Worst Performing ETFs Of The Year

Last week we highlighted the top-performing ETFs of 2017. With nearly 90% of all U.S.-listed ETFs on track to end the year with gains, it wasn’t hard to find worthy candidates for that story.

In this article, we’ll take a look at the other side of the ledger—the ETFs that performed the worst. Once again, we made two lists, one that excludes leveraged and inverse products, and one them includes them.

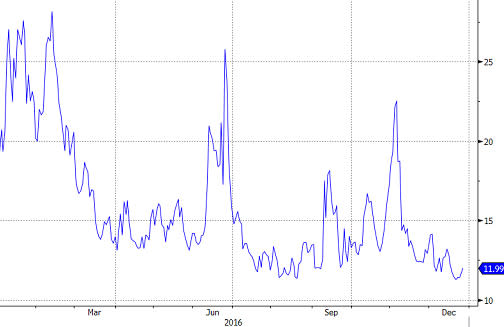

VIX ETFs Devastated

Both lists are topped by volatility ETFs, as record lows in the Cboe Volatility Index weighed on these products. The VIX briefly hit 8.56 in November, the lowest reading ever for the index, and has hovered below 10 consistently throughout the year. When all is said and done, 2017 will turn out to be one of the worst years ever for betting on rising volatility.

In fact, seven of the 20 worst-performing nonleveraged/noninverse ETFs were VIX products, with declines of 48% or more during the year-to-date period through Dec. 20. The REX VolMAXX Long VIX Weekly Futures Strategy ETF (VMAX) was the worst of the bunch, with an 82.2% loss in the period.

Worst Performing ETFs Of 2017 (excluding leveraged/inverse)

Ticker | Fund | YTD Return (%) |

-82.19 | ||

-72.87 | ||

-72.78 | ||

-72.76 | ||

-65.3 | ||

-48.84 | ||

-48.74 | ||

-48.61 | ||

-44 | ||

-31.94 | ||

-30.26 | ||

-30.08 | ||

-28.57 | ||

-27.49 | ||

-26.03 | ||

-25.83 | ||

-25.4 | ||

-22.95 | ||

-21.63 | ||

-21.47 |

Note: Data measures the total return for the year-to-date period through Dec. 20.

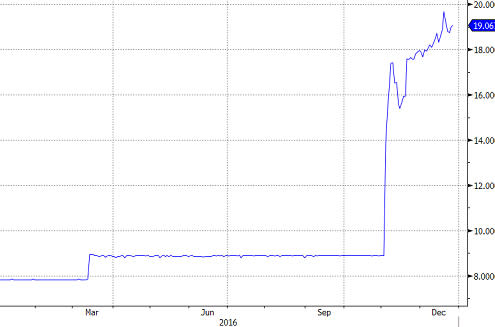

NatGas Leads Energy Losses

Outside of the decimation in VIX ETFs, commodity-related ETFs were the worst hit. That includes the iPath Bloomberg Natural Gas Subindex Total Return ETN (GAZ) and the United States Natural Gas Fund LP (UNG), which sagged 65.3% and 44%, respectively, this year.

Natural gas prices themselves dropped almost 30% in 2017 due to rising production and tepid demand as the all-important North American winter kicks into gear. Roll costs from contango further compounded the troubles for natural gas futures-tracking products

UNG and GAZ weren’t the only energy products to be hit this year. Energy equity ETFs also fared poorly. The PowerShares S&P SmallCap Energy Portfolio (PSCE) fell by 30.1%, while the VanEck Vectors Oil Services ETF (OIH) shed 22.9%.

In addition to the woes affecting natural gas, energy equities have had to contend with disappointing oil prices. Even though crude oil rose by about 8% in 2017 to last trade at $58, many investors had expected a stronger recovery in prices from last year’s rock-bottom levels.

Small-caps and services companies, which are more leveraged to energy prices, felt the disappointment most deeply.

Soft Commodities Slide, Too

Energy wasn’t the only commodity group to lose steam in 2017. Soft commodities like sugar and coffee slid too. The iPath Bloomberg Sugar Subindex Total Return ETN (SGG) fell by 31.9%, while the iPath Bloomberg Coffee Subindex Total Return ETN (JO) lost 21.6%.

Improved weather conditions in Brazil helped ease the supply squeeze that sent sugar and coffee prices surging last year. The normalization of supply levels in the world’s largest producer of the two commodities brought prices down to where they were before last year’s spike.

Leverage Compounds Woes

Adding leveraged and inverse ETFs into the mix doesn’t change the picture much when it comes to the worst-performing funds. As bad a trade as betting on the VIX was, doing it with leverage simply made it even more devastating.

The ProShares Ultra VIX Short-Term Futures ETF (UVXY) and the VelocityShares Daily 2x VIX Short-Term ETN (TVIX) lost a whopping 94% each.

The same goes for betting on natural gas with leverage. The VelocityShares 3x Long Natural Gas ETN (UGAZ) dropped 88.4% this year.

At the same time, betting against areas of the market that were hot—with leverage—proved just as unhealthy for one’s portfolio. The Direxion Daily S&P Biotech Bear 3x Shares (LABD) shed 73%; the Direxion Daily Semiconductor Bear 3x Shares (SOXS) fell by 71.6%; and the Direxion Daily FTSE China Bear 3X Shares (YANG) tanked 61.9%.

Worst Performing ETFs Of 2017 (all-encompassing)

Ticker | Fund | YTD Return (%) |

-94.22 | ||

-94.19 | ||

-88.43 | ||

-82.19 | ||

-74.94 | ||

-73.03 | ||

-72.87 | ||

-72.78 | ||

-72.76 | ||

-72.05 | ||

-71.6 | ||

-65.3 | ||

-62.2 | ||

-61.86 | ||

-60.99 | ||

-60.07 | ||

-58.25 | ||

-53.6 | ||

-52.15 | ||

-52.06 |

Note: Data measures the total return for the year-to-date period through Dec. 20.

Sumit Roy can be reached at sroy@etf.com

Research All ETFs Related to This Story