Weekly Energy Roundup: Offshore Drilling Companies, January 8 - 12

The markets have been plagued with concerns of a government shutdown over the past week, a trend that is likely to persist through the next week. This is due to the inability for politicians in Washington to agree on a bill to fund the government. Otherwise, this week was a rather slow week in the markets, which is somewhat typical around the end of or beginning of a year. Nevertheless, there was still some action in the offshore drilling sector, which will be discussed here.

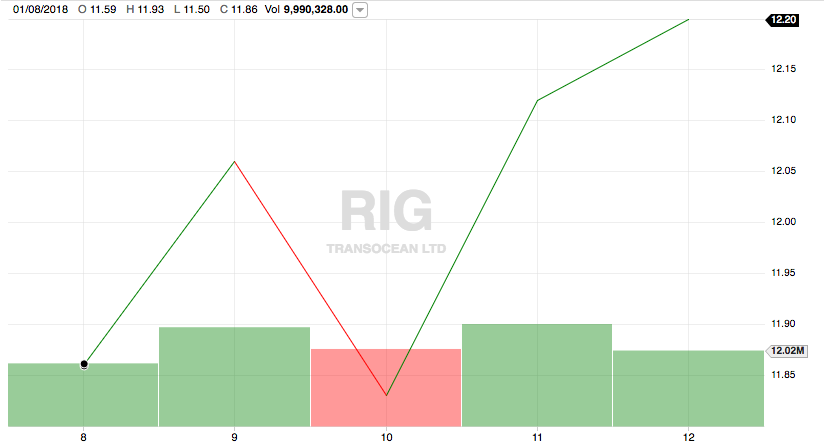

Transocean (RIG)

On Monday, January 8, 2018, Transocean opened at $11.59 per share. The stock climbed on every day except for Wednesday, when it closed barely above its open for the week. However, it sharply rebounded and closed out the week at $12.20. This gives the stock a 5.26% gain on the week, a rather respectable performance.

Source: Fidelity Investments

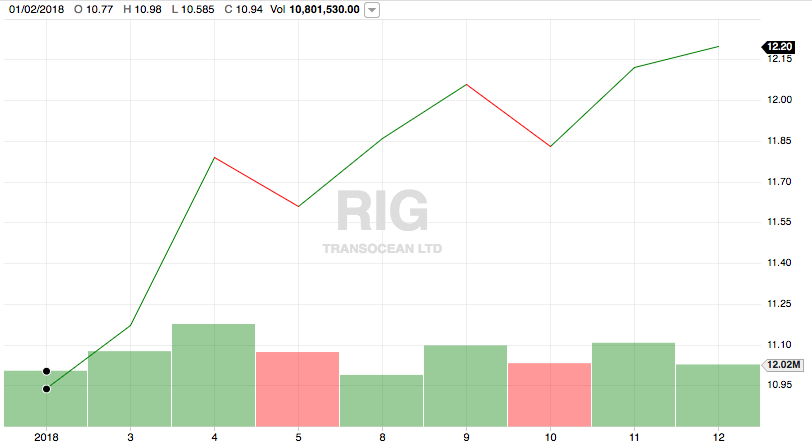

Transocean's stock performance was strongly positive over the trailing two-week period. While there were both up days and down days, the days with a positive return outnumbered those with a negative return and it returned an overall gain over the period. Transocean opened at $10.77 on Tuesday, January 2, 2018 (January 1 was a market holiday) and climbed to $12.20 by Friday, January 12. This gives the stock a two-week gain of 13.28%, which any investor should be able to appreciate. A trader would have had numerous opportunities to profit over the period as well.

Source: Fidelity Investments

Transocean did not have any news that significantly impacted the stock over the past week. While the Trump Administration announced that Florida will be exempt from the proposal to expand offshore drilling in the United States, that announcement would have a minimal impact on the stock price or on the company going forward.

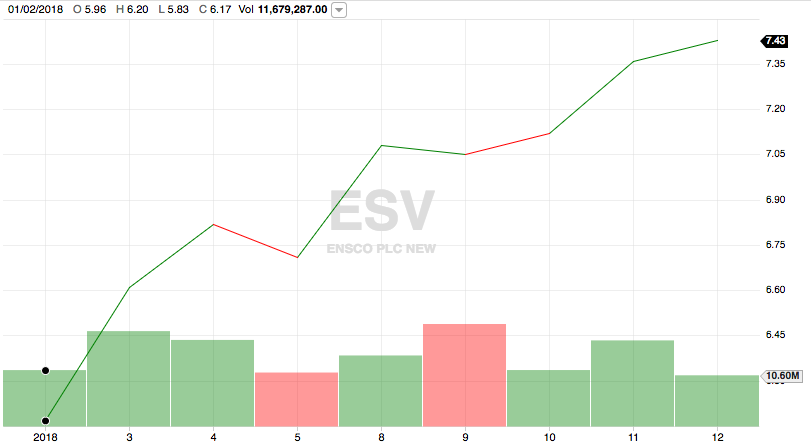

Ensco plc (ESV)

Ensco stock also increased over the week ending January 12, 2018, with significantly less volatility than Transocean. On January 8, the stock opened at $6.74 per share and closed out the week at $7.43 per share. Ensco’s stock price saw only a small decline on Tuesday but otherwise ended every day in the black. Overall, the stock delivered a gain of 10.24% on the week.

