Advertisement

Advertisement

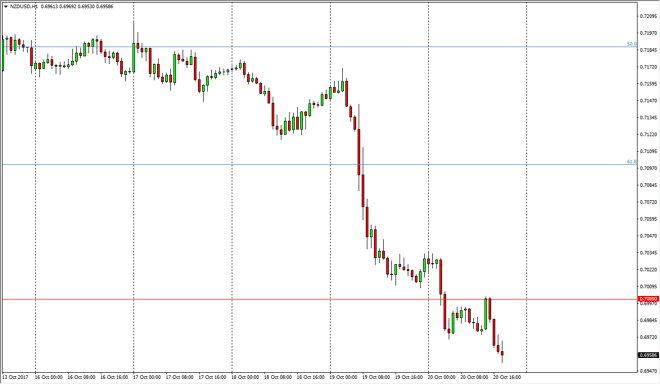

NZD/USD Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:16 UTC

The New Zealand dollar fell during the Friday trading session, breaking below the 0.70 level finally. We then bounced to test that area, and broke down

The New Zealand dollar fell during the Friday trading session, breaking below the 0.70 level finally. We then bounced to test that area, and broke down rather significantly. Since the election results were confirmed that Labour had won, the New Zealand dollar has been absolutely crushed. The 0.70 level above should now be resistance, and it’s likely that we will go looking towards the next major support level on the longer-term charts, which is currently seen as the 0.68 handle. I think that the commodity markets rolling over of course will work against the value of the Kiwi dollar also, and you should also keep in mind that the next Federal Reserve Chairman out of the United States looks to be very hawkish, which is dollar positive anyway. Because of this, I think we continue to see selling pressure in this market, and the real question will be whether we can break down below the 0.68 level.

If we do, that could open the floodgates for massive selling. Either way, I’m very dubious about rallies at this point, and don’t have any interest in buying the New Zealand dollar, although I’m the first person to admit that perhaps the selling is a bit overdone. Feeding rallies will continue to be the best way to trade this market in the short term, as there is little to think that things will turn around completely. Remember, this market does tend to be a bit choppier than the other major pairs, so it could be volatile going forward, but then again, we should continue to see an overall bearish attitude. Focus on the longer-term move, and scale into positions if you have the ability to do so, as it should extend profits. Ultimately, I believe that the 0.68 level will be targeted.

NZD/USD Video 23.10.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement