Advertisement

Advertisement

AUD/USD Price Forecast February 26, 2018, Technical Analysis

Updated: Feb 24, 2018, 04:07 UTC

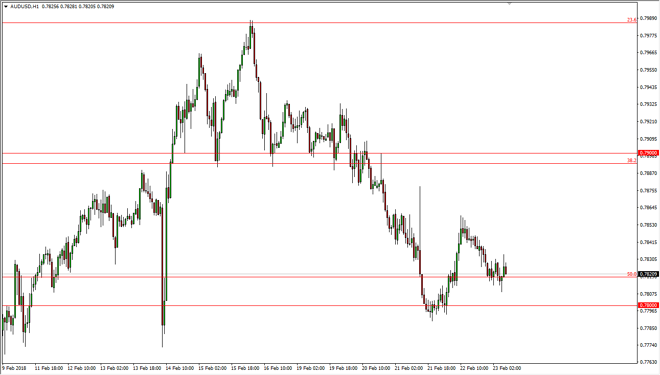

The Australian dollar has gone sideways during most of the trading session on Friday, as the Aussie continues to test a major amount of support underneath at the 0.78 level. I believe that there are plenty of buyers will eventually show up, as the market has been very supportive in the 0.78 region.

The Australian dollar has gone sideways during most of the session on Friday, as we are getting close to a significant support level. The 50% Fibonacci retracement level is in the neighborhood, and of course the psychologically important 0.78 region. That’s an area that should offer plenty of opportunity for buyers to jump in and take advantage of, as we have seen several times recently. I believe that if we rally from here, the market should then go looking towards the 0.79 level, and then eventually break above there to reach towards the 0.80 level.

Don’t forget that the gold markets have a massive amount of influence on the Australian dollar, and I think that if they rally, this pair will follow. However, if gold struggles with a strengthening US dollar, it will send this market down below the 0.78 level, perhaps looking at the 0.7750 level next. In general, I think that we will eventually see buyers jump back into the market, but I recognize that there are lot of risk appetite issues as well lately. Remember, when people are a bit concerned they will start by the US dollar, and by extension some gold, which of course puts downward pressure in this market. Longer-term though, I think we will break out and find ourselves in a “buy-and-hold” situation, but it may take several weeks if not months to make that happen. In the meantime, expect volatility but I prefer buying when possible.

AUD/USD Video 26.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement