Talking Points:

- Risk aversion intensified into the close of the past trading week - pushing the S&P 500 and Dow to the worst week's loss in 2 years

- News of a $1.3 Tln spending bill in the US and softer interpreted metal tariffs didn't renew any of the last optimism

- While the read on risk trends is distinct ahead; the bearings for the Dollar, Euro, Pound and more will remain complicated

See how the DailyFX Analysts' top trade ideas for 2018 are faring now that we are nearing the end of the first quarter. Download the top trades guide on the DailyFX Guides page.

Risk Aversion Intensifies into Week's Close

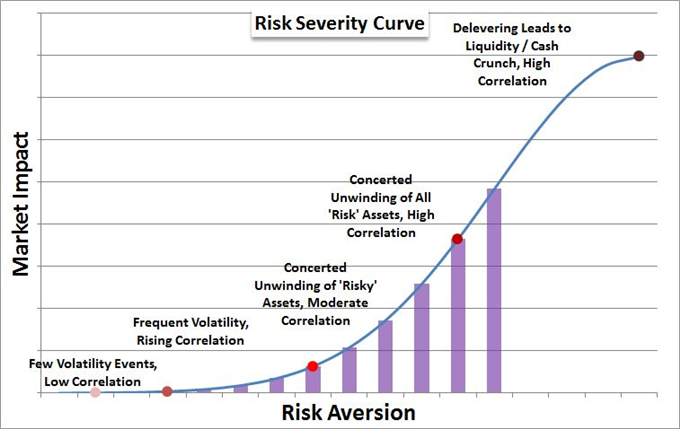

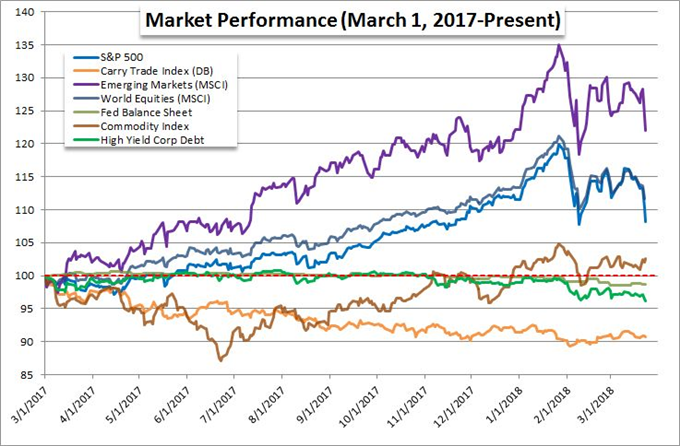

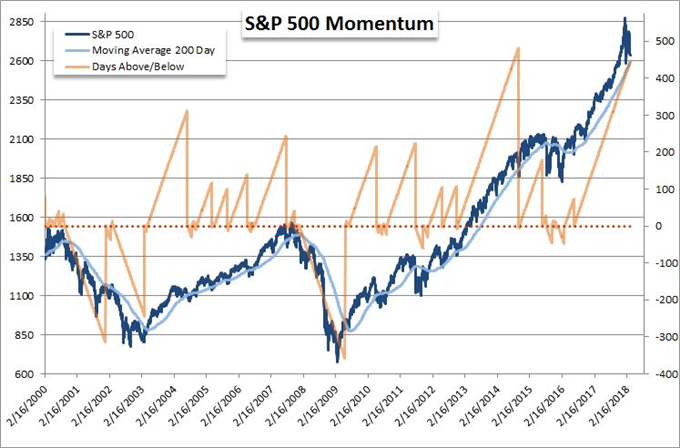

Sentiment cratered this past week, but it seemed in the closing hours that there was going to be some relief from the relentless bearish winds. Had that break in the storm held out through the weekend, it would have significantly curbed the threat of true risk aversion building up momentum in successive weeks and beyond. Liquidity will inevitably drain through the weekend, but ending the week with calm or a significant bounce from opportunistic bulls often soothes anxiety that can lead panicked traders to unload on the next open. Yet, that solace wouldn't show up this time around. A renewed selling pressure picked up in the afternoon hours of the New York session. The slide was measured in most 'risk assets'. Yet, perhaps the most remarkable/troubling performance was on behalf of the US equity indices. The Dow and S&P 500 posted their worst weeks in two years - and very top echelon of worse performances in many more years. Furthermore, the past eight weeks of activity from the S&P 500 represents the highest level of volatility for the benchmark since 2008 - not a flattering comparison. If you are looking for a technical milestone on which to hinge your convictions still, there are few better than the 200-day moving average for the SPX.

'Good News' Can't Buoy Reality of Bad News

What took many by surprise with Friday's resurgence was the assumption that some of the news was positive. News that the US government had approved a $1.3 trillion spending bill to keep the lights on through early September avoided President Trump's threat of a veto for passion projects and yet another government shutdown. Yet, was this truly positive news or merely averting yet another crisis? Meanwhile, the trade war is in full swing with the United States' $60 billion tax on China implemented and China so far reciprocating with a $3 billion tariff on a range of US imports. If there was any encouragement that perhaps the retaliation would not be in kind, this was more likely a response to the expected metal tariffs rather than the more sudden and painful intellectual property-motivated taxes. Furthermore, the exclusion of certain critical trade relations from the onerous steel and aluminum actions should really be viewed as 'not as bad as feared' rather than a positive interpretation of higher returns and thereby asset prices into the future. The troubles the global markets face are growing too large and numerous to ignore against record high costs of entry.

The Dollar's Standing Amid Trade Wars

At the center of the world's greatest risks and uncertainties is the US Dollar. It is difficult to ignore that the escalation of protectionism (polite word for 'trade wars') was made by the United States. Suggestions that the initiator of these reciprocal trade actions stands to benefit on net doesn't properly credit history. In reality, the effort to penalize all trade partners either directly or indirectly is more likely to earn a collaborative effort to retaliate in kind. Furthermore, the expectation that the US can be the catalyst for its own revived safe haven status presumes a full shift into panicked liquidation and the assumption that the world will not look to diversify its havens. Even if you aren't an FX trader, you should watch pairs like EUR/USD, USD/JPY and USD/CNH for signals on risk trends and how they are taking shape.

There are Other Themes Out

While traders should give the return of a definitive risk-based trends their full attention, we have yet to make that qualification. We are certainly close to it. In the meantime, other fundamentally important macro themes will earn market volatility and movement. From the Euro, we have a currency that has ignored a laundry list of its own issues and a stretched in value to take advantage of its main counterpart's weakness. For the Sterling, Brexit seems to always pull our attention from competing themes; yet here too, the Sterling is reaching far beyond what the fundamentals suggest. And there is always the importance of monetary policy as not just a relative measure of value, but a global factor in sentiment. The past nine years of windfall for speculators was not founded on traditional growth and return expectations. Rather, the charge was heavily founded on accommodative monetary policy. While we always have to give way to the top driver in the markets, that doesn't mean we should forget the others. We discuss what is moving the markets and how to navigate them in this weekend Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE