The markets have had a great year. The SPY has increased 20%, the QQQ is up 32% and the IWM advanced 13%. But as we look towards a new trading year, it’s time to ask a very pertinent question: can this continue?

The probabilities say no. Nothing can rise forever, after all. Aside from quoting pithy phrases, a number of fundamentals support this argument.

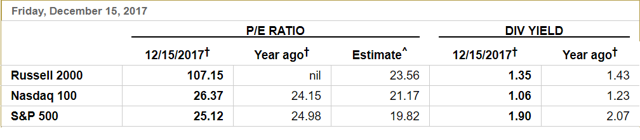

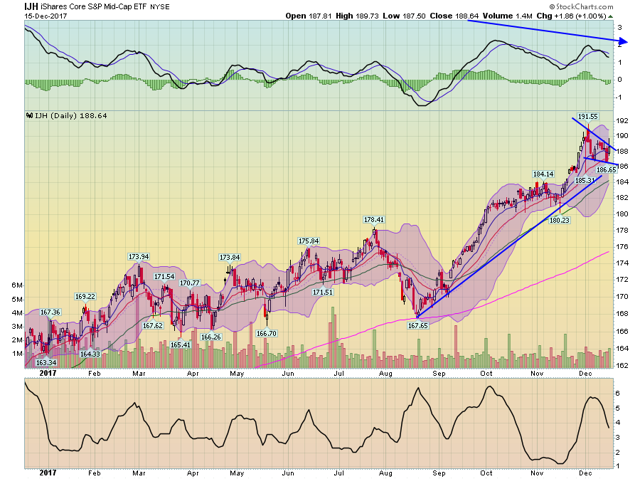

Stocks are expensive: Consider the following table from the Wall Street Journal:

This alone isn’t determinative. Stocks have traded at expensive levels for extended periods of time before. But let’s add the following facts:

The Fed is tightening: The Fed continues to raise rates to make a pre-emptive strike against (non-existent) inflationary pressures. According to their latest “Dot Plot,” the Fed intends to raise rates at least three times next year. If they maintain this schedule, short-term rates will be 2%-2.25% by the end of 2018. While these rate levels are hardly growth prohibitive, they will have a gradual slowing effect on the economy.

Congress passed tax legislation: The markets are a leading not coincident indicator. They rallied after the election and continued to do so in anticipation of a pro-business Congress. Now that Congress has acted, a good argument can be made that the markets will sell-off because they've gotten what they wanted.

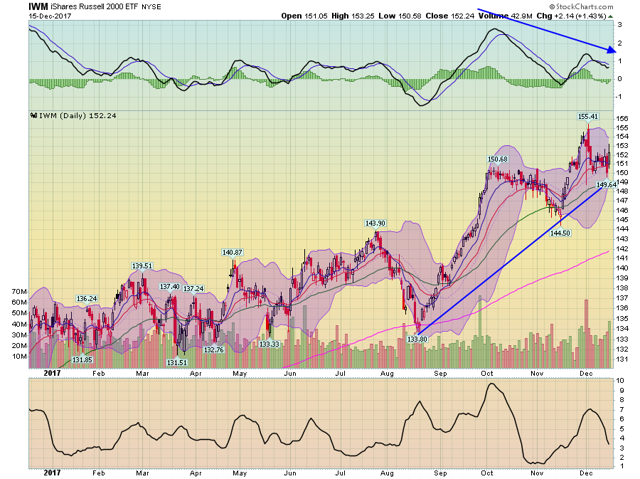

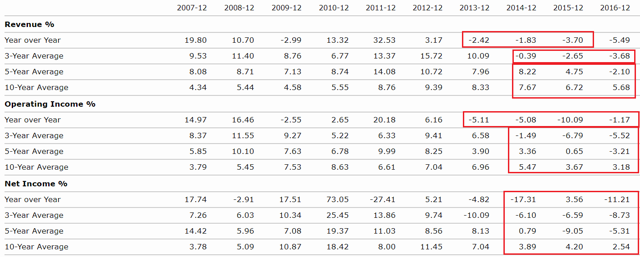

Market technicals are weakening: Not all averages are participating in the rally:

While mid-caps (the IJH, top chart) and small-caps (the IWM, bottom chart) are still rallying, neither made new highs with the broader market averages. These two averages are more speculative in nature. Their lack of participation in recent advances indicates a narrowing of the rally to larger, more established companies.

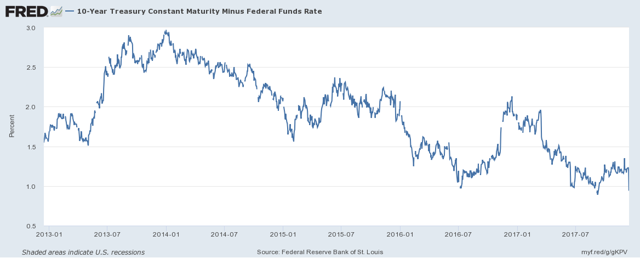

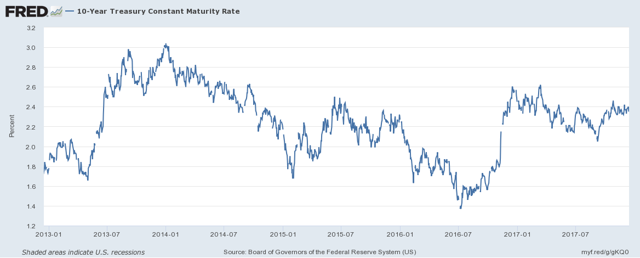

The bond market isn’t predicting booming growth:

The 10-year CMT’s yield is still very low, indicating bond traders see modest growth.

