Advertisement

Advertisement

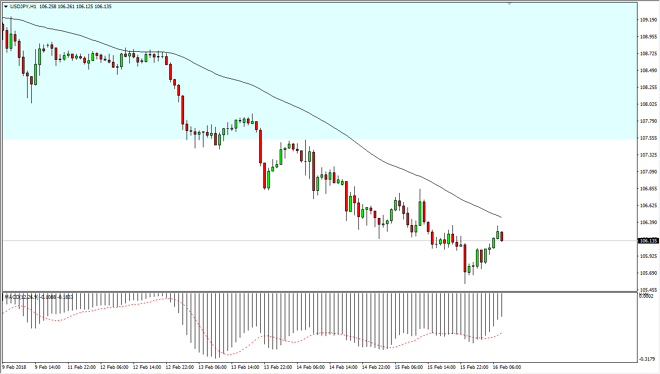

USD/JPY Price Forecast February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:08 UTC

The US dollar has been noisy against the Japanese yen during the trading session on Friday, as we continue to drift lower in a downward channel. Ultimately, we have further to go to the downside, but the occasional rally could offer a trade.

The US dollar has fallen initially during the trading session against the Japanese yen, only to turn around and bounce significantly above the 106 level. This is a market that looks as if it is trying to find a bit of buying pressure, but I think it’s only a matter of time before the sellers get involved again. The question now remains as to how high can we go before they show up? At this point, I am hesitant to buy this market until we break above the 107.50 level, which was the bottom of the longer-term consolidation area that the market has been bouncing around in for quite some time. Because of that, I recognize that the area will probably be resistance going forward, so a clearance of that would mean something. Until then, I assume that rallies are selling opportunities, and will look for signs of exhaustion to do so, perhaps reaching down towards the 105-level underneath which is the next large, round, psychologically significant level that has shown historical precedents.

If we were to break down below there, things could get ugly, perhaps reaching down towards the parity level of the longer term, but I believe it is a bit of a stretch to assume that’s going to happen. That would almost have to be confirmed by some type of melt down in the stock markets were something like that. In the meantime, I think short-term traders are going to start selling when they get the chance.

USD/JPY Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement