December 13, 2017

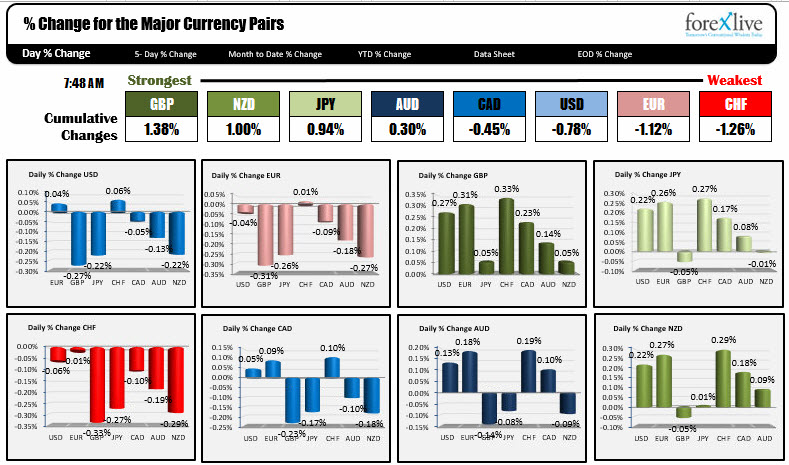

As North American traders enter for the day, the GBP is the strongest, while the CHF is the weakest. However, the major pairs are clustered close together on a relative basis. So the "league table" can be shuffled around in the NY session. The USD is more lower (modestly) with declines vs the GBP, JPY, NZD, AUD, and CAD. The greenback is a little higher vs the EUR and CHF.

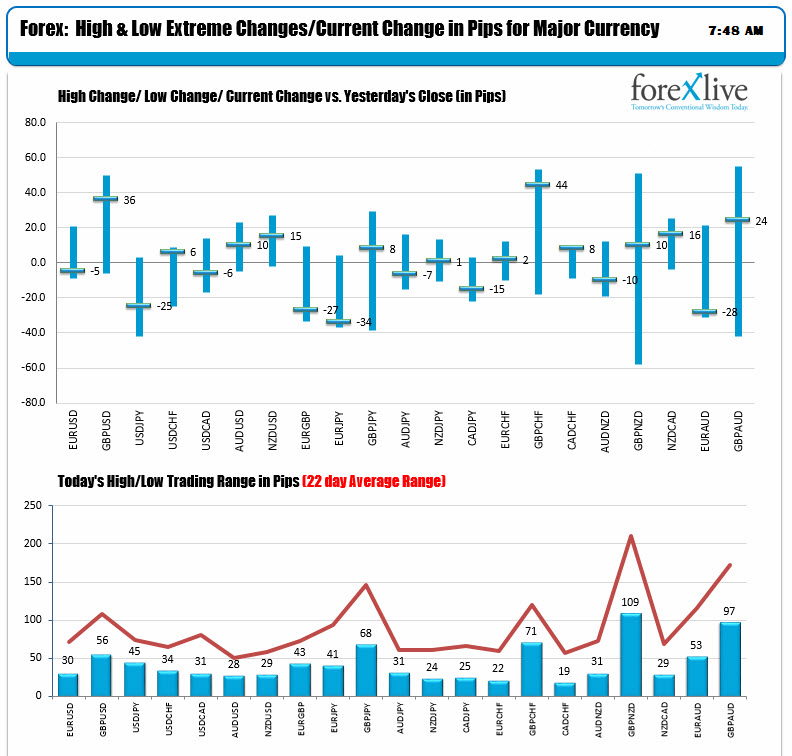

The ranges (lower chart below), show that they are running well below the 22 day averages (about a month of trading). That is an indication of the non-trending nature of the market. It could also be a calm before a storm.

Today to potentially nudge the market includes:

- US CPI at 8:30 AM ET/1330 GMT. The headline estimate is 0.4% MoM and 2.2% (up from 2.0%) for YoY

- Crude oil inventories will be released at 10:30 AM ET

- Pres. Trump is expected to speak some time today on the tax reform. The joint Capitol Hill committee is expected to announce there final version of the bill by the end of the week. Last night Rep. Roy Moore lost a close special election to Dem Doug Jones which will bring the GOP majority down to 51 vs. 49. That could have implications for repealing Obamacare in 2018 difficult (and other key votes). Jones takes office in January (hence the importance of passing tax reforrm in 2017)

- The FOMC will hike rates by 0.25% to 1.5% at 2:00 PM ET/1900 GMT. We will listen to Yellen for her last act as Fed Chair starting at 2:30 PM ET/1930 GMT. The Fed signalled they expect 3 hikes in 2018 and 2 in 2019 on the last "dot plot". The Fed will also release their central tendencies for employment, GDP and inflation

- In the new trading day tomorrow, the ECB, BOE and SNB will announce their rate decisions. Austalia will release employment statistics. China will release Industrial production and retail sales

So there is a lot of stuff, that could goose the market. Be aware.

In other markets right now....

- Spot gold is down -$2.91 or -0.23%

- WTI crude is up $0.49 or 0.88% at $57.65

- US yields are up. 2 year 1.847%, up 2 bp. 5 year 2.1937%, up 2.2 bp. 10 year 2.419%, up 1.8 bp. 30 year 2.7909%, up 1.4 bp

- US stock futures are near unchanged levels. S&P is down -0.25 points. The Nasdaq futures are up 5.5 points. The Dow futures are up 12 points.

- Finally bitcoin has a range of of $17,546.52 high/$16,377.21 low. It trades at $17,162.67