While the 10-year CMT-Fed Funds spread is still positive, it is narrowing. If the Fed continues to tighten, this trend will continue.

When we add these factors together, they at least give us reason to look at this year’s winners and ask ourselves, “Is it time to take some profits?” The answer to that is, yes, it’s time to look at selling some stock.

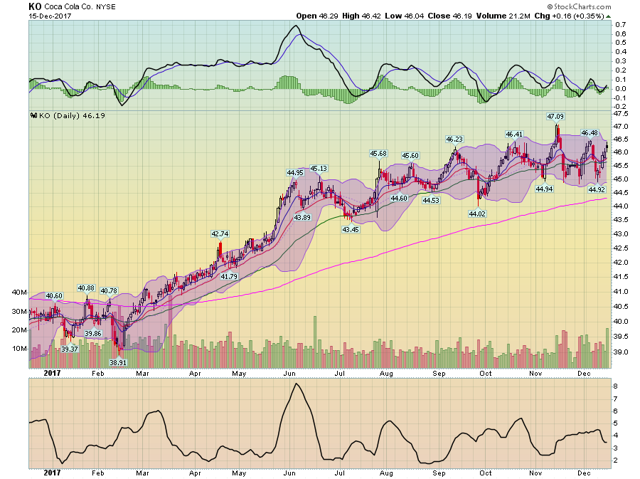

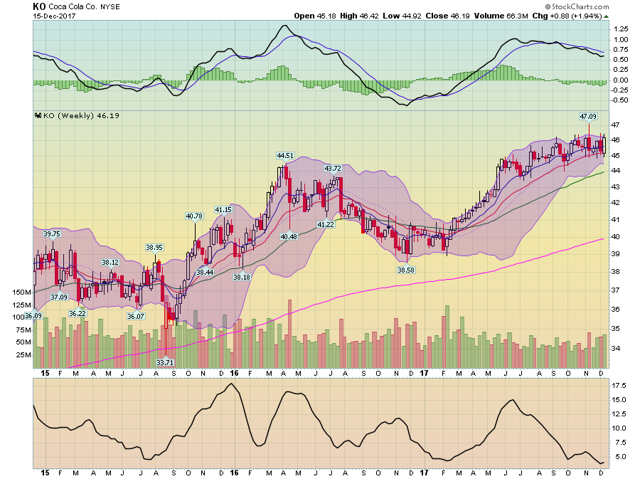

It seems almost un-American to say it’s time to sell Coca-Cola (NYSE:KO). The company is literally the iconic U.S. brand. But a look at the technical and fundamentals reveals that it’s time to take some profits. Let’s start with the daily chart:

This year, KO has rallied in two phases. The first, which lasted from mid-February to early June, was a nice gradual move higher that netted about 16%. But the second rally, which lasted about one more month, contained five rallies and sell-offs, with each succeeding high marginally higher than the preceding. The EMAs are close to forming “barbed wire” – the situation where they become entwined with one another. And the MACD indicates a remarkable lack of consistent momentum.

The weekly chart shows that 2017's high was only about 6% above the stock’s previous peak about a year earlier. And momentum is gently lower.

Fundamentally, Coke is very expensive. Among soft-drink stocks, its PE of 43.95 is the 4th highest, its 23.33 forward PE is the 6th highest and its PEG ratio – which comes in at a whopping 8.2 - is the highest by far; PepsiCo (PEP) has the second highest PEG ratio at 3.87.

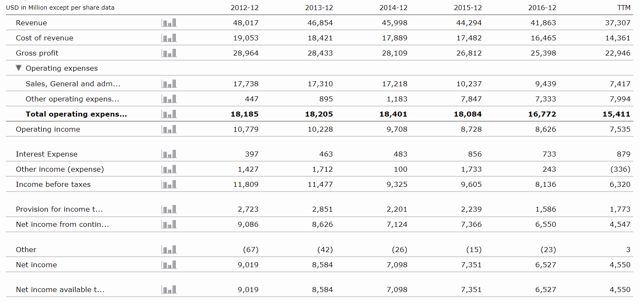

And this is for a company whose top line revenue has been declining for the last five years (data from Morningstar):

Revenue has declined over $10 billion in the last five years while net income decreased about $2.5 billion.

This has had a negative impact on the average growth rate of a number of income metrics (data from Morningstar):

If you bought Coke in the last year: you’ve made money. Between a nice dividend and some capital appreciation, you’ve enjoyed modest, above-inflation growth. But Coke is very expensive, especially for a company with a weakening earnings history. It’s time to take some money off the table and sell this position.

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. Please see our disclaimer for additional information.