Morning Call For Friday, Oct. 20

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.21%) this morning are up +0.23% at a new record high on optimism that the Trump administration will be able to enact its tax reform plans after the Senate adopted a fiscal 2018 budget resolution by a 51-49 vote. Final approval of the measure will enable a special procedure that allows Republicans to pass a subsequent tax code rewrite without Democratic support. European stocks are up +0.29% on carry-over support from the rally in U.S. stocks along with comments from ECB Governing Council member Nowotny who said the ECB should gradually end QE. Asian stocks settled mostly higher: Japan +0.04%, Hong Kong +1.17%, China +0.25%, Taiwan -0.29%, Australia +0.18%, Singapore +0.17%, South Korea +0.74%, India closed for holiday. Japan's Nikkei Stock Index closed higher for a 14th day and matched the longest winning streak on record. A slide in the yen to a 3-month low against the dollar boosted Japanese exporter stocks and the overall market found support ahead of Sunday's elections in Japan where Prime Minister Abe's Liberal Democratic Party is expected to retain its two-thirds majority in parliament.

The dollar index (DXY00 +0.16%) is up +0.23% after he U.S. Senate passed a fiscal 2018 budget resolution. EUR/USD (^EURUSD) is down -0.36% after ECB Governing Council member Nowotny said the ECB should be slow to end its bond purchases. USD/JPY (^USDJPY) is up +0.65% at a 3-month high.

Dec 10-year T-note prices (ZNZ17 -0.25%) are down -11 ticks at a 2-week low as a rally in stocks to new record highs dampens demand for T-notes.

ECB Governing Council member Nowotny said that "it will be dangerous to make an abrupt full stop" in asset purchases and that "the ECB will take the foot off the gas pedal slowly."

German Sep PPI rose +0.3% m/m and +3.1% y/y, stronger than expectations of +0.1% m/m and +2.9% y/y and the largest increase in 5-months.

U.S. STOCK PREVIEW

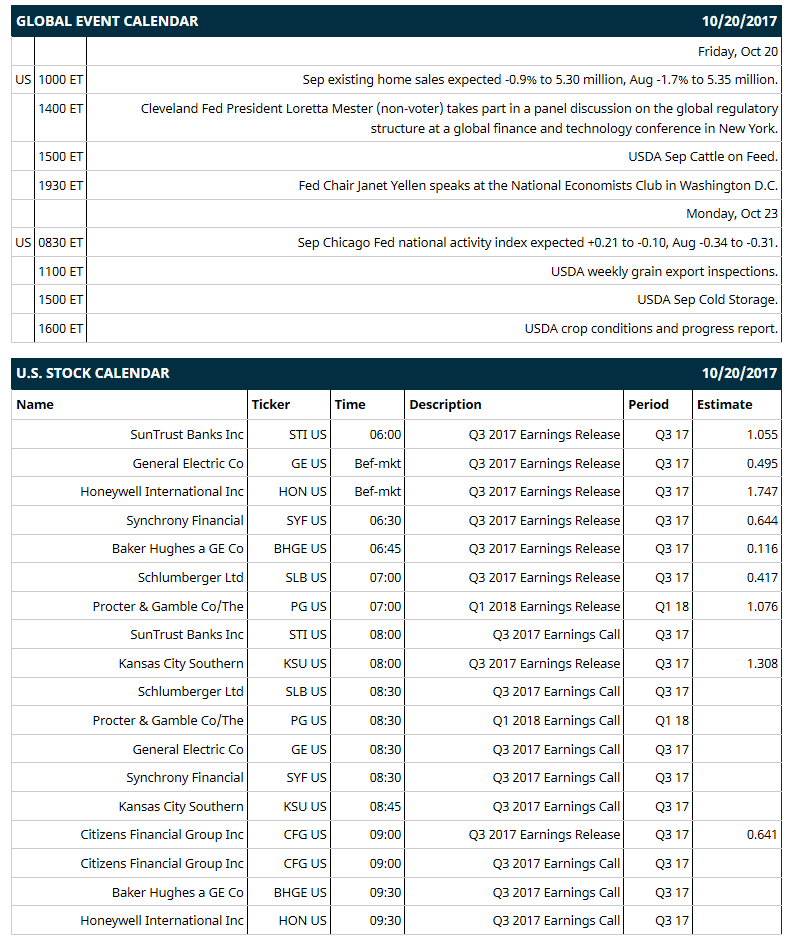

Key U.S. news today includes: (1) Sep existing home sales (expected -0.9% to 5.30 million, Aug -1.7% to 5.35 million), (2) Cleveland Fed President Loretta Mester (non-voter) takes part in a panel discussion on the global regulatory structure at a global finance and technology conference in New York, (3) Fed Chair Janet Yellen speaks at the National Economists Club in Washington D.C., (4) USDA Sep Cattle on Feed.

Notable S&P 500 earnings reports today include: GE (consensus $0.50), Honeywell (1.75), Baker Hughes (0.12), Schlumberger (0.42), Procter & Gamble (1.08), Kansas City Southern (1.31), Citizens Financial (0.64), SunTrust Banks (1.06), Synchrony Financial 0.64).

U.S. IPO's scheduled to price today: FAT Brands (FAT).

Equity conferences this week: American Association for the Study of Liver Diseases Liver Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Harley-Davidson (HOG +0.15%) was upgraded to 'Buy' from 'Hold' at Argus Research with a 12-month target price of $53.

JB Hunt Transport Services (JBHT +0.33%) was initiated with a 'Buy' at Buckingham Research Group with a 12-month target price of $124.

