is dead; it just needs to be contextualized to the current scenario. The chart below is one way of doing that.

Why Russell 2000 Is Rallying

The Russell 2000 was down slightly on Thursday, but even on a down day it still beat the other major indexes as the Russell 2000 fell 0.09% and the S&P 500 fell 0.30%. The three reasons why I think the Russell 2000 is outperforming are the following: AAPL is underperforming lately and dragging down the major indexes, the Russell 2000 has more financials and the financials have done well because of the recent hawkish Fed, and President Trump’s approval rating is improving which is good news for domestic firms.

The point about financials being a large part of the Russell 2000 isn’t widely known as you’d think an index with 2000 names would be well diversified. The KBW S&P regional bank index is up 9.50% since September 7th. In that period, the Russell 2000 is up 3.25%, so the financials have been pulling the index up lately.

AAPL stock continued to selloff based on the previous stories about how the iPhone 8/ 8 Plus isn’t getting as much interest as expected. There are also rumors that potential customers think iPhone X costs too much. If the iPhone X price was lowered because of tepid demand, it would cause Apple to lower all of its iPhone prices. This discussion is likely far too early. Anyone who is mad about the iPhone X price will complain on social media while the people who want it have nothing to say because the pre-orders won’t start for another 5 weeks. The situation looks worse than it is which is why I would buy AAPL for a trade in a few weeks if the stock drops more. The stock is now down 6.50% from its September 1st high.

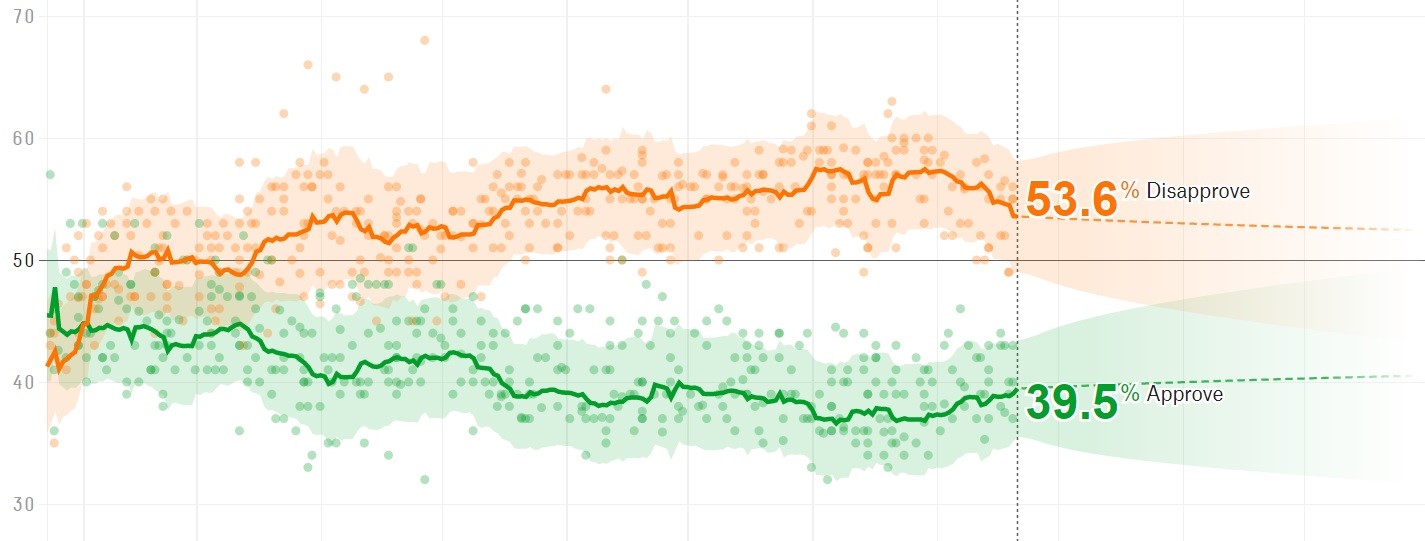

As you can see from the chart below, President Trump’s approval rating has been boosted by a few points possibly because of the government’s handling of hurricane disaster relief. His controversies weren’t in the headlines during the period where storms dominated the news in late August and early September. The more popular President Trump gets, the more sway he has over Congress when it comes to lowering taxes and passing a healthcare plan. This may not move the needle on big issues, but it’s a step in the direction towards getting simulative measures passed which is great for the domestic economy; this may be supporting the Russell 2000 index lately.

Conclusion

The Dow ended its 9 day streak as stocks had a minor selloff. Even with this selloff, the VIX fell to 9.67 further cementing the chances that this will be the calmest month of September ever. The calmness will end next year if Warsh is picked. The market has shown no response to the fact that there’s a 28% chance of a hawkish Fed taking over. That means I expect a selloff when he’s picked. The decision should be made in the next few weeks. The healthcare discussions might be holding back this pick as President Trump may choose to make the decision when there aren’t other conflicts in the news. The President is pressing hard to get the healthcare plan passed using the bully pulpit, so he doesn’t want to start a monetary policy debate in the midst of this. If the healthcare plan fails again, I’d expect him to make the decision soon afterwards. I’m targeting October as the most likely month the decision will be made.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more