Scott Black Divests Wyndham, Starts 3 New Positions in 3rd Quarter

- By James Li

Delphi Management chairman Scott Black (Trades, Portfolio) says that as disciples of the Graham-Dodd school of value investing, his team only makes investments that exhibit "absolute value." During the third quarter, Black divested his position in Wyndham Worldwide Corp. (WYN) and initiated three new positions: Unum Group (UNM), Snap-on Inc. (SNA) and STORE Capital Corp. (STOR).

Warning! GuruFocus has detected 3 Warning Sign with NORD. Click here to check it out.

The intrinsic value of WYN

Wyndham

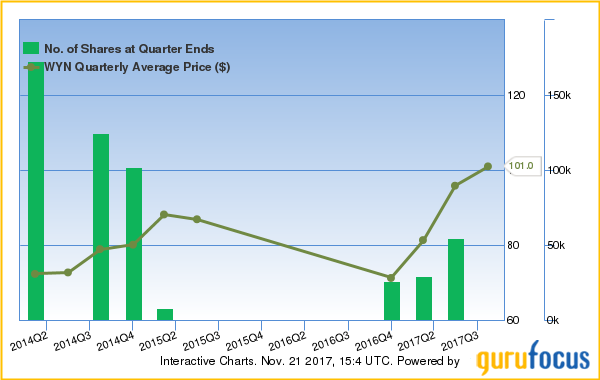

Black sold 54,433 shares of Wyndham for an average price of $100.98 per share. With this transaction, the fund manager trimmed 2.77% off his portfolio.

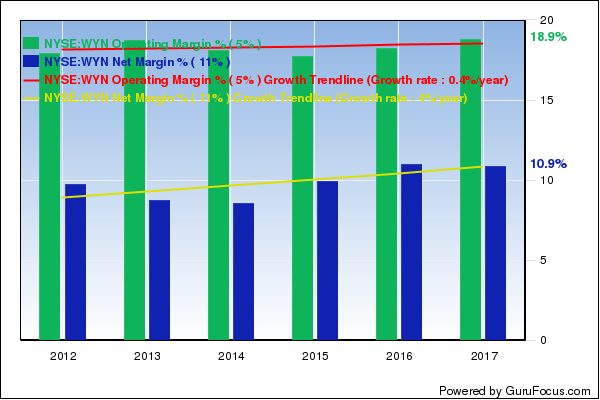

New Jersey-based Wyndham said earnings results met expectations despite headwinds from Hurricanes Harvey, Irma and Maria. The hotel company"s profitability ranks 8 out of 10, driven by strong profit margins and returns. Wyndham"s operating margins are near a 10-year high and outperform 75% of global competitors.

Although the company has a strong Piotroski F-score, Wyndham still has poor financial strength. The company has high leverage, with approximately $9.46 in debt per $1 in equity and $4.79 in debt per $1 in EBITDA. The company"s debt-to-equity ratio is near a 10-year high of 9.81 and underperforms 98% of global competitors.

Guru starts three new positions

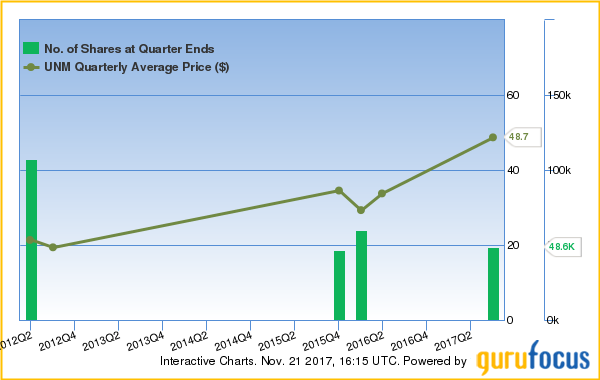

Black added 48,580 shares of Unum Group for an average price of $48.72, 16,297 shares of Snap-on for an average price of $150.41 and 91,465 shares of STORE Capital for an average price of $24.32. The fund manager increased his portfolio about 4% in the aggregate with these three transactions.

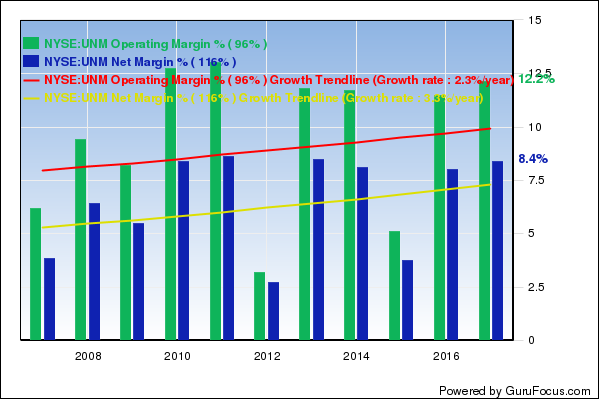

Unum Group provides income-protection products in the U.S. and the U.K. The company"s profitability ranks a modest 5 despite having expanding operating margins.

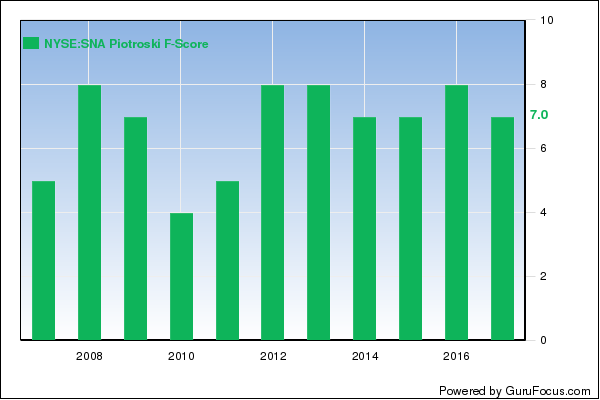

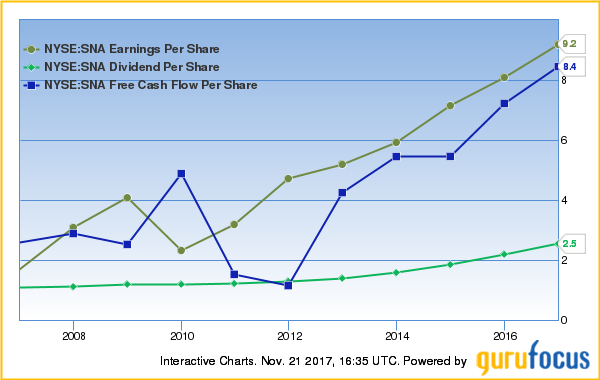

Snap-on manufactures and sells various equipment and systems solutions primarily for independent vehicle repair centers. The company has seven positive investing signs, including consistent revenue growth, strong operating margins, high Piotroski F-score and good dividend yields.

Berkshire Hathaway Inc. (BRK-A)(BRK-B) CEO Warren Buffett (Trades, Portfolio) owns 18,621,674 shares of STORE Capital, a REIT specializing in single-tenant operational real estate.

Disclosure: I do not have positions in the stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with NORD. Click here to check it out.

The intrinsic value of WYN