General Electric (GE +1.99%) tumbled 5% in pre-market trading after it reported Q3 adjusted EPS of 29 cents, well below consensus of 50 cents

Pinnacle Financial Partners (PNFP +0.07%) was downgraded to 'Neutral' from 'Buy' at Hilliard Lyons.

Skechers (SKX -4.22%) surged over 20% in after-hours trading after it reported Q3 net sales of $1.09 billion, stronger than consensus of $1.07 billion.

Resolute Energy (REN -1.73%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Celgene (CELG -0.88%) dropped 6% in after-hours trading after it said it will end a final-stage trial of a Crohn's disease drug after it said there were no meaningful safety imbalances identified in the analysis of its drug mongersen on patients.

PayPal Holdings (PYPL -0.01%) climbed 4% in after-hours trading after it reported Q3 adjusted EPS of 46 cents, better than consensus of 44 cents, and then raised guidance on full-year adjusted EPS to $1.86-$1.88 from a prior view of $1.80-$1.84.

NCR Corp (NCR -0.70%) sank over 10% in after-hours trading after it reported Q3 revenue of $1.66 billion, weaker than consensus of $1.69 billion, and then cut its full-year revenue forecast to $6.475 billion-$6.525 billion from a prior forecast of $6.63 billion-$6.75 billion, well below consensus of $6.7 billion.

athenaHealth (ATHN -3.62%) slipped almost 4% in after-hours trading after it reported Q3 revenue of $304.6 million, weaker than consensus of $310.8 million, and then said it sees full-year revenue of $1.20 billion-$1.22 billion, the midpoint below consensus of $1.22 billion.

Allassiam Corp PLC (TEAM +1.11%) jumped nearly 12% in after-hours trading after it reported Q1 revenue of $193.8 million, better than consensus of $185.8 million, and then gave guidance for full-year revenue of $841 million-$847 million, higher than consensus of $831 million.

Imperva (IMPV +0.97%) rose 4% in after-hours trading after it reported preliminary Q3 adjusted EPS of 29 cents-32 cents, above a prior estimate of 22 cents-26 cents.

Werner Enterprises (WERN +0.56%) dropped over 4% in after-hours trading after it reported Q3 operating revenue of $528.6 million, below consensus of $533 million.

CAI International (CAI -0.16%) rallied 5% in after-hours trading after it reported Q3 EPS of 90 cents, well above consensus of 71 cents.

Immune Design (IMDZ -16.03%) climbed nearly 5% in after-hours trading after it said its G100 drug for treatment of non-Hodgkin's Lymphoma had received Orphan Drug Designation by the European Medicines Agency.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.21%) this morning are up +6.00 points (+0.23%) at a fresh nearest-futures record high. Thursday's closes: S&P 500 +0.03%, Dow Jones +0.02%, Nasdaq -0.36%. The S&P 500 on Thursday fell to a 1-week low but recovered its losses and closed slightly higher. Stocks were boosted by the strong weekly unemployment claims report that showed a -22,000 decline to a 44-1/2 year low of 222,000. In addition, the U.S. Oct Philadelphia Fed business outlook index unexpectedly rose +4.1 to 27.9, stronger than expectations of -1.8 to 22.0 and a 5-month high. Stocks were undercut by weakness in technology stocks led by losses in Apple and its suppliers after the Taipei-based Economic Daily reported that Apple has cut orders linked to its iPhone 8 models by as much as 50% over the rest of the year due to lukewarm reception for its newest models.

Dec 10-year T-note prices (ZNZ17 -0.25%) this morning are down -11 ticks at a 2-week low. Thursday's closes: TYZ7 +4.00, FVZ7 +2.00. Dec 10-year T-notes on Thursday closed higher on the fall in the S&P 500 to a 1-week low and by the escalation of Spanish political tensions after Spanish Prime Minister Rajoy said Spain will move forward with suspending the powers of the Catalan government after Catalan President Puigdemont refused to drop his claim for independence.

The dollar index (DXY00 +0.16%) this morning is up +0.21 (+0.23%). EUR/USD (^EURUSD) is down -0.0043 (-0.36%) and USD/JPY (^USDJPY) is up +0.73 (+0.65%) at a 3-month high. Thursday's closes: Dollar Index -0.097 (-0.10%), EUR/USD +0.0065 (+0.55%), USD/JPY -0.40 (-0.35%). The dollar index on Thursday closed lower on the slide in stock prices, which boosted safe-haven demand for the yen, and the decline in T-note yields, which weakened the dollar's interest rate differentials.

Dec crude oil (CLZ17 -0.85%) is down -41 cents (-0.80%) and Dec gasoline (RBZ17 -0.87%) is -0.0112 (-0.69%). Thursday's closes: Dec WTI crude -0.75 (-1.44%), Dec gasoline -0.0036 (-0.22%). Dec crude oil and gasoline on Thursday closed lower on the slide in global stocks, which reduces confidence in the economic outlook and energy demand, and on negative carry-over from Wednesday's EIA data that showed U.S. gasoline inventories rose +908,000 bbl and distillate supplies rose +528,000 bbl.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.46%) -7.4 (-0.57%), Dec silver (SIZ17 -0.72%) -0.140 (-0.81%) and Dec copper (HGZ17 +0.90%) +0.034 (+1.06%). Thursday's closes: Dec gold +7.0 (+0.55%), Dec silver +0.258 (+1.52%), Dec copper -0.0105 (-0.33%). Metals on Thursday settled mixed. Metals prices were boosted by a weaker dollar and by increased safe-haven demand for precious metals as political risks in Spain escalated. Copper closed lower as the slide in the S&P 500 to a 1-week low undercut optimism in the economic outlook and in industrial metals demand.

(Click on image to enlarge)

Disclosure: None.