Advertisement

Advertisement

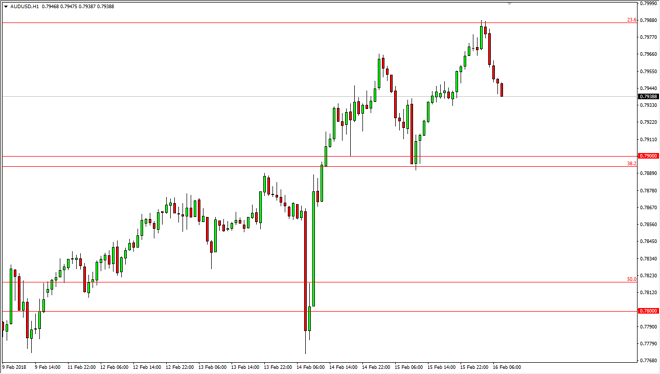

AUD/USD Price Forecast February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:06 UTC

The Australian dollar has been noisy during the trading session on Friday, as the US dollar has picked up a bit of strength. I believe that ultimately this market should continue to find buyers underneath, especially near the psychologically important 0.79 level underneath.

The Australian dollar has initially tried to break out above the 0.80 level during the trading session on Friday but has rolled over since then to fall significantly. However, I think that the 0.79 level underneath will continue to offer support, and I think that the market should eventually find enough buyers to get involved to the upside as I believe the US dollar is going to struggle longer-term due to selling in the bond markets.

This should coincide nicely with what is going on in the gold markets, as is typical with this currency pair. I believe that the market will eventually go higher due to the problems in the bond markets, but obviously we are going to have a lot of back and forth momentum in the meantime. I think that the market could struggle at times, but I believe that once we break above the 0.80 level, and perhaps the 0.81 handle, the market is ready to go much higher over the longer term, perhaps as high as parity over the next couple of years. The 0.80 level and its importance cannot be stressed enough, as it goes back to the late 1980s, and market memory has been very strong in this general vicinity. This is why we are seen so much in the way of volatility. However, the buying pressure is consistent, and tenacious. Because of this, I believe that the buyers will eventually win. I believe that the 0.75 level underneath is where the bottom of the uptrend is found.

AUD/USD Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement