Advertisement

Advertisement

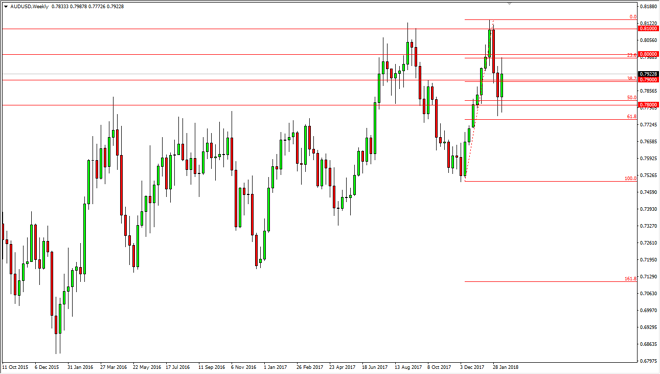

AUD/USD Price forecast for the week of February 19, 2018, Technical Analysis

Updated: Feb 17, 2018, 09:14 UTC

The Australian dollar has been noisy during the week, but overall has been bullish. The 0.80 level obviously offered resistance, but that’s nothing new.

Pay attention to the US bond markets, particularly the 10-year note. The market looks likely to continue to see selling off US bonds, and if that’s the case it’ll drive the price of the US dollar much lower. That will drive gold higher, and therefore it should drive the Australian dollar higher. I believe that if we can break above to a fresh, new high, the market will become more of a “buy-and-hold” situation. I do believe this happens given enough time, but I also recognize that it is a major level, so it may take several attempts to finally clear as the 0.80 level has been the epicenter of massive interest by both sides of the market going back to the late 1980s.this market

The 61.8% Fibonacci retracement level has held true for the last couple of weeks, and therefore I think that we have plenty of buyers in that general vicinity to keep this market afloat. If we were to break down below the 61.8% Fibonacci retracement level, roughly the 0.7750 handle, then I think the market unwinds a bit. At that point, we could go to the 0.75 level, but right now it does look like the buyers are very insistent on this area, and I think that we won’t have that type of a move anytime soon. If we can break above to the upside, the market should continue to go towards the 0.85 handle, the 0.90 level, and then eventually parity over the longer term. That’s obviously a multi-year call, and it would need the US dollar to continue to soften overall.

AUD/USD Video 19.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement