Advertisement

Advertisement

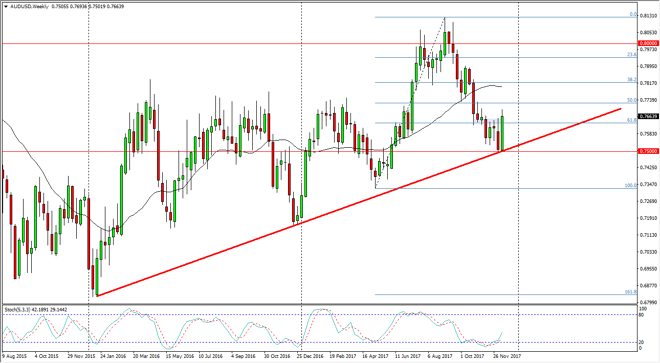

AUD/USD Price forecast for the week of December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:00 UTC

The Australian dollar has made a strong move during the week, bouncing from a particularly strong uptrend line from the longer term. I think given enough time, we should continue to go much higher.

The Australian dollar rallied significantly from the 0.75 handle, and more importantly a strong uptrend line. That being the case, looks likely that the market will continue to go to the upside, and perhaps go looking towards the 0.0 level after that. I believe that the market continues to be very volatile, but I think that the upward momentum will continue. Gold markets course have their say, so having said that I think that the gold markets breaking above the $1300 level would send this market into overdrive, perhaps reaching the 0.80 level above rather quickly. The level is important from a longer-term perspective though, because it has been both support and resistance going back decades.

I believe that if we can stay above the uptrend line, there’s no way to short this market with any type of strength, or confidence. It will be noisy between now and the end of the year, but it looks as if the Australian dollar is continuing to look like a viable currency that will continue to go higher in value. For what it’s worth, the daily candle does look to be a shooting star, so we may get a short-term pullback, but again, if we can stay above the vital 0.75 handle, we should continue to see plenty of opportunities to start buying. A breakdown below the 0.75 handle should send this market down to the 0.68 handle of the longer-term, with several stops along the way. After this week’s candle, it looks likely that we will find plenty of buyers.

AUD/USD Video 18.12.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement