Advertisement

Advertisement

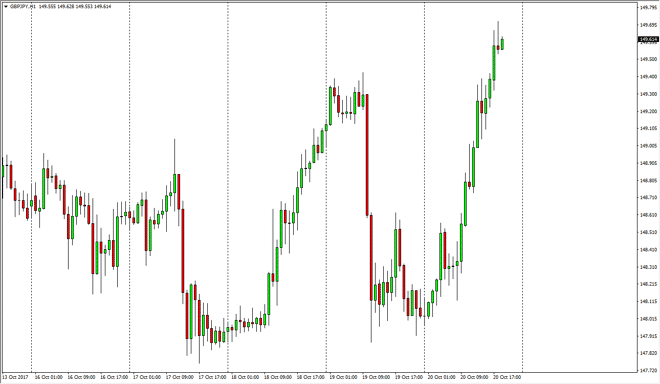

GBP/JPY Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:15 UTC

The British pound accelerated the uptrend during the day on Friday, as we shot towards the 149.50 level against the Japanese yen. If we can break above

The British pound accelerated the uptrend during the day on Friday, as we shot towards the 149.50 level against the Japanese yen. If we can break above the 150 handle, the market should continue to go much higher, but at this point I think that pullbacks will be thought of as buying opportunity as the longer-term charts are in an uptrend in channel. Ultimately, the market should breakout, but we may need to pull back occasionally to build up the momentum to go higher. I think that if we pull back, you should be looking for value in a market that has proven itself to be rather resilient, regardless of what happens. The Bank of England looks likely to raise interest rates, while the Bank of Japan is almost impossibly dovish, so with this being the case I think that buying on the dips continue to be the best way to play this market. If we break above the 150 handle, I think that the market should then go to the 142 handle above.

The market will of course be influenced by risk appetite, and of course the stock markets. The stock markets of course influence based upon the idea of how much risk people are willing to take, and having said that it’s likely that if we go higher, we will continue to go higher here as well. I have no interest in shorting this pair, although I recognize that a pullback is probably not only likely, but necessary. Longer-term, I suspect that the 160 handle will be targeted, but that obviously will take quite some time to get to. By adding slowly on dips, as the trade goes in your favor, you should be a prophet quite nicely from an overall uptrend.

GBP/JPY Video 23.10.17

Related Articles

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement