Top Financial Dividend Yielding Stocks To Profit From

The fortunes of financial services companies often follow that of the broader economy. These companies provide services ranging from consumer finance to investment banking. During downturns, financial services companies tend to be hit the hardest as net interest margins shrink and credit losses grows. However, during prosperous times, they report robust profits and many pay attractive dividends. Below is my list of huge dividend-paying stocks in the financial industry that continues to add value to my portfolio holdings.

Wells Fargo & Company (NYSE:WFC)

WFC has a wholesome dividend yield of 2.89% and pays 39.14% of it’s earnings as dividends . While there’s been some level of instability in the yield, WFC has overall increased DPS over a 10 year period from $1.24 to $1.56.

BlackRock, Inc. (NYSE:BLK)

BLK has a good-sized dividend yield of 2.09% and pays 45.29% of it’s earnings as dividends . BLK’s dividends have seen an increase over the past 10 years, with payments increasing from $2.68 to $10 in that time. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend.

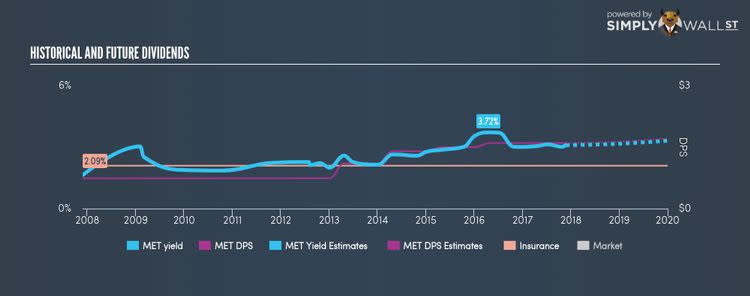

MetLife, Inc. (NYSE:MET)

MET has a solid dividend yield of 3.09% and a reasonably sustainable dividend payout ratio , and analysts are expecting a 33.51% payout ratio in the next three years. MET’s dividends have seen an increase over the past 10 years, with payments increasing from $0.74 to $1.6 in that time. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Over the past year, MET’s return on equity (-1.23%) surpassed the US Insurance industry average of 8.00%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.