Dollar-Cost-Average Your Way To Wealth

Dollar cost averaging is like steroids for your money. The difference between doing it and not doing it is millions of dollars.

The concept of earning interest is extremely fundamental to living a happy life in any modern society. It’s as basic and important as having health insurance, knowing how to read and write, even having a job.

What most people don’t understand is that you’re always losing money. Every second that goes by you’ve lost money. Even if you’re absolutely dead broke, you’ve just become broke-er by doing nothing. This is because even if you're not wasting your money, time will waste it for you. Every year, the cost of living rises 3.3%. Which is too small a number to notice day to day, but large enough to cut your real net worth in half every 20 years.

Put simply, 20 years ago, every dollar could buy you double what you can get today for a dollar. Said differently, if you can afford a $500k home today, then 20 years ago, with $500k, you could’ve purchased two of them.

Life is like going the wrong way on a moving escalator. Walk and you stay put. Stand still and you go backwards. To get ahead, you have to hustle. Or at least, your money has to hustle. You have to make your money make you money. Here’s how it’s done: investing.

The most basic style of investing is called dollar cost averaging. It’s a strategy that anyone anywhere can enact, without needing a financial advisor or a deep understanding of stocks. It’s a way for anyone to become a millionaire in their lifetime. Yes, anyone. It’s not as exciting as getting crypto-rich overnight but you’re chances of success are substantially higher.

Dollar cost averaging does, however, have one fatal flaw: it takes time. A lot of time. But if you’re young, in your 20s or 30s, that shouldn’t be a problem for you because if you’re young and in good health, then you’re rich in time.

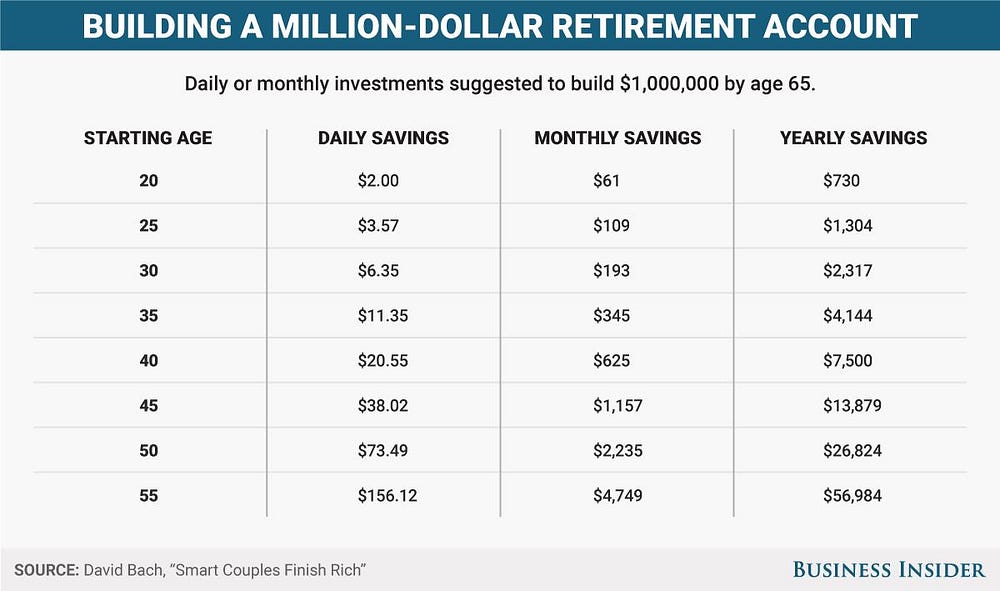

Based on your age, here’s how much you’d need to invest everyday to end up with $1M when you turn 65, if you dollar cost average your way into stocks.

Dollar cost averaging is consistently transferring an amount of money from your earnings into an investment account so it can be put to productive use earning interest. You can invest a consistent amount of money into America’s top 500 public companies by putting your money into one single security: an S&P 500 index fund. These index funds can be purchased in any investment account under the ticker symbol SPY.

SPY is like steroids for your money. Here is a chart comparing an investment of $25 a week on steroids vs. that same $25 not on steroids:

With steroids, you weekly $25 investment becomes $1.31M over 45 years. Without them, your investment adds up to a measly $54k.

The bottom line: don’t do steroids. Have your money do steroids.

Dollar cost average into SPY. The difference between doing it and not doing it is $1.26M.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of ...

more