Advertisement

Advertisement

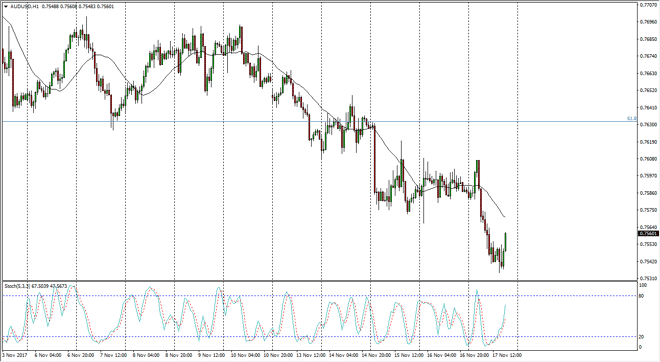

AUD/USD Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:28 UTC

The Australian dollar has fallen a bit during the day on Friday, showing signs of struggle against the US dollar you again. The 0.7550 level underneath

The Australian dollar has fallen a bit during the day on Friday, showing signs of struggle against the US dollar you again. The 0.7550 level underneath has been supportive in the past, and is the beginning of massive support at the 0.75 handle. If we were to break down below there, I think that the market come on routing go looking towards the 0.7350 level after that. However, right now looks as if we are starting to bounce a bit, and I think that were going to find resistance near the 0.76 level above. That’s an area that could cause a bit of trouble, extending towards the 0.7650 level. Overall, I think it’s not until gold markets rally that the Australian dollar can pick up any major strength, so I think that it’s only a matter of time before we do roll over. I think that continues to be very choppy and volatile, but most certainly negative in general.

Remember that the Australian dollars highly sensitive to risk appetite as well, so if the stock markets roll over or the commodity market selloff, it’s likely that the Aussie will fall as well. Markets have been selling off the US dollar in general, but the Aussie has not been able to rally against it. This tells me most of what I need to know, that the Australian dollar is inherently soft currently, and that is likely to continue to be the case going forward. All things being equal, I’m looking for opportunities to pick up the greenback “on the cheap” when it comes to commodity currencies in general. With commodities going lower, and looks as if we are going to continue to see trouble with the commodity currencies. The gold markets certainly aren’t looking likely to break out, so I remain negative.

AUD/USD Video 20.11.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement