Advertisement

Advertisement

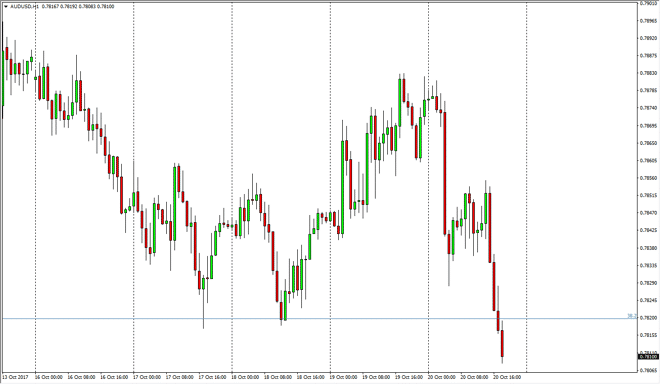

AUD/USD Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:15 UTC

The Australian dollar got hammered during the Friday trading session, dropping almost immediately, rallying a bit, and then breaking down again as the

The Australian dollar got hammered during the Friday trading session, dropping almost immediately, rallying a bit, and then breaking down again as the Americans came on board. Most of this would’ve been due to the finalists in the job for Chairman of the Federal Reserve. Most of them are hawkish, and that should be good for the US dollar. This has had a negative effect on gold as well, and that of course translates into a lower-priced Australian dollar. With this sudden bearish pressure, looks as if rallies will be selling opportunities, and is very difficult to imagine a scenario in which a willing to buy this market, least in the short term. I do recognize that there is a significant amount of support extending down to the 0.7750 level, so I think short-term trading is probably best at this point.

Rallies are to be sold, but I would also be looking to take profits or at least move stop losses to breakeven as quickly as possible. Remember, this market can get very choppy due to what goes on in the gold pits, and the wrong headline can make things move over there rather rapidly. Because of this, I believe that scalping to the downside might be the best way to play this market over the next several sessions, but if we do break down below the 0.7750 level, the market can break down significantly from there and go much lower. At that point, I would be looking for a move to the 0.75 handle next. If we do turn around, I think that we need to see the market break above the 0.7850 level to instill enough confidence for most of the buying public to come back in. Until then, it remains very bearish.

AUD/USD Video 23.10.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement