Investing well can be hard. Everyone who tries his or her hand at it wants to do well. Unfortunately, too many of us do poorly for a litany of reasons, including trading too often or chasing yield instead of stable payouts and returns. But individual investors can do well by following an effective strategy that's proven to work: Invest in high-quality companies at reasonable prices, hold them for as long as possible, and reinvest the dividends.

Don't think it will work? Check out the following collection of dividend stock charts that highlight how incredibly well this strategy can work.

The lesson this chart shows could help you turn around your investing results. Image source: Getty Images.

A simple chart that shows you the best way to invest well

There's an old saying, that time in the market beats timing the market. This is true for almost all of us. The stock market, which is affected by the economy, investor sentiment, interest rates, inflation, and numerous other things, is essentially impossible to reliably predict from one day, week, month, or even year, to the next. But over the very long term, that volatility has proven to be a boon for investors, since the best companies grow along with the economy, become more profitable, expand, and increase their payouts to shareholders.

Since June 1988 (the oldest data available), the S&P 500 has increased in value by 856% at this writing, while total returns -- which includes all dividends paid -- are 1,730%. Here's what that looks like in real-money returns:

An investor in a low-cost index fund like one of the three Vanguard 500 Index Funds (VOO -0.41%) (VFINX 1.20%) (VFIAX 1.20%) would have captured returns very similar to this, turning $10,000 into $173,000 over 29 years and change, with over half of that from dividends.

That includes sitting on your hands and holding your investments through some of the worst times to be an investor: the dot-com bubble, Sept. 11, and even the Great Recession, riding out the worst of it, while still collecting dividends (and better yet, reinvesting them).

It can work even better if you focus on the best individual stocks. Here are three -- The Coca-Cola Co. (KO 0.31%), Nucor Corporation (NUE 1.81%), and 3M Co. (MMM -0.66%) -- that have delivered market-crushing total returns over the past 29 or so years:

These three companies delivered even better results than the rest of the market over the same period, both in stock price appreciation and in total returns. Furthermore, these companies were not exactly start-ups trying to prove themselves in 1988 -- they were market leaders with years of success behind them that would help pave the way for the decades since that delivered such wonderful returns for their investors.

Here's how much better the total returns from these top-notch companies over the past 29 years have been: While the S&P 500 generated a wonderful $173,000 for every $10,000 invested, 3M delivered $293,000, Coca-Cola made investors $349,000, and Nucor Corporation forged an amazing $429,000 in total returns since June 1988.

Just imagine how it can work out if you steadily invest more money on a regular basis for years and years. That's how regular people become millionaires.

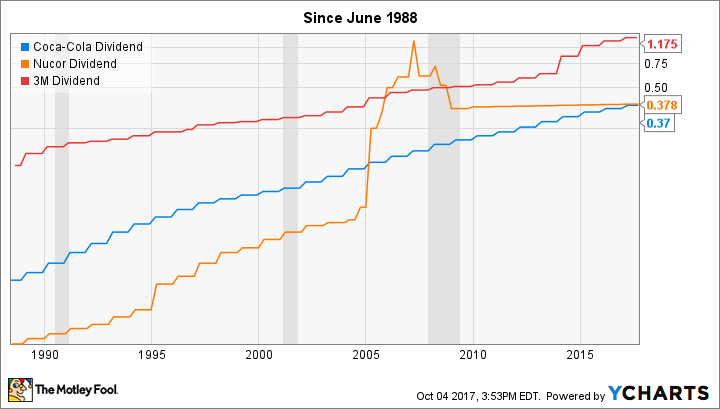

It's also worth noting that none of these companies have ever been particularly high-yield investments. Here's a look at their yields over the past 29 years:

KO Dividend Yield (TTM) data by YCharts.

Except for when their stock prices were hammered during and since the Great Recession, none of these stocks has ever paid a yield above 4%, and generally they have paid yields closer to 2.5% or below. But all three have delivered huge dividend growth over the very long term:

KO Dividend data by YCharts.

Let time (and great businesses) do the work

The big takeaway from this is simple. You really don't need to constantly tinker with your portfolio. To the contrary, chances are, the more often you trade in and out of stocks, the worse your returns are going to be.

But if you invest in great companies with solid prospects and simply hold on to those investments for as long as you can, your returns will almost certainly improve. In the case of the three companies above (which I honestly cherry-picked to prove my point), you may not only do better than the typical individual investor who underperforms the market but end up with returns that far exceed the market itself.