Advertisement

Advertisement

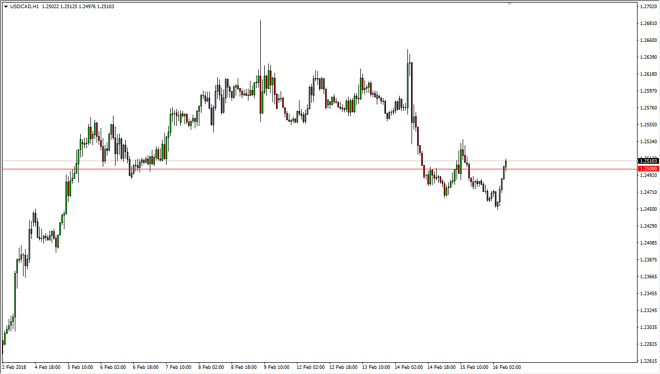

USD/CAD Price Forecast February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:08 UTC

The US dollar rallied significantly during the Friday session, as the oil markets seem to be struggling again. Ultimately, I believe that the US dollar will continue to find buyers, and that it’s only a matter of time before we break out to the upside and reach towards the 1.26 handle, and perhaps even beyond that.

The US dollar has rallied against the Canadian dollar during the trading session on Friday, slicing through the 1.25 level again. The market looks as if it is trying to break out, perhaps reaching towards the 1.26 handle, and beyond. I believe that longer-term we will see a rally in this market, but this of course will have a lot to do with oil, and if oil rolls over, this typically will send the Canadian dollar fall. That of course puts upward pressure on this market, but right now I think the upside is somewhat limited, at least until we get some type of significant move in the crude oil markets.

Ultimately, I believe that the market has a very limited downside, and I do think that eventually we will find the market looking towards the 1.29 level over the longer term, but this pair tends to be extraordinarily choppy, as the economies are so highly intertwined. Typically, people look at the Canadian dollar is a proxy for crude oil, and therefore the correlation between the 2 assets cannot be ignored.

The US dollar has been selling off against other currencies, so I think that might be part of the choppiness that we are starting to see, as it is a conflict of energies, meaning that the market will have a lot of erratic behavior. Overall though, I do believe in the uptrend mainly because of the oversupply of crude oil and the housing bubble that we currently have going on in the Greater Toronto Area.

USD/CAD Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement