Advertisement

Advertisement

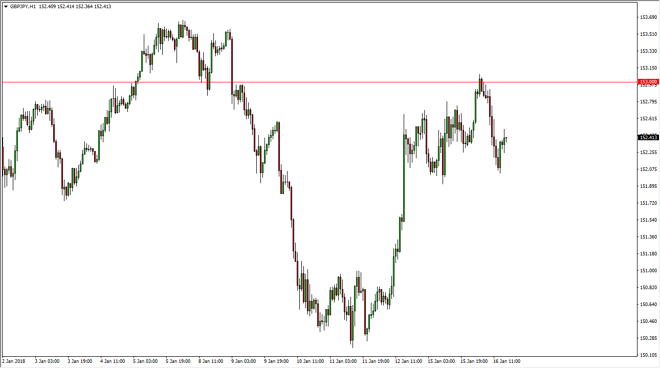

GBP/JPY Price Forecast January 17, 2018, Technical Analysis

Updated: Jan 17, 2018, 08:03 UTC

The British pound has seen a lot of volatility over the last 24 hours, but most importantly has found support at 152, an area that is important for short-term standpoint. Because of this, I think we are trying to build up momentum for a larger move, but it may take some time to happen.

The British pound has fallen during the session on Tuesday, reaching down to the 152 level. This is an area that is important from not only a psychological standpoint, but a structural standpoint as well. We have bounced from there a couple of times, and it now looks as if we are going to go looking towards the 153 handle. A break above that level is very bullish and should send this market higher again. The British pound of course has been noisy as of late, but it looks likely that we are going to see a lot of buying pressure based upon value, and of course based upon the general attitude of traders around the world.

The better that stock markets in general do, the better that this pair does. Obviously, this works in both ways, so if we start you to sell off of risk appetite around the world, that will be bearish when it comes to this market. If we were to break down below the 152 handle, I think at that point we go looking towards the 150 handle. A break above the 153 level has the market first attacking the 153.50 level, and then going to 160 longer term. This is my longer-term outlook for this market, but I recognize that we have a lot of work to do to break out above what has been significant resistance as of late.

GBP/JPY Video 17.01.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement