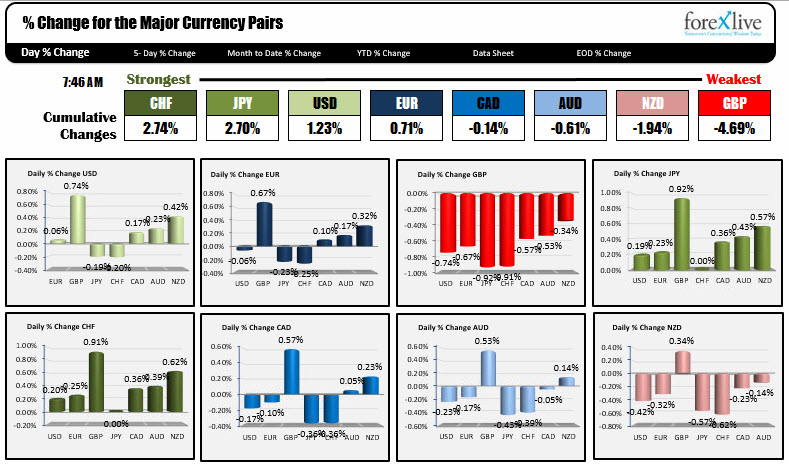

October 13, 2017. The USD is the mostly higher

There seems to be a flight into safety with the CHF and the JPY being the strongest. The GBP is the weakest. Continued concerns about Brexit (and May's leadership) is pressuring the currency. The commodity currencies are also bringing up the rear. The USD is mostly higher with gains

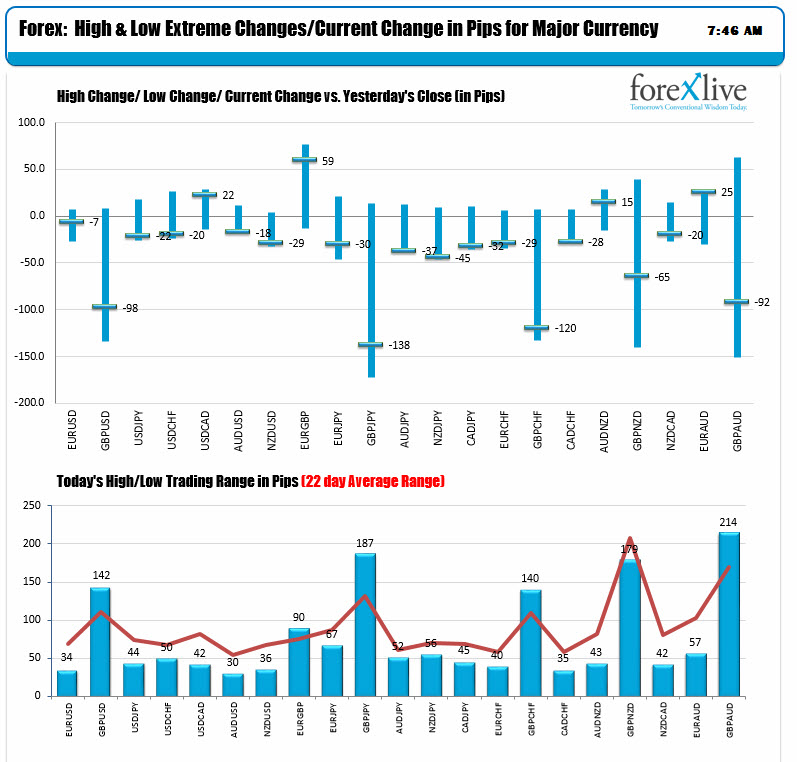

The GBP pairs are all in the red (well EURGBP is higher but the GBP is still getting hit), and all have oversized trading ranges relative to their 22 day averages. The other major pairs and crosses are watching the cable action (or so it seems). The EURUSD is waffling in a 34 pip ranges. The AUDUSD has a 30 pip range. Even the USDJPY and USDCHF (the strongest for the day) are struggling with 44 and 50 pip ranges respectively.

In other markets, the snapshot is showing:

- Spot gold up $1.49 or 0.12% at 1277.20

- WTI crude oil is up $0.12 or 0.21% at $56.86

- US yields are lower on the longer end today. 2 year 1.6584, unchanged. 5 year 2.0498%, unchanged. 2.3824%, down -1.6 bp. 30 year 2.8559%, -2.3 bp

- US stocks in pre-market trading are lower. S&P futures are down -6.25 points. Dow futures are down -78 points. Nasdaq futures are down -19 points

- European stocks are lower with German Dax down -0.9%. France down -0.8%. UK donw -0.16%

- Europe 10 year yields are unchanged to lower. Germany 0.402, down -0.8 bp. France 0.77%, down 1 bp. UK 1.316%, -2.6 bp. Spain 1.542%, -3.4 bp. Italy 1.831%, -1.5 bp

Events today:

- Fed's Dudley will be on CNBC shortly. He will be resigning from the Fed in 2018 (I think March) CORRECTION. He is not on CNBC. Sorry...

- Kuroda speaks at 12:45 PM ET/1745 GMT

- US monthly budget statement at 2 PM ET/1900 GMT.