Source: Fidelity Investments

This gain comes on the heels of strong performance over the prior week. On January 2, 2018, Ensco’s stock opened at $5.96 and largely delivered daily gains over the following two-week period. The stock suffered from a surprisingly limited number of down days, delivering a 24.7% gain over the two-week period.

Source: Fidelity Investments

Ensco also had no news of any consequence over the past week. The company did refinance some of its debt and issue a warning about contract renegotiations on the DS-8 rig, but anyone following the industry knows that it remains challenged even with the recent increases in Brent crude so the possibility of these renegotiations has been priced into the stock for weeks, if not months. The company’s debt refinance was done at a 7.75% interest rate, so this could serve as a data point to see what interest rate other drillers are likely to obtain given the fact that Ensco is one of the strongest companies in the industry financially.

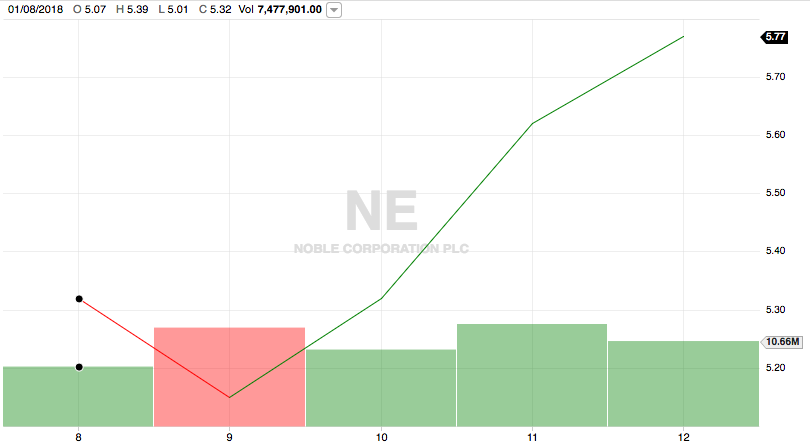

Noble Corp. (NE)

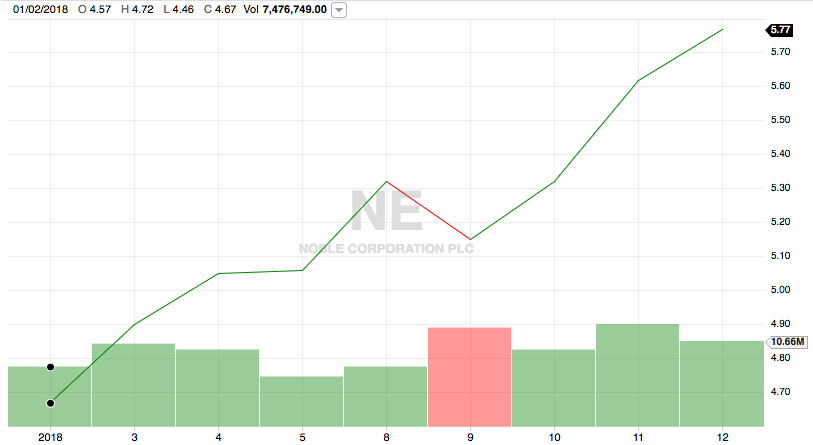

Noble’s stock also delivered strong gains to its holders over the past week. On January 8, 2018, Noble's stock opened at $5.07 per share. By the end of the week, the stock had gained $0.70 and closed at $5.77. This represents a gain of 13.81%

Source: Fidelity Investments

Noble’s stock delivered solid gains with surprisingly little volatility over the trailing two-week period. In fact, it ended almost every single day in the black. On Tuesday, January 2, shares of Noble Corp. opened at $4.57. As they closed at $5.77 on January 12, the company’s stock delivered a total gain of 26.26% over the two-week period. This is certainly a performance that should be appealing to any investor.

Source: Fidelity Investments

As was the case with many of its peers, Noble had no news of any consequence over the past week. It will likewise be positively impacted by the Trump Administration’s plan to expand offshore drilling in the United States sans Florida, so it is certainly possible that the stock is receiving a boost from that news along with its peers.

