Advertisement

Advertisement

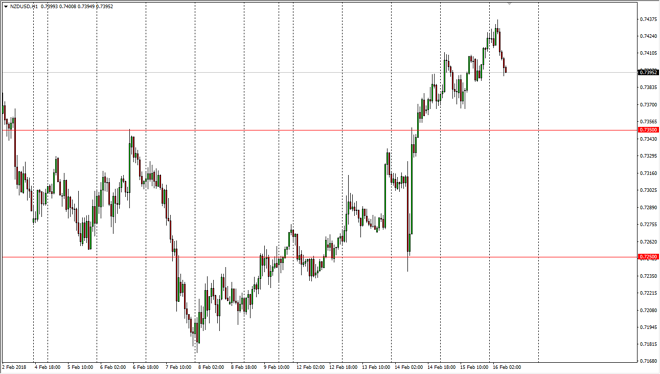

NZD/USD Price Forecast February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:08 UTC

The New Zealand dollar has initially tried to rally during the trading session on Friday but has pulled back significantly to break below the 0.74 level. It looks as if we will probably have plenty of support below, so I look at this as a buying opportunity going forward, as we are building up momentum to finally make a huge breakout.

The New Zealand dollar has initially tried to rally during the trading session on Friday, reaching towards the 0.7440 level. We pulled back a bit, but I see a significant amount of support at several levels reaching down to the 0.7350 level. I believe that the market will eventually find reasons enough to go higher, especially considering how much the US dollar seems to have left to fall. I believe that the market should continue to go higher, but the 0.75 level above will cause a significant amount of noise. If we can break above that level, then I think we will eventually go to the 0.80 level. A break above the 0.75 level would be a sign of significant strength.

Ultimately, I believe that the 0.7350 level will offer significant support, and I think that is the area where the most amount of bullish pressure will be found. I believe that the US dollar continues to fall, and I believe that the New Zealand dollar will be one of the main beneficiaries as it is considered to be a “risk on” currency, and of course the interest rate differential favors the New Zealand dollar. I think that the US bond market selling off should continue to put bearish pressure on the greenback, therefore I don’t have any interest in shorting this pair, a least not anytime soon as we have seen such a strong move to the upside.

NZD/USD Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement