What Does Q4 Earnings Hold for Comcast's (CMCSA) Cable Unit?

Comcast Corp. CMCSA is scheduled to release fourth-quarter 2017 results on Jan 24, before the market opens.

The U.S. cable behemoth carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s take a look at the company’s Cable Communications segment as well as its operations, revenues, operating margins and subscriber count.

(See more in Comcast to Report Q4 Earnings: What's in Store?)

Revenues

We expect Comcast to see an improvement in revenues in the quarter to be reported.

Total operating revenues in fourth-quarter 2017 is estimated at $22,081 million, up from $20,983 million in the last quarter.

The Zacks Consensus Estimate for fourth-quarter revenues at Cable Communications Segment is pegged at $13,334 million. In third-quarter 2017, revenues at Cable Communications Segment were $13,203 million, accounting for 62.92% of total revenues.

Comcast Corporation Revenue (TTM)

Comcast Corporation Revenue (TTM) | Comcast Corporation Quote

Coming to the sub-categories, we notice a similar uptrend in estimates.

High-Speed Internet revenues estimate of $3,777 million is above $3,709 million and $3,483 million reported in third-quarter 2017 and fourth-quarter 2016, respectively.

Video revenues estimate of $5,789 million lags $5,825 million reported in the last quarter.

Voice revenues estimate of $829 million is below $840 million reported in the last quarter.

Advertising revenues estimate is at around $837 million, up from $542 million reported in the preceding quarter.

Business Services revenues estimate is at around $1,622 million, up from $1,575 million reported in the previous quarter.

Subscriber Statistics

The Zacks Consensus Estimate for high-speed Internet customer count is pegged at 25.816 million, up from 25.519 million in the previous quarter.

Voice customers count is estimated at 11.538 million for fourth-quarter 2017 compared with 11.565 million in the last quarter.

Video customer count is estimated at 22.336 million for fourth-quarter 2017, down from 22.390 million customers in the last quarter.

Security and Automation customer count is expected at around 1.186 million in the to-be-reported quarter, up from 1.079 million in the previous quarter. The company is likely to witness a net gain of 107,000 security and automation customers compared with a gain of 51,000 in the last quarter.

Comcast is expected to gain 30,600 single-play subscribers and 114,000 double-play subscribers in fourth-quarter 2017 compared with a net gain of 125,000 and 38,000 subscribers, respectively, in the previous quarter. However, the company is likely to lose 102,000 triple and quad product customers compared with a loss of 79,000 in the last quarter.

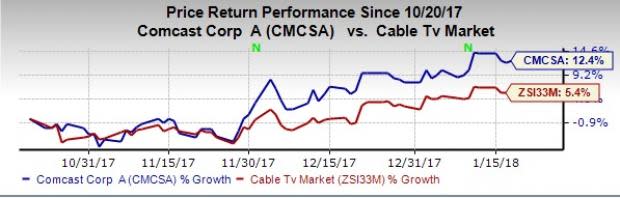

Price Performance

Comcast portrays an impressive price performance. In the past three months, shares of Comcast have rallied 12.4% compared with the industry’s gain of 5.4%.

When compared with the market at large, the stock looks good as the S&P 500 index has soared 9.0%.

Bottom Line

Comcast has initiated the nationwide rollout of the DOCSIS 3.1 technology, with its latest xFi Advanced Gateway. Further, the company completed the nationwide rollout of its wireless services under the Xfinity Mobile brand, with plans to include YouTube in its X1 video platform. Notably, Comcast is entering into the highly competitive U.S. wireless market to compete with big players like Verizon Communications Inc VZ, AT&T Inc T, T-Mobile US Inc TMUS and Sprint.

Business Services has been witnessing strong momentum and continues to present an attractive growth opportunity. We believe that Comcast’s focus on large businesses will help it gain traction in the segment and boost revenues.

Comcast has started deploying fiber-based 2 gigabits per second (2 Gbps) residential broadband Internet services in certain regions. Comcast is venturing into residential solar programs with a 40-month deal with Sunrun. The company is working toward 5G network deployment and continues to expand its theme park business. With this, Comcast aims to check customer churn and provide viewers with more streaming options.

Despite such efforts, Comcast continues to suffer from video subscriber losses due to cord-cutting. The company lost 94,000 voice customers and 125,000 video customers in the last quarter.

We fear that if the subscriber count continues to fall, Comcast’s video businesses will be at stake. Cable operators are trying to revamp their business model to keep market share intact. In order to cope with the loss and be competitive in the market, operators have also started offering Internet-TV services with selected TV channels at cheaper rates.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research