Diamond Offshore (DO)

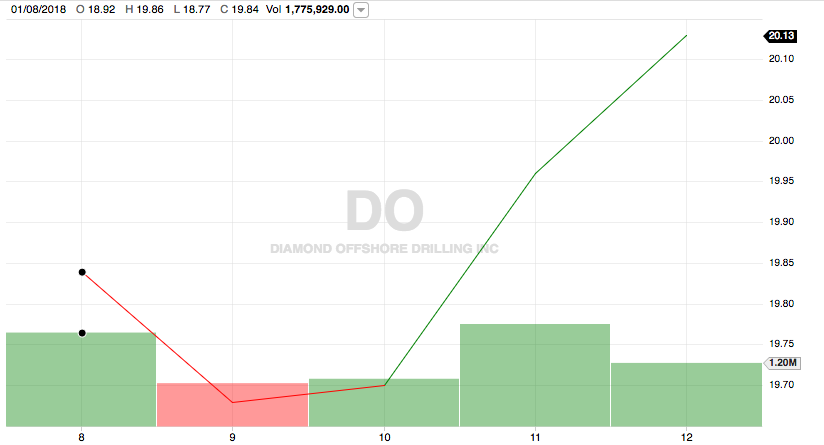

Diamond Offshore had somewhat more volatility in its stock price over the past week than some of its peers, but it likewise delivered a gain to stockholders. Diamond Offshore’s stock opened the week at $18.92 per share and promptly declined before it finally rebounded in the latter half of the week. The stock closed out the week at $20.13 per share, giving the company a return of 6.40% over the week.

Source: Fidelity Investments

The stock exhibited considerable volatility over the past two weeks, giving traders plenty of opportunities to profit. On Tuesday, January 2, 2018, Diamond Offshore opened at $18.70 per share and, following an early week gain, promptly plummeted. The stock rebounded this week and delivered a gain of 7.65% over the two-week period.

Source: Fidelity Investments

As was the case last week, Diamond Offshore had no notable news over the past week. It is also likely to benefit from the Trump Administration's planned expansion of offshore drilling. In this case, there is a chance that Diamond Offshore might benefit slightly more from this plan than some of the other drillers as it is an American company, unlike its peers. While complete details of the plan still need to emerge, the Administration’s “America First” policies may result in incentives for exploration & production companies to contract with American drillers over others.

Rowan Companies (RDC)

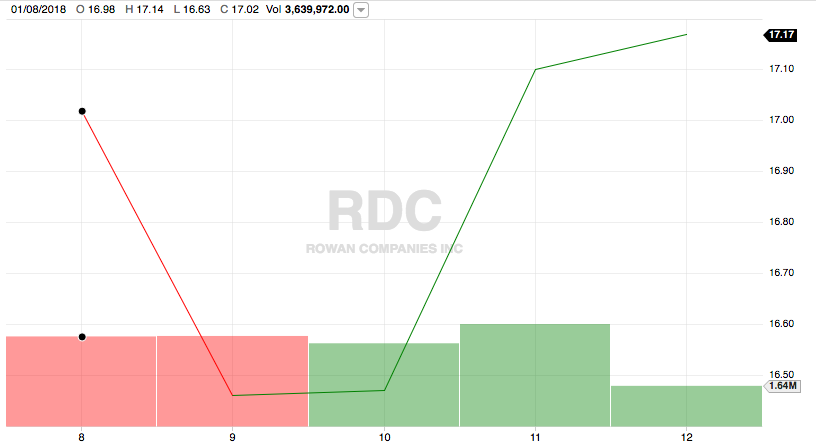

Rowan's performance over the past week was quite similar to Diamond Offshore. The company delivered a somewhat weak performance early in the week but ultimately recovered to hand a gain to its investors. Rowan opened at $16.98 per share on Monday, January 8, 2018, and closed out the week at $17.17. This represents a gain of 1.12%, which is admittedly the weakest gain of any of its peers shown above.

