How Financially Strong Is International Flavors & Fragrances Inc (IFF)?

With a market capitalization of USD $11.75B, International Flavors & Fragrances Inc (NYSE:IFF) falls in the category of stocks popularly identified as large-caps. These are established companies that attract investors due to diversified revenue streams and ability to enhance total returns through dividends. However, another important aspect of investing in large caps is its financial health. Why is it important? A major downturn in the energy industry has resulted in over 150 companies going bankrupt and has put more than 100 on the verge of a collapse, primarily due to excessive debt. Here are few basic financial health checks to judge whether a company fits the bill or there is an additional risk which you should consider before taking the plunge. Check out our latest analysis for International Flavors & Fragrances

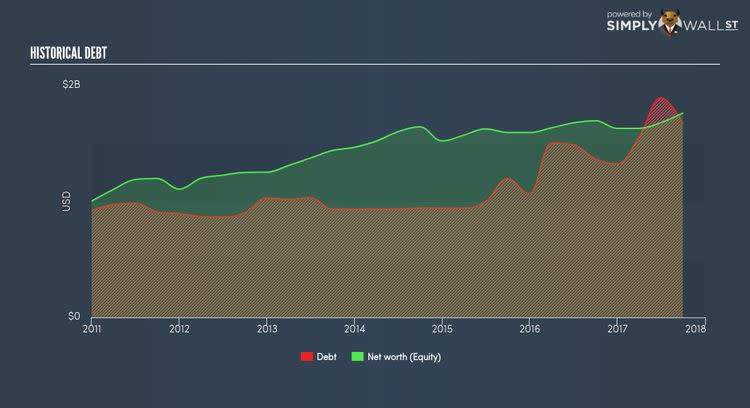

Is IFF’s level of debt at an acceptable level?

A debt-to-equity ratio threshold varies depending on what industry the company operates, since some requires more debt financing than others. A ratio below 40% for large-cap stocks is considered as financially healthy, as a rule of thumb. In the case of IFF, the debt-to-equity ratio is 94.98%, which means that it is a highly leveraged company. This is not a problem if the company has consistently grown its profits. But during a business downturn, as liquidity may dry up, making it hard to operate. While debt-to-equity ratio has several factors at play, an easier way to check whether IFF’s leverage is at a sustainable level is to check its ability to service the debt. A company generating earnings at least three times its interest payments is considered financially sound. IFF’s profits amply covers interest at 9.44 times, which is seen as relatively safe. Lenders may be less hesitant to lend out more funding as IFF’s high interest coverage is seen as responsible and safe practice.

Does IFF generate enough cash through operations?

A basic way to evaluate IFF’s debt management is to see whether the cash flow generated from the business is at a relatively high level compared to the debt capital invested. This is also a test for whether IFF has the ability to repay its debt with cash from its business, which is less of a concern for large companies. Last year, IFF’s operating cash flow was 0.23x its current debt. This means, over a tenth of IFF’s near term debt can be covered by its day-to-day cash income, which somewhat reduces its riskiness to its debtholders.

Next Steps:

Are you a shareholder? With a high level of debt on its balance sheet, IFF could still be in a financially strong position if its cash flow also stacked up. However, this isn’t the case so investors should ask themselves if they believe IFF can sustainably increase its operational efficiency going forward. Given that IFF’s financial situation may be different in the future, I suggest researching market expectations for IFF’s future growth on our free analysis platform.

Are you a potential investor? Although understanding the serviceability of debt is important when evaluating which companies are viable investments, it shouldn’t be the deciding factor. Ultimately, debt is often used to fund or accelerate new projects that are expected to improve a company’s growth trajectory in the longer term. As for next steps, I recommend potential investors to look at IFF’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.