10 year yields are also mixed

The major European stock indices are editing session mixed. European 10 year bond yields are also mixed. Gold is up. Crude oil is higher on the back of a surprise draw in supply. Bitcoin is lower. The US dollar lower.

In the European stock markets:

- German DAX up 0.19%

- France's CAC of 0.33%

- UK FTSE down -0.27%

- Spain's Ibex, up 0.8%

- Italy's FTSE MIB, down -0.84%

- Portugal's PSI 20, down -0.13%

In the 10 year debt sector:

- Germany 0.703%, -1.8 basis points

- France 0.979%, -1.0 basis points

- UK 1.540%, -1.4 basis points

- Spain 1.518%, +0.5 basis points

- Italy 2.074%, +2.5 basis points

- Portugal 2.029%, +3.2 basis points

In other markets at the NA midday:

- Spot gold is higher on the back of a weaker dollar. It is up $4.55 or 0.34% at $1329

- WTI crude oil futures are up over a dollar (+$1.03) or 1.69% at $62.72. There was a surprise draw in this week's inventory data from the Department of Energy

- Bitcoin is trading down $232 at $10,050

In the US stock market, major indices are higher:

- S&P index of 26 points or 0.90% at 2727

- NASDAQ up 55 points or 0.76% at 7273

- Dow industrial average of 318 points or 1.28% at 25115

In the US debt market, yields are lower:

- two-year 2.256%, -1.0 basis points

- 5 year 2.653% -3.2 basis points

- 10 year 2.913%, -3.6 basis points

- 30 year 3.195%, -2.5 basis points

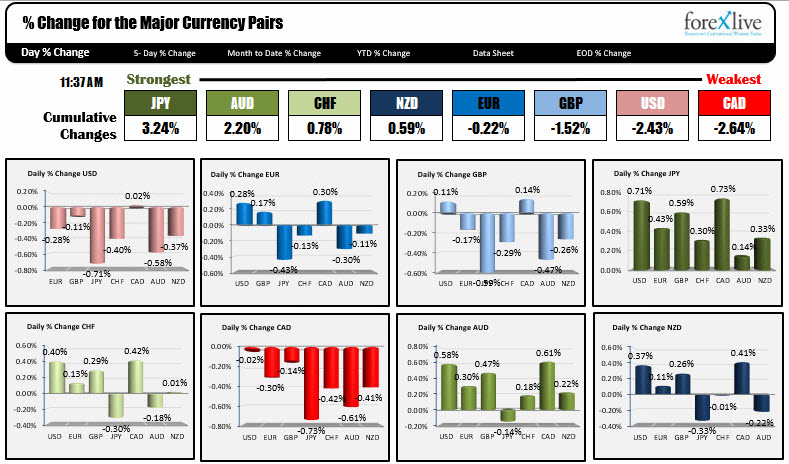

A snapshot of the major currency pairs shows that the JPY is the strongest currency while the CAD is the weakest. Canada reported weaker retail sales today. The USD is trading lower as well. It is only up vs. the CAD (and the gain is very small). Although lower, the greenback is off the NA session lows.