Source: Fidelity Investments

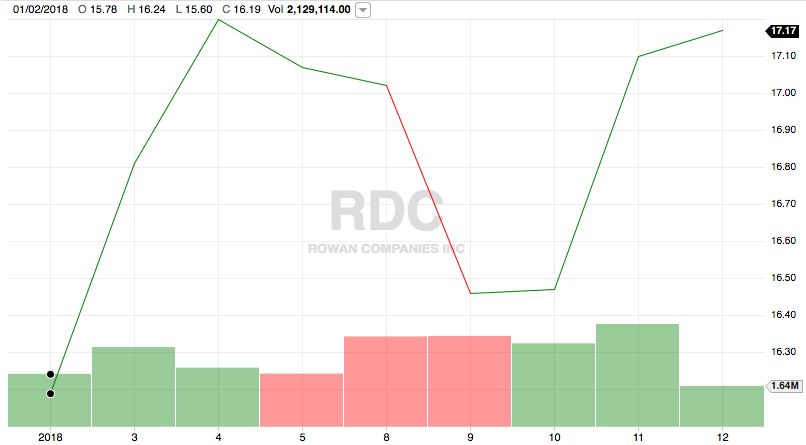

Rowan’s two-week stock price was very volatile and unlike the other companies discussed above, did not achieve its highest price of the two-week period on January 12. The stock still delivered a two-week gain, however. Traders would have been quite pleased with its volatility over the period. On Tuesday, January 2, 2018, Rowan shares opened at $15.78 and delivered quite strong early performance before declining. The declines were reversed and the stock delivered a two-week gain of 8.81%.

Source: Fidelity Investments

As with many of its peers, Rowan had no notable news affecting the stock this week. It does seem to be less followed than some of the other companies discussed here by the American financial media as well so what impact that has could be anybody's guess, but that may have an impact on its overall performance.

Seadrill (SDRL )

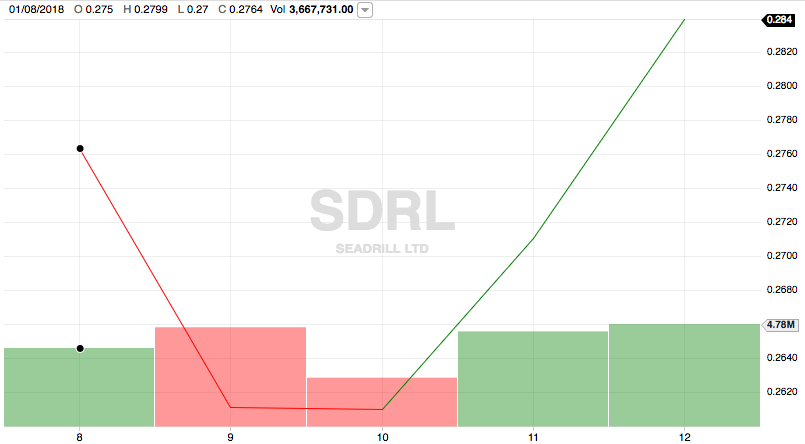

Seadrill is easily the most troubled firm on this list as it is the only one currently in Chapter 11 bankruptcy. As with all of its peers, however, Seadrill stock delivered a gain over the past week. On January 2, shares of Seadrill opened at $0.275 and quickly declined before recovering in the latter half of the week (similar to both Rowan and Diamond Offshore). The shares closed out the week at $0.284, representing a gain of 3.27%.

Source: Fidelity Investments

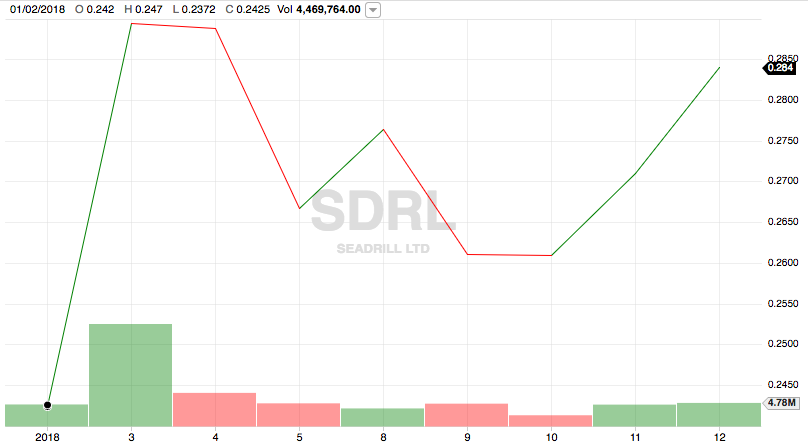

The company had a significant amount of volatility over the past two weeks, which is not atypical of a firm going through restructuring. Indeed, many view these stocks as being most appropriate for traders, which is a characterization that I would agree with. With that said, the stock opened at $0.242 per share on Tuesday, January 2, 2018, and closed at $0.284 on January 12, 2018, which gives it a two-week gain of 17.4%.

Source: Fidelity Investments

Seadrill had no significant news affecting it over the past week, so the stock’s performance is entirely due to the uncertainly surrounding the company as it attempts to restructure itself. Long-term investors may wish to avoid it in general until more certainty is available, while traders may appreciate the volatility and wish to take advantage of the sharp swings to earn some money.

Disclosure: I am considering taking a long position in RDC, but have not decided when to make the purchase.