Advertisement

Advertisement

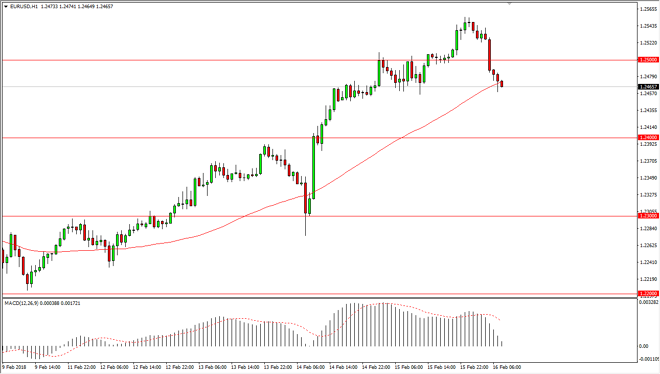

EUR/USD Price Forecast February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:07 UTC

The EUR/USD pair has broken down significantly during the trading session on Friday, slicing through the 1.25 handle, and then reaching towards the 1.24 level. This is a market that has been reviewed on the breakout of a major level. The question now is will we find buyers underneath to attempt the break out again? The answer is probably yes.

The EUR/USD pair has broken down significantly during the trading session on Friday, reaching towards the 1.24 handle. I think there is a significant amount of support there, and we are most certainly in an uptrend. Most of the pullback will have been a technical move based on the recent high, and of course a lot of risk off type of trading around the world.

Ultimately, I think that the buyers do return, and this could be a nice buying opportunity. However, you should get out of the way and not be bothered by trying to catch a falling knife. I believe that looking at large, round, psychologically significant number such as the 1.24 level for clues as to when the buyers are getting involved is the way to go forward. This is a simple pullback in a market that has seen a significant amount of buying pressure.

If we break down below the 1.24 handle, then the market probably goes down to the 1.23 level to look for support again. I don’t have any interest in shorting this pair, at least not until we break down below the 1.21 handle, which was the massive resistance that we had broken out of previously. I believe that patience will be the most important thing to practice when it comes to trying to profit from this market. Ultimately, I do think we go much higher based upon longer-term charts.

EUR/USD Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement