Advertisement

Advertisement

USD/JPY Price Forecast for the Week of January 22, 2018, Technical Analysis

Updated: Jan 21, 2018, 09:49 UTC

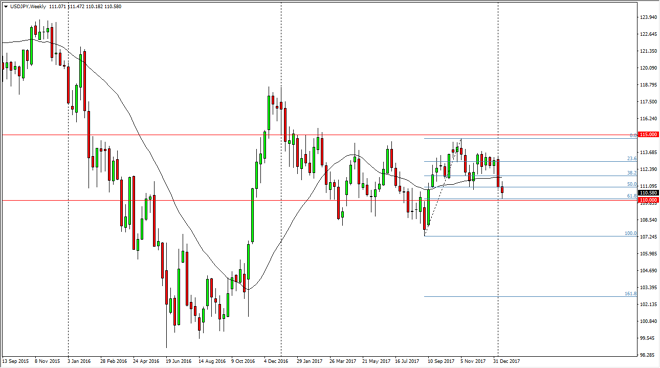

The US dollar has gone back and forth during the week, but mostly shown a lot of negativity. The 110-level underneath offers plenty of support, as it is not only a large, round, psychologically significant number, but it is also the 61.8% Fibonacci retracement level.

The US dollar has pulled back a bit against the Japanese yen, but is starting to show plenty of support around the 110 level. This is an area that is not only a large, round, psychologically significant number, but it is also the 61.8% Fibonacci retracement level from the recent rally. I suspect that longer-term traders will probably be looking to buy in this general vicinity, but if we were to break down below the 110 handle, the market then should go down to the 100% Fibonacci retracement level, which is roughly the 107.50 level.

I anticipate that there will be a lot of noise, so longer-term traders will need to be very patient, as the market is highly sensitive to risk appetite, and as stock markets go higher typically it will push this market to the upside. However, at the same time we have a lot of trouble at the feet of the US dollar, as it continues to struggle in general. That causes a lot of tension in this market, so that is why I think it could take several weeks to reach towards the 113 handle, or even the 107.50 level underneath, depending on which way we break. Short-term traders continue to pick up this pair on dips, but longer-term traders need to perhaps either play small positions, or simply be prepared to sit on this position for several weeks. Longer-term, I am bullish of this market, but I recognize we have a lot of work to do.

USD/JPY Video 22.01.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement