What Happened to Eric Mindich?

- By Robert Abbott

On March 23, the New York Times ran this headline, "Eton Park to Shut Down as $3 Trillion Hedge Fund Industry Faces Turmoil." And, indeed, Eton Park did send a message to its remaining clients that it would return their capital and close its doors.

Warning! GuruFocus has detected 4 Warning Sign with NXPI. Click here to check it out.

The intrinsic value of NXPI

Eric Mindich (Trades, Portfolio), the man behind Eton Park and once the brightest young man on Wall Street, was effectively admitting defeat after what was a brilliant beginning in the industry. The closure helped call into question the whole business model of the hedge fund industry.

What happened to Mindich, and the industry?

Who is Mindich?

Mindich had what would have been, for many, the best of summer jobs: Working after high school and during summer breaks at Goldman Sachs (GS) while earning a degree in economics at Harvard University.

In 1988, after college, he joined the firm full time and enjoyed a storied, 15-year career. That included becoming the firm"s youngest partner, in 1994, at the age of 27. He led the risk arbitrage section and managed the equities division from 1992 to 2000, then became co-chief operating officer of the equities division. In 2002, he became a member of the firm"s management committee and, a year later, moved to the executive office as the senior strategy officer.

Despite all that, he moved out and started a hedge fund, called Eton Park Capital Management, in 1995. Like the rest of his career--to that time--it was newsworthy. He launched with $3.5 billion, which was considered the largest fund launch at that time. He even managed to get Goldman Sachs to provide part of that capital.

While undoubtedly possessed of a bright mind, Mindich was also paid to apprentice in the financial industry at one of the highest-flying firms. It also seems likely Goldman Sachs enjoyed a good return by investing in Mindich over the 15 years he spent there.

What is Eton Park Capital Management?

The New York-based hedge fund launched with a global, multidisciplinary focus in 2004. Its goal was to give investors risk-adjusted returns over multiyear periods.

According to a Bloomberg profile, Eton Park invests in public equity, fixed income and alternative markets. More specifically, it invests in value stocks on the equity side and credit and credit-related instruments for fixed income.

For alternative investments, it put its money into derivatives, residential and commercial mortgage-backed securities as well as other securities with asset-backing and collateralized debt instruments, mainly in emerging markets. Its mandate includes both domestic and international markets.

The firm is privately owned and controlled by Mindich. Its clients include mainly institutional investors (such as pension plans, funds-of-funds, endowments and charities), high net-worth individuals and family offices.

As with many hedge funds, the firm gives itself a wide palette on which to paint. It has gone into three disparate areas: equities, fixed income and alternative investments. Would a tighter focus and specialization lead to better outcomes?

Strategies & tactics

The firm lists several strategies in its Form ADV Part 2A (with the fund now winding down, it may not use any or all at this time). Those listed include:

Fundamental Long/Short: Going long on securities that are consider undervalued, or selling short those it believes are overpriced.

Event-Orient: Acting in situations where an announced or anticipated event leads to pricing inefficiencies.

Credit & Distressed Debt: Again, long and short positions in credit instruments that may produce capital gains or other income.

Asset-Backed & Structured Credit: Investments that are backstopped by assets, including trust preferred securities, aircraft leases, mutual fund fees and other.

Derivatives: Used to take a fundamental investment position, to hedge positions or adjust market exposure or to profit from derivative transactions.

According to Bloomberg, the firm uses fundamental analysis to create its portfolios within those strategic categories.

As to the closing of his firm, Bloomberg cites a passage from Mindich"s letter to clients, explaining that a confluence of issues led to his decision to close:

Industry headwinds.

Difficult market environment.

2016 results (a loss of 9.6%).

He says this combination "challenged our ability to continue to maintain the scale and scope we believe necessary to pursue our investment program consistent with our founding principles."

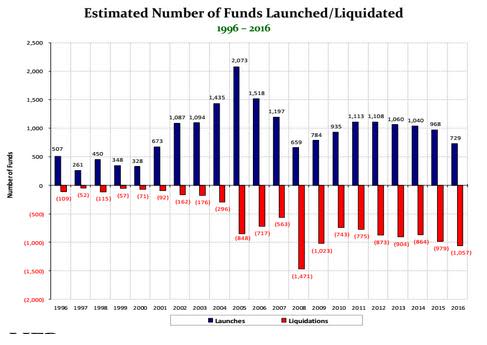

Mindich is not alone in abandoning the hedge fund business, as shown in this Business Insider chart (based on data from HFR). It shows launches in blue on the top half, and liquidations in red on the bottom half:

Overall, the number of hedge funds has been shrinking, despite new entrants. A New York Times Dealbook article reports state pensions funds are following the lead of the California Public Employees" Retirement System in getting out of hedge funds. It further says the hedge fund strategies are too complex and too costly, especially when underperforming (as they often have since 2008).

According to another New York Times Dealbook article from 2015, hedge funds were closing then because of extra regulation (Dodd-Frank Act), the volatility of markets and additional investor scrutiny.

Regardless of structural reasons for closures, it hardly makes sense for institutional investors or others to pay high management and performance fees for mediocre performance. As will be seen below, Mindich"s performance has been spotty and he likely has not collected performance fees in many of the past 10 years.

Holdings

This GuruFocus chart shows Eton Park"s sectoral holdings on March 31, just a week after Mindich announced the firm"s closing:

This top 10 list of equity holdings, again dated March 31, also comes from GuruFocus:

NXP Semiconductors NV (NXPI): 9.18%

Comcast Corp. (CMCSA): 7.61%

Microsoft Corp. (MSFT): 6.89%

Reynolds American Inc. (RAI): 6.15%

Diamondback Energy Inc. (FANG): 5.65%

Visa Inc. (NYSE:V): 4.82%

Syngenta AG (SYT): 3.16%

CDK Global Inc. (CDK): 2.83%

Kinder Morgan Inc. (KMI) 2.51%

Bank of America Corp. (BAC): 2.27%

Not surprisingly for a hedge fund, the top line shows derivatives being the biggest sector. Among common stocks, a relatively conventional group, with a mix of domestic and international holdings.

Performance

A caveat, to begin: as hedge fund operators, Mindich and Eton Park are not required to file regulatory reports on their performance. Both specific years and an overview must be pieced together from other published information.

Bloomberg reports Mindich lost 9.4% in 2016. In contrast, he was a positive 22% in 2013. It also reports flat performance during the first quarter of 2017, and that assets had dropped by half since 2011.

A Fortune article from 2012 notes Mindich lost 11% in 2011. In addition, Bloomberg puts Mindich"s average annual return since inception at 9.4%. Ironically, his last full year before winding down also came in at 9.4%, but on the negative side.

The articles do not mention if these results are net (after management and performance fees are paid), but presumably they are gross. For clients paying 2% management fees and a 20% performance fee, as well as restrictive withdrawal terms, clients have not received much of a return, whichever is the case.

Conclusion

Mindich was the toast of Wall Street when he raised $3 billion to launch his new hedge fund company. Thirteen years later, he is shutting down Eton Park Capital Management, which at the end of 2016 had only $7 billion in assets.

An average annual return that brought in less than double-digit returns over 13 years is not the kind of result pension and mutual fund managers can live with for long.

Because of the complex strategies employed by Mindich, it is hard for value investors to find much to emulate or study, even though Mindich employed some value tactics in his operations.

Disclosure: I do not own shares in any of the companies listed in this article, and do not expect to buy any in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with NXPI. Click here to check it out.

The intrinsic value of NXPI