Advertisement

Advertisement

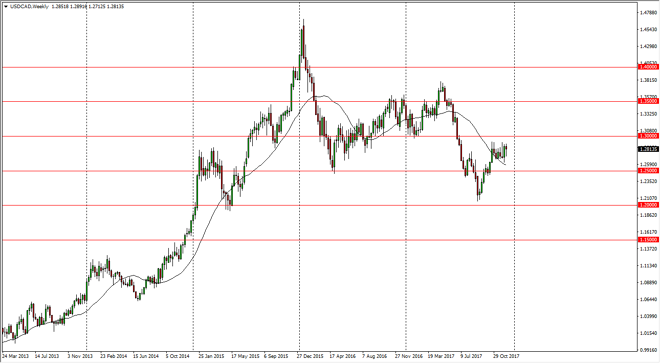

USD/CAD forecast for the week of December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 05:03 UTC

The US dollar rallied after initially falling against the Canadian dollar this week, and by the time we closed down the market on Friday, we formed a hammer.

The US dollar continues to be volatile against the Canadian dollar, as we have been consolidating in a very tight trading range. However, we had formed a hammer and that of course is a very bullish sign. A break above the top of the hammer should send this market testing the 1.30 level, a significant area of resistance. I believe that eventually we will find the market breaking above there and reaching towards the 1.35 handle, but it will take some time to get there. The recent rally has been important and impressive, but at the end of the day I think we should continue to see noise as a factor. After all, there are a lot of concerns when it comes to the US tax bill, but at the same time there is a Canadian housing bubble that is just waiting to pop.

Ultimately, I think that this remains a “buy on the dips” market, that we will eventually find buyers looking for value every time we pull back. That being the case, those who are more long-term inclined can find value occasionally, and will be looking to do so repeatedly. Once we break free of the 1.30 level, they will almost undoubtedly go looking to add to their position size, thereby making the most of their profitable move. If we were to break down below the 1.25 handle, that would of course be rather negative, but at the end of the day I don’t think that’s going to happen anytime soon. I remain bullish into the new year.

USD/CAD Video 18.12.17

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement