Advertisement

Advertisement

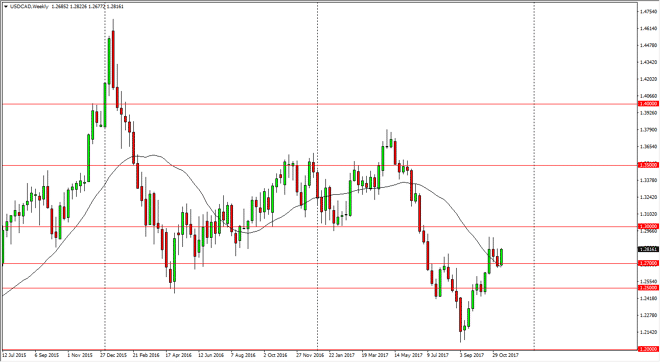

USD/CAD Price forecast for the week of November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:31 UTC

The US dollar continues to be very choppy in general against most currencies around the world. However, the market breaking above the 1.27 level suggests

The US dollar continues to be very choppy in general against most currencies around the world. However, the market breaking above the 1.27 level suggests to me that the US dollar is ready to continue to go higher, perhaps reaching towards the 1.30 level above, and the 1.35 level after that. In general, the market looks very likely to be very noisy, especially considering that the oil markets have a lot of different drivers in both directions. In general, I believe that this pair goes higher though as interest rates continue to strengthen in the United States. That being the case, the US dollar should continue to find plenty of buyers as we seem to have put in a hard bottom at the 1.20 level previously.

If oil markets roll over, it’s likely that we will continue to see buyers jump in, and perhaps breaking above the 1.30 level. This is a market that should continue to go higher longer-term, especially considering that the Canadians must worry about a housing bubble, and I think that is going to come into play next year in a much stronger sense. If we can finally break above the 1.36 handle, the market is free to go much higher, perhaps reaching to the 1.4750 level again.

The alternate scenario of course is that we roll over and break down below the 1.25 handle, which at that point I suspect that we would go looking towards the 1.20 level again. That’s less likely in my estimation though, but we never know as markets can suddenly change their attitude based upon unforeseen events. We have seen a significant selloff over the last several months before the recent bounce, so I do not expect any move to the upside to be easy.

USD/CAD Video 20.11.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement