Advertisement

Advertisement

EUR/USD Price forecast for the week of January 22, 2018, Technical Analysis

Updated: Jan 20, 2018, 07:15 UTC

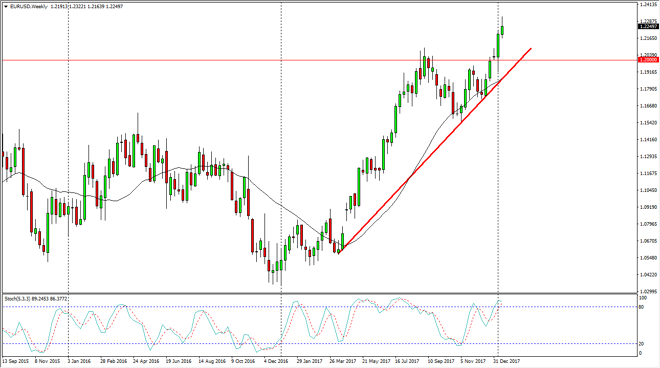

The EUR/USD pair rallied significantly during the week, but gave back some of the gains, to form a candle that looks almost like a shooting star. I believe that sends this market looking for lower pricing, but that should only offer more bullish pressure in the end.

The EUR/USD pair has broken above the 1.20 level recently, and that is a bullish sign, as I think that the market should go looking to the 1.25 level above. I think that a pullback, and I do think it’s coming, should be thought of as a value proposition. Remember, the EUR/USD pair is traded by a lot of high-frequency traders, and that means that there is always a bit of a grind. However, when you look at the weekly chart it’s clear that we have broken out of a bullish flag, and that should continue to be the way you look at this market, as one that is grinding this way to the upside, and will occasionally offer value. That is what you should be looking for: value.

If we break down below the 1.20 level, then I think the market would be in trouble. However, that seems very unlikely to happen, at least for any length of time, and of course we have the uptrend line underneath that should continue to hold things in check as well. I believe that the market should offer that opportunity, so be patient, there’s no reason to “pay up” for a longer-term trade. Ultimately, I believe that value investors will continue to benefit from the rising Euro, but obviously patience is needed for the long-term game. Shorting is in the thought, but if we were to break down below the uptrend line, then you need to start reassessing the entire situation.

EUR USD Forecast Video 22.01.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement