Advertisement

Advertisement

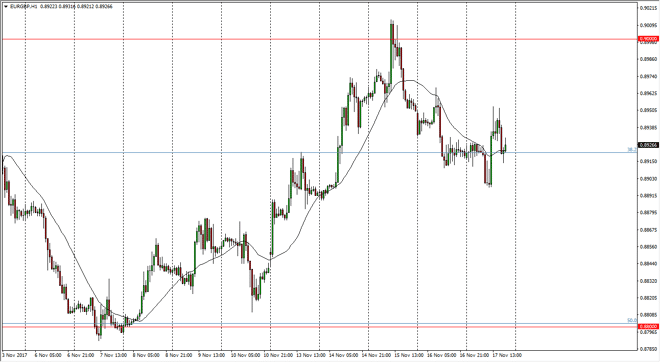

EUR/GBP Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:28 UTC

The EUR/GBP pair has been very volatile over the course of the last 24 hours, hanging about the 0.89 level. This market has been consolidating between the

The EUR/GBP pair has been very volatile over the course of the last 24 hours, hanging about the 0.89 level. This market has been consolidating between the 0.88 level on the bottom, and the 0.90 level above. As we are in the middle of that area, we are essentially at “fair value.” I believe that given enough time, the market should continue to go higher though, as traders will continue to favor the European Union over the United Kingdom as the two economies split. I believe that a break above the 0.90 level would be a very bullish sign, and the market should then go to the 0.93 handle after that. I think that pullbacks continue to be buying opportunities, and although I think that the bearish pressure to the British pound has been overdone, the reality is the traders prefer stability and trade away from uncertainty, something that the United Kingdom is full of.

I think that we will continue to be very susceptible to headlines coming out of both London and Brussels, and that causes a lot of trouble. I think that the 0.88 level should be a hard “floor” though, and I would be surprised to see this market break down below there. Dips continue to be buying opportunities, but I also recognize that the noise will continue to be extreme. The one remedy for this is to trade to the upside only, but in small portions. Remember, this pair is almost double the value of most other ones per tech, so that comes into play as well. Once we break to a fresh, new high, then I’m willing to throw more money into the market to the upside. If we were to break down below the 0.88 level, I would not be a seller immediately, I would have to rethink the entire situation.

EUR/GBP Video 20